Cement Industry In Nepal 30b4a

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3i3n4

Overview 26281t

& View Cement Industry In Nepal as PDF for free.

More details 6y5l6z

- Words: 4,063

- Pages: 6

cement story By Sagar Tamrakar

CEMENT

INDUSTRY in Nepal

N © the boss photo file/Ajaya Joshi

epal is enriched with large and small deposits of good cement grade limestone 1. The limestone deposits occur within the sequence of the Lesser Himalayas 2 extending from the east to west. Limestone is by far the most important mineral resource in Nepal, followed by magnesite, marble, lead and zinc. So far, this is also the most economically viable mineral resource. A total of about 1,250 million tons of cement grade limestone is estimated to exist in the country and the existence of at least 224 million tons have been confirmed through drillings and dedicated surveys. Even when only a few deposits are being exploited for commercial production of cement and allied products, limestone still tops the list of the most exploited mineral resources in Nepal.

Despite the abundance, domestic cement production only s for 40 percent of total consumption in Nepal, informs Tej Kant Jha, general manager, Udayapur Cement Industries (UCI). He adds, “UCI alone has been fulfilling 25 percent of the total domestic market demand. All other Nepali cement manufacturers contribute about 15 percent of the demand. Imported cement, mainly Indian, fulfill the remaining 60 percent. But Ramesh Kumar Aryal, general manager, Hetauda Cement Industries (HCI) chooses to differ. He comments, “In the latest scenario, imported cement supplies 70 percent of the market demand.” Needless to say, a good market for cement exists within and outside the country. Aryal 1

2

2

adds, “With inadequate infrastructure and frequent power crisis in the industries, forget exporting, even self dependency in cement production will remain a dream.” The data from the Department of Industries does confirm that cigarettes and beer are the only merchandise whose total capacity utilisation exceeds 50 percent. With the resolution of conflict, a big boost in this industry is likely. The government has promised to invest a lot in infrastructure development – particularly roads, in addition to housing construction and expansion of corporate production facilities. But private sector investment in the cement industry according to the Department of Industries

calcareous sedimentary rock composed of mineral calcite (CaCO3) which upon calcination yields lime (CaO) for commercial use. range of mountains southwards the range of snow capped mountains extending 2400 km east-west along the Himalayan range.

the boss 15 Sep - 14 Oct 2007

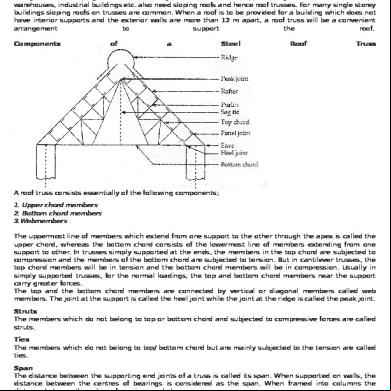

Limestone deposit map

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45.

Nigale Sindhali Katari Chobhar Bhainse Okhare Rossi Jogimara Narpani Gandari Surkhet (Chaukune) Diyari Gad Bhumeshwar Chauraha Kajeri (Halchaur) Chuladhunga Ghyampethumka Waling Beldanda Kakaru Sarada Lakharpata Supa Balthali Nandu Bhatte Danda Mane Nigure Lamatar Halesi Kurichaur Badhare Khola Kerabari Bhardeo Majuwa Bhartapur Khanchikot Sabdu Mauwa Khola Tamor River Tankuwa Khola Dhankuta Khola Khalung Khola Neupane Salendanda

Source: Mineral Resources Division, Department of Mines and Geology, July 2003

Cement grade limestone reserves in Nepal and usage Bagmati Zone Lalitpur District Chobhar: Himal Cement Company (a 130,000-Mt/yr cement plant but has closed down with 15.3 million mt of proven reserves) Dhading District Jogimara and Beldanda areas: Hetauda Cement Industries, Tribeni Cement and Annapurna Cement Narayani Zone Makawanpur District Bhainse-Dobhan, Majuwa and Okhare: Hetauda Cement Industries (a 260,000-Mt/yr cement plant with 18 million mt of proven reserves of limestone) Sagarmatha Zone Udayapur District Sindali: Udayapur Cement Industries (a 270,000-Mt/yr cement plant with 70 million mt of proven reserves) Koshi Zone Dhankuta District Nigale, unexploited Proven reserve: 10 million mt Bheri Zone Surkhet District Chaukune, unexploited Proven reserve: 31.5 million mt Source: Ministry of Industry, Department of Mines and Geology, Kathmandu

to subscribe online: www.readtheboss.com 15 Sep - 14 Oct 2007 the boss 3

cement story

CASE

ANALYSIS

Market Research The market for Nepali cement is very good. All the cement stock sells easily for they are good in quality and competitively priced as well. Jha says, “The limestone quality is also superb. Calcium oxide (CaO) content ranges from 43 to 53 percent and Magnesium oxide (MgO) content is less than three percent. Therefore, cement quality is the best in market.” The standard content of CaO in cement grade limestone is 42 percent and MgO is five percent. The ratio of CaO and MgO needs to be maintained to enhance the binding power of cement. About HCI, Aryal says, “The quality of limestone in all the mines is of cement grade except that of Bhainse. Bhainse limestone has to be mixed with

limestone from other mines to produce quality cement.” Grade of Cement Grade of cement only indicates the compressive strength of cement (not concrete) at 28 days. But cement continues to increase in strength beyond 28 days, with not much difference in long term strength. Required compressive strength of various grades of Ordinary Portland Cement (OPC) 33 Grade

43 Grade

53 Grade

Age

Minimum compressive strength in Newton per square millimetre

Three days Seven days 28 days

16.0 22.0 33.0

23.0 33.0 43.0

27.0 37.0 53.0

Annual total cement production and capacity usage percent Cement Production (million metric ton)

does not indicate the expected boost but rather a decline. Companies but fail to operate either due to government indecisiveness and negligence or their own inabilities. Jha comments, “Even after approval from the Ministry of Industry, Commerce and Supply, new projects are still lost in a bureaucratic maze trying to coordinate with agencies like the Department of Road, Department of Forest and other related departments,” and adds, “Mineral regulation will be efficient if such hindrances are removed once the Department of Mines and Geology leases the land for exploitation.” Aryal further suggests, “The government should offer time bound license to private companies so that they are motivated to operate within the time frame,” and emphasises, “The government should the company by eliminating hassles.”

700 –

613643

610044

600 –

644325

500 – 400 – 300 – 200 –

151681

100 –

Fiscal Year

0– 1986/87

49%

2004/05

39.72%

41.71%

2005/06

2006/07

Annual Cement Production Capacity Usage Percent * * Proportion of production with respect to total capacity of industry.

Productivity Index 2005/06 404.69

2006/07 424.93

Source: Ministry of Industry, Department of Industries

Factory Price

Transportation cost

Total price

Nepali

Gaida cement Shakti cement Siddhartha cement Trishakti cement Gorkha cement Bishwokarma cement Jagadamba cement Nirman cement

380 400 380 385 380 385 390 380

90 60 60 65 65 65 65 65

470 460 440 450 445 450 455 445

Indian

Cement prices per bag in Kathmandu Valley Cement Brand

Satana cement Buland cement L & T 43 grade L & T 53 grade Lafarge cement Reliance cement ACC cement

440 440 435 465 430 375 430

65 65 65 65 65 65 65

505 505 500 530 495 440 495

(Source: July 2007 Survey, Udayapur Cement Industries)

4

the boss 15 Sep - 14 Oct 2007

Udayapur Cement Industries general manager

Tej Kant Jha

Factory-running scenario The factory is profitable and expanding in of capacity utilisation, production and turnover. Capacity utilisation has risen over 42 percent from around 35 percent in the previous four years. Promotion of staff, which had been pending since 10 years, have been made. All the factory staff have been made permanent. The total employee count of the factory is 602 with 184 in the istrative section and 418 in technical division. Capital investment The financing of the industry was covered by Japanese OECF assistance of Rs 9.84 billion granted to the government during its establishment. The assistance is provided by the government to UCI as a loan. Also, the government has equity share of 450 million rupees in the industry. The industry is paying back the loan with annual interest rate of five percent. With the rise of foreign currency exchange rate of the Japanese yen, the amount payable is also rising. Had the exchange rate been constant, the loan would have been cleared by this time. Total mineral reserve UCI has limestone reserves for 150 years at the rate of producing 800 metric ton (mt) of clinker a day. The factory is capable of producing 277,200 mt cement per year. Annually, 330,000 mt of limestone is required. The total estimated reserve of the limestone mine is 72 million mt which is in Sindhali area of Udayapur district. It is 27 kms from Jaljale plant site. Besides this, clay, silica sand, iron ore and gypsum are required for cement production. Except clay and silica sand, other raw materials are imported from India. Essential utilities also include fuel (coal, furnace oil), electricity and water. Factory capacity and production The estimated total production capacity of the factory is 277,200 mt of cement per year. This capacity was only met in the fiscal year 2001/2002. The production was 45 percent of the total capacity in 2006/2007. Records of the previous three years show that the capacity utilisation then was only around 35 percent. Taxation The government charges five percent excise duty on imports such as gypsum, coal and iron ore. The government charges excise duty of Rs 5.25 per bag and VAT at 13 percent. Demand and supply With full capacity utilisation, UCI can

contribute in supplying about 60 percent of the market demand. We have not been able to reach this target though. There are certain constraints in our inability to utilise our full potential; these include frequent power failure, load shedding, lockouts, strikes and machinery breakdown. Measures to curb low output To improve output, many changes have been made. A separate transformer for UCI has been installed. This minimises power failures to a great extent. An adequate spare parts reserve has also decreased the negative effect of machinery breakdown. Foreign cement encroachment Market research tells us that consumers go for Indian cement only when they do not find Nepali cement. We have always been trying to increase the production to cover larger proportion of the market and lessen the encroachment of Indian cement. But the aforementioned constraints pull us back. Also, due to leakage in the borders, Indian cement enters the market at cheaper prices. Declining cement production Political instability, formation of trade unions, frequent change in management and incompetent managers are the mains reasons for the decline. Political instability has created a sense of insecurity for foreign investors. Private investment has also been grossly discouraged. Just as schools have been declared

peace zones, effort should also be made to declare industries as peace zones. Environment protection measures To be environmentally friendly in compliance with the mineral law, we have advanced machinery control. Modern machines with electrostatic precipitator (ESP) greatly reduce environment hazards. This technology collects dust that otherwise spreads in the atmosphere creating air pollution. Contribution to national economic growth UCI paid electricity bills of 150 million rupees, loan payoff of 200 million rupees, VAT of 87.5 million rupees and excise duty of 10.5 million rupees to the government this fiscal year. These revenues grow with the growth of cement production. And as a commodity, cement definitely contributes to national development. Self dependency in cement Nepal has more than enough mineral resources to be self-dependent in cement. Political instability is the major drawback in exploiting this rich resource. Also, the industrial policy must be updated from time to time. Currently, the policy must be revised to attract foreign investors. Foreign investors are not sure when and if they will be able to reap returns. Primary goal should not be

focused on economic growth but political stability. Another drawback in our system is late decision making. According to one door policy, investors long to invest but lack of prompt decisions at bureaucracy levels disinterests them. In countries such as China, India, Thailand, Pakistan, Bangladesh and others, once the license is approved for foreign projects according to the one door policy, then and there they sit together and decide everything. Here, even after licensing, different departments keep hindering the operation. Poor labour laws are another drawback. The Ministry of Labour and Social Welfare is focused only on overseas labour law. The ministry is least concerned about formulating appropriate labour laws in the country. Ministers should know their ministries well before they take office.

advt...

Webster University

H 09

to subscribe online: www.readtheboss.com 15 Sep - 14 Oct 2007 the boss 5

cement story

CASE

ANALYSIS Hetauda Cement Industries general manager

Ramesh Kumar Aryal Factory running scenario The factory has not been able to utilise its full production capacity. The output is only around 40 percent of the installed capacity. This inability does not arise from problems with the plant but with short running hours. This fiscal year, the factory production lagged for four months since August due to scarcity of limestone. We excavate limestone from mines at four different locations – Bhainse, Majuwa, Okhare and Jogimara. Some of them are hard to access due to poor road network whereas some have strong opposition from local communities that are demanding higher facilities, way beyond our strengths. Bhainse mine is easily accessible but because of poor limestone quality, we cannot solely depend on it. Disturbances from local communities

stand out as a major hindrance. These disturbances, though present, were not as intense in the past. This problem can be partially solved by fulfilling their demands. But again, the factory is closed now not because of raw material but power crisis – low voltage and irregular power cuts. In addition, some machines are not running well. Even with all these setbacks, we have produced 43 percent of total capacity in this fiscal year. HCI has been making profits for the past three years. If all impediments are managed, production strength will be even more than the capacity utility realised in previous years. Our debt is gradually being paid back. Capital investment The government initially supplied Hetauda Cement Industries with a loan of 10 billion rupees that it received from Asian Development Bank. The government has divided this sum into two dividends. HCI pays interest rate of 10.5 percent and nine percent. The payback to government this year is 120 to 130 million rupees. The industry has equity shares of six different ministries. Total available reserve of mineral resources The total reserve of mineral resources is enough for about 20 years in the future, but the same mine extensions can supply limestone for more periods of time.

EVOLUTION IN

CEMENT USAGE

Panchakanya Group has taken the initiative to introduce a new product in the field of concrete construction, ie, Ready Mix Concrete (RMC). RMC is relevant for big construction works that are presently taking place in Kathmandu. Pradeep Kumar Shrestha, managing director, Panchakanya Group (Industrial and Trading House) explains: What is the product? Ready Mix Concrete (RMC) is a very new concept in Nepal. This product was on our 6

the boss 15 Sep - 14 Oct 2007

mind for quite sometime because there is a real need for it. But since this is a new product, people are only slowly getting used to it. Nevertheless the response has been very good, and we have been encouraged. The most difficult thing has been to convince people on prices. It sounds a little costly, but at the end of the day, it is more cost effective. It eliminates storage space requirement at the construction site and makes construction more efficient. In addition, it prevents noise and dust pollution. The general customers, contractors and even engineers do not understand this. Many contractors and labourers feel that this product is displacing them, but this is not the reality. RMC is important in the valley because Kathmandu is an earthquake prone area. We were also the first to launch TMT steel bars in the country. But just good steel is not enough for construction. Good engineering and something good to concretise should also go hand in hand. This is why the idea of RMC struck us.

Factory capacity and production The total installed capacity at the factory is 750 tons or 16,000 bags of cement per day. The annual production becomes 5.2 million bags of cement. Our production target is 60 percent of the total capacity, ie, 3.1 million bags of cement per year. But due to various factors mentioned above, production met only 67 percent of the target. The production this year has been 2.3 million bags. This is the data of Ordinary Portland Cement (OPC). Some years ago, HCI had been producing Portland Slag Cement (PSC). The production of PSC ceased due to poor supplement of slag, the raw material that comes from steel industries. Even India is having a difficult time getting slag. Profits The profit was Rs 65.7 million in the fiscal year 2061/2062, Rs 24.5 million in 2062/2063. The decrease was a result of the insurgency. This year, the factory is at marginal profit within the range of Rs 100 to 130 million, although exact figures are yet to be calculated. Challenges and plans Power cuts is the enduring problem. We asked for a double circuit line so that we could get power 24 hours a day. They say that power is limited with the fluctuation of the Kulekhani power plant. Load shedding, voltage drop and frequent tripping of power all add to our woes. Frequently tripped power supply even damaged Production capacity With the two factories, we can produce 400 cubic metres of RMC per day, ie, we can cater to 40 small houses a day. Transit mixers that deliver RMC have capacity ranging from three cubic metres to six cubic metres. Three cubic metres cover 300 square feet area of construction. We have 12 transit mixers at present. We have factories in two locations, Jadibuti and Thankot so that we can cater to the needs of customers. We are equipped with a lot of transit mixers and other infrastructure. Clientele Major clients are general households. They are the main sufferers during construction because of space, time, cost and other hassles. Secondly, we are targeting big project sites. We have set an understanding with some of the big contractors, consultants, and we are trying to work closely with building contractors including MK Nirman Sewa and Alliance Insurance, to name a few. We believe that this product will pick up market demand quickly. With the rise in building multi-storey houses in the valley, the demand of RMC will also rise. RMC placement technology We have different grades of RMC. RMC grade is chosen as per the requirement of the structure of the building. RMC is delivered by transit mixers and placement is done by cranes and/or pumping units. RMC can be pumped up to 30 metres height. In inaccessible gullies,

the kiln and other machineries. Efficiency of the machineries drops drastically by irregularity in power supply. HCI pays the highest amount for electricity in the area, so we demand special attention of continuous power supply to the factory. HCI is helpless in getting adequate power supply. NEA maintains that the whole industrial corridor in the area suffers the same problems. We are calling on all top s of electricity in the area to shed load in a systematic way in order to get rid of irregular power tripping. Research must be carried out to find optimum sources of power, be it coal or other fuels; only this can improve efficiency and reduce costs. Demand and supply HCI along with other cement industries in our country fulfill only about 30 percent of the market demand. We have huge reserves of cement grade limestone but production is still very low and consumers have to depend on cement from India. Government should seriously update its policies and bring the reserves spread throughout the country into good use. Foreign cement encroachment The import of Indian cement has never affected HCI’s market. Indian cement come into use only after HCI runs out of stock. HCI has maintained its production standard, and this is the fact why Indian cement cannot compete with

RMC delivery is done using wheel barrows. Pros and cons for contractors and labourers Some labourers and contractors may be displaced. That is the reason why we did not launch this everywhere. It has been launched on need basis. But it also speeds up construction work and helps in bringing more construction projects. The contractors have more jobs to take. Therefore, they need to change their mindset. Difference from other mortars RMC is a proven technology. We are using the aggregate, sand or water that is tested. We use good quality cement, aggregate, double/

our product. HCI has been using the limestone reserves with 43 to 53 percent CaO content which is not found in Indian cement industries. Even if Indian cement is introduced at cheaper prices, people’s first priority will be quality Nepali cement. Nepalis have a good concept of maintaining standard in building houses as Nepal is a highly earthquake prone country. Declining cement production Declining cement production is directly proportional to power crisis. Other requisites do not have many serious effects as most are imported without much difficulty. Contribution of the private sector has been improving gradually although some ed parties have still failed to operate. Private companies in Butwal and Arghakhanchi districts have started cement production via limestone exploitation, which until now was only done by state owned industries. This trend should continue to lessen the import of clinker from India. The time bound licensing strategy will definitely yield much in the field of cement in Nepal. Environmental protection measures HCI has been using ESP equipments to produce cement in environmentally responsible manner, but the equipment have worn down and operate now at 50 percent efficiency. The retrofitting of this equipment

triple washed sand, water and chemicals that strengthen bonding. We provide a guarantee certificate. These are the parameters that ordinary mortars cannot guarantee. Cement brands used We mostly use Udayapur cement. Some local cement is under test. Main objective is to promote Nepali cement. In case of scarcity, we use Indian brands like Ultratec and JP. Market Competition There is no competition in the market, but there is a lot of pain to start something new. We bear all the pain to educate the customers and one fine day someone else may take the advantage once the market is built.

is quite costly. Therefore, we are planning to introduce another technology for minimising pollution. We are preparing documents to get reverse air bag house (RABH) equipment which is more effective. It is eco-friendly, easy to handle and equipped with recycling of dust which otherwise would go to waste. Along with this, we are planning minor modifications in the overall machinery to improve efficiency and production. Past records have demonstrated that we can exceed production of 20,000 tons per month.

OUT OF THE BOX

AVOID HAZARD The hype of earthquake along the Himalayan range was hot last month. It was an irrational rumour but seismologists from around the world have investigated and predicted high Richter scale earthquakes along the Himalayan range in near future. In Nepal, main cities are located in the high earthquake hazard zones. The government has also been making the people aware of the probable hazard. The government has formulated certain guidelines for construction of earthquake resistant buildings and made people follow them. The major component in construction is concrete that includes cement, sand, aggregates and water. Following are the tips on selection of building materials provided by Structural Engineers’ Association Nepal. TIPS ON CEMENT USAGE: • Only high grade cement does not increase the strength of concrete. • Grade of cement used should be just higher than the grade of concrete. • Higher grade cement produces more heat of hydration and increases the risk for cracks. • Just the quantity of cement does not increase strength; the water-cement ratio should also be optimum.

NOTE: • You can replace switch, bulb, finishing, but not the structure (cement, sand and aggregate). The cost of structure is only 30 to 40 percent of total cost. • For good quality of construction you have to pay only 10 to12 percent more. • After addition of water, concrete and/or mortar should be placed at position within three hours. • More water does not give the compaction and leads to porous and weak concrete.

to subscribe online: www.readtheboss.com 15 Sep - 14 Oct 2007 the boss 7

CEMENT

INDUSTRY in Nepal

N © the boss photo file/Ajaya Joshi

epal is enriched with large and small deposits of good cement grade limestone 1. The limestone deposits occur within the sequence of the Lesser Himalayas 2 extending from the east to west. Limestone is by far the most important mineral resource in Nepal, followed by magnesite, marble, lead and zinc. So far, this is also the most economically viable mineral resource. A total of about 1,250 million tons of cement grade limestone is estimated to exist in the country and the existence of at least 224 million tons have been confirmed through drillings and dedicated surveys. Even when only a few deposits are being exploited for commercial production of cement and allied products, limestone still tops the list of the most exploited mineral resources in Nepal.

Despite the abundance, domestic cement production only s for 40 percent of total consumption in Nepal, informs Tej Kant Jha, general manager, Udayapur Cement Industries (UCI). He adds, “UCI alone has been fulfilling 25 percent of the total domestic market demand. All other Nepali cement manufacturers contribute about 15 percent of the demand. Imported cement, mainly Indian, fulfill the remaining 60 percent. But Ramesh Kumar Aryal, general manager, Hetauda Cement Industries (HCI) chooses to differ. He comments, “In the latest scenario, imported cement supplies 70 percent of the market demand.” Needless to say, a good market for cement exists within and outside the country. Aryal 1

2

2

adds, “With inadequate infrastructure and frequent power crisis in the industries, forget exporting, even self dependency in cement production will remain a dream.” The data from the Department of Industries does confirm that cigarettes and beer are the only merchandise whose total capacity utilisation exceeds 50 percent. With the resolution of conflict, a big boost in this industry is likely. The government has promised to invest a lot in infrastructure development – particularly roads, in addition to housing construction and expansion of corporate production facilities. But private sector investment in the cement industry according to the Department of Industries

calcareous sedimentary rock composed of mineral calcite (CaCO3) which upon calcination yields lime (CaO) for commercial use. range of mountains southwards the range of snow capped mountains extending 2400 km east-west along the Himalayan range.

the boss 15 Sep - 14 Oct 2007

Limestone deposit map

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45.

Nigale Sindhali Katari Chobhar Bhainse Okhare Rossi Jogimara Narpani Gandari Surkhet (Chaukune) Diyari Gad Bhumeshwar Chauraha Kajeri (Halchaur) Chuladhunga Ghyampethumka Waling Beldanda Kakaru Sarada Lakharpata Supa Balthali Nandu Bhatte Danda Mane Nigure Lamatar Halesi Kurichaur Badhare Khola Kerabari Bhardeo Majuwa Bhartapur Khanchikot Sabdu Mauwa Khola Tamor River Tankuwa Khola Dhankuta Khola Khalung Khola Neupane Salendanda

Source: Mineral Resources Division, Department of Mines and Geology, July 2003

Cement grade limestone reserves in Nepal and usage Bagmati Zone Lalitpur District Chobhar: Himal Cement Company (a 130,000-Mt/yr cement plant but has closed down with 15.3 million mt of proven reserves) Dhading District Jogimara and Beldanda areas: Hetauda Cement Industries, Tribeni Cement and Annapurna Cement Narayani Zone Makawanpur District Bhainse-Dobhan, Majuwa and Okhare: Hetauda Cement Industries (a 260,000-Mt/yr cement plant with 18 million mt of proven reserves of limestone) Sagarmatha Zone Udayapur District Sindali: Udayapur Cement Industries (a 270,000-Mt/yr cement plant with 70 million mt of proven reserves) Koshi Zone Dhankuta District Nigale, unexploited Proven reserve: 10 million mt Bheri Zone Surkhet District Chaukune, unexploited Proven reserve: 31.5 million mt Source: Ministry of Industry, Department of Mines and Geology, Kathmandu

to subscribe online: www.readtheboss.com 15 Sep - 14 Oct 2007 the boss 3

cement story

CASE

ANALYSIS

Market Research The market for Nepali cement is very good. All the cement stock sells easily for they are good in quality and competitively priced as well. Jha says, “The limestone quality is also superb. Calcium oxide (CaO) content ranges from 43 to 53 percent and Magnesium oxide (MgO) content is less than three percent. Therefore, cement quality is the best in market.” The standard content of CaO in cement grade limestone is 42 percent and MgO is five percent. The ratio of CaO and MgO needs to be maintained to enhance the binding power of cement. About HCI, Aryal says, “The quality of limestone in all the mines is of cement grade except that of Bhainse. Bhainse limestone has to be mixed with

limestone from other mines to produce quality cement.” Grade of Cement Grade of cement only indicates the compressive strength of cement (not concrete) at 28 days. But cement continues to increase in strength beyond 28 days, with not much difference in long term strength. Required compressive strength of various grades of Ordinary Portland Cement (OPC) 33 Grade

43 Grade

53 Grade

Age

Minimum compressive strength in Newton per square millimetre

Three days Seven days 28 days

16.0 22.0 33.0

23.0 33.0 43.0

27.0 37.0 53.0

Annual total cement production and capacity usage percent Cement Production (million metric ton)

does not indicate the expected boost but rather a decline. Companies but fail to operate either due to government indecisiveness and negligence or their own inabilities. Jha comments, “Even after approval from the Ministry of Industry, Commerce and Supply, new projects are still lost in a bureaucratic maze trying to coordinate with agencies like the Department of Road, Department of Forest and other related departments,” and adds, “Mineral regulation will be efficient if such hindrances are removed once the Department of Mines and Geology leases the land for exploitation.” Aryal further suggests, “The government should offer time bound license to private companies so that they are motivated to operate within the time frame,” and emphasises, “The government should the company by eliminating hassles.”

700 –

613643

610044

600 –

644325

500 – 400 – 300 – 200 –

151681

100 –

Fiscal Year

0– 1986/87

49%

2004/05

39.72%

41.71%

2005/06

2006/07

Annual Cement Production Capacity Usage Percent * * Proportion of production with respect to total capacity of industry.

Productivity Index 2005/06 404.69

2006/07 424.93

Source: Ministry of Industry, Department of Industries

Factory Price

Transportation cost

Total price

Nepali

Gaida cement Shakti cement Siddhartha cement Trishakti cement Gorkha cement Bishwokarma cement Jagadamba cement Nirman cement

380 400 380 385 380 385 390 380

90 60 60 65 65 65 65 65

470 460 440 450 445 450 455 445

Indian

Cement prices per bag in Kathmandu Valley Cement Brand

Satana cement Buland cement L & T 43 grade L & T 53 grade Lafarge cement Reliance cement ACC cement

440 440 435 465 430 375 430

65 65 65 65 65 65 65

505 505 500 530 495 440 495

(Source: July 2007 Survey, Udayapur Cement Industries)

4

the boss 15 Sep - 14 Oct 2007

Udayapur Cement Industries general manager

Tej Kant Jha

Factory-running scenario The factory is profitable and expanding in of capacity utilisation, production and turnover. Capacity utilisation has risen over 42 percent from around 35 percent in the previous four years. Promotion of staff, which had been pending since 10 years, have been made. All the factory staff have been made permanent. The total employee count of the factory is 602 with 184 in the istrative section and 418 in technical division. Capital investment The financing of the industry was covered by Japanese OECF assistance of Rs 9.84 billion granted to the government during its establishment. The assistance is provided by the government to UCI as a loan. Also, the government has equity share of 450 million rupees in the industry. The industry is paying back the loan with annual interest rate of five percent. With the rise of foreign currency exchange rate of the Japanese yen, the amount payable is also rising. Had the exchange rate been constant, the loan would have been cleared by this time. Total mineral reserve UCI has limestone reserves for 150 years at the rate of producing 800 metric ton (mt) of clinker a day. The factory is capable of producing 277,200 mt cement per year. Annually, 330,000 mt of limestone is required. The total estimated reserve of the limestone mine is 72 million mt which is in Sindhali area of Udayapur district. It is 27 kms from Jaljale plant site. Besides this, clay, silica sand, iron ore and gypsum are required for cement production. Except clay and silica sand, other raw materials are imported from India. Essential utilities also include fuel (coal, furnace oil), electricity and water. Factory capacity and production The estimated total production capacity of the factory is 277,200 mt of cement per year. This capacity was only met in the fiscal year 2001/2002. The production was 45 percent of the total capacity in 2006/2007. Records of the previous three years show that the capacity utilisation then was only around 35 percent. Taxation The government charges five percent excise duty on imports such as gypsum, coal and iron ore. The government charges excise duty of Rs 5.25 per bag and VAT at 13 percent. Demand and supply With full capacity utilisation, UCI can

contribute in supplying about 60 percent of the market demand. We have not been able to reach this target though. There are certain constraints in our inability to utilise our full potential; these include frequent power failure, load shedding, lockouts, strikes and machinery breakdown. Measures to curb low output To improve output, many changes have been made. A separate transformer for UCI has been installed. This minimises power failures to a great extent. An adequate spare parts reserve has also decreased the negative effect of machinery breakdown. Foreign cement encroachment Market research tells us that consumers go for Indian cement only when they do not find Nepali cement. We have always been trying to increase the production to cover larger proportion of the market and lessen the encroachment of Indian cement. But the aforementioned constraints pull us back. Also, due to leakage in the borders, Indian cement enters the market at cheaper prices. Declining cement production Political instability, formation of trade unions, frequent change in management and incompetent managers are the mains reasons for the decline. Political instability has created a sense of insecurity for foreign investors. Private investment has also been grossly discouraged. Just as schools have been declared

peace zones, effort should also be made to declare industries as peace zones. Environment protection measures To be environmentally friendly in compliance with the mineral law, we have advanced machinery control. Modern machines with electrostatic precipitator (ESP) greatly reduce environment hazards. This technology collects dust that otherwise spreads in the atmosphere creating air pollution. Contribution to national economic growth UCI paid electricity bills of 150 million rupees, loan payoff of 200 million rupees, VAT of 87.5 million rupees and excise duty of 10.5 million rupees to the government this fiscal year. These revenues grow with the growth of cement production. And as a commodity, cement definitely contributes to national development. Self dependency in cement Nepal has more than enough mineral resources to be self-dependent in cement. Political instability is the major drawback in exploiting this rich resource. Also, the industrial policy must be updated from time to time. Currently, the policy must be revised to attract foreign investors. Foreign investors are not sure when and if they will be able to reap returns. Primary goal should not be

focused on economic growth but political stability. Another drawback in our system is late decision making. According to one door policy, investors long to invest but lack of prompt decisions at bureaucracy levels disinterests them. In countries such as China, India, Thailand, Pakistan, Bangladesh and others, once the license is approved for foreign projects according to the one door policy, then and there they sit together and decide everything. Here, even after licensing, different departments keep hindering the operation. Poor labour laws are another drawback. The Ministry of Labour and Social Welfare is focused only on overseas labour law. The ministry is least concerned about formulating appropriate labour laws in the country. Ministers should know their ministries well before they take office.

advt...

Webster University

H 09

to subscribe online: www.readtheboss.com 15 Sep - 14 Oct 2007 the boss 5

cement story

CASE

ANALYSIS Hetauda Cement Industries general manager

Ramesh Kumar Aryal Factory running scenario The factory has not been able to utilise its full production capacity. The output is only around 40 percent of the installed capacity. This inability does not arise from problems with the plant but with short running hours. This fiscal year, the factory production lagged for four months since August due to scarcity of limestone. We excavate limestone from mines at four different locations – Bhainse, Majuwa, Okhare and Jogimara. Some of them are hard to access due to poor road network whereas some have strong opposition from local communities that are demanding higher facilities, way beyond our strengths. Bhainse mine is easily accessible but because of poor limestone quality, we cannot solely depend on it. Disturbances from local communities

stand out as a major hindrance. These disturbances, though present, were not as intense in the past. This problem can be partially solved by fulfilling their demands. But again, the factory is closed now not because of raw material but power crisis – low voltage and irregular power cuts. In addition, some machines are not running well. Even with all these setbacks, we have produced 43 percent of total capacity in this fiscal year. HCI has been making profits for the past three years. If all impediments are managed, production strength will be even more than the capacity utility realised in previous years. Our debt is gradually being paid back. Capital investment The government initially supplied Hetauda Cement Industries with a loan of 10 billion rupees that it received from Asian Development Bank. The government has divided this sum into two dividends. HCI pays interest rate of 10.5 percent and nine percent. The payback to government this year is 120 to 130 million rupees. The industry has equity shares of six different ministries. Total available reserve of mineral resources The total reserve of mineral resources is enough for about 20 years in the future, but the same mine extensions can supply limestone for more periods of time.

EVOLUTION IN

CEMENT USAGE

Panchakanya Group has taken the initiative to introduce a new product in the field of concrete construction, ie, Ready Mix Concrete (RMC). RMC is relevant for big construction works that are presently taking place in Kathmandu. Pradeep Kumar Shrestha, managing director, Panchakanya Group (Industrial and Trading House) explains: What is the product? Ready Mix Concrete (RMC) is a very new concept in Nepal. This product was on our 6

the boss 15 Sep - 14 Oct 2007

mind for quite sometime because there is a real need for it. But since this is a new product, people are only slowly getting used to it. Nevertheless the response has been very good, and we have been encouraged. The most difficult thing has been to convince people on prices. It sounds a little costly, but at the end of the day, it is more cost effective. It eliminates storage space requirement at the construction site and makes construction more efficient. In addition, it prevents noise and dust pollution. The general customers, contractors and even engineers do not understand this. Many contractors and labourers feel that this product is displacing them, but this is not the reality. RMC is important in the valley because Kathmandu is an earthquake prone area. We were also the first to launch TMT steel bars in the country. But just good steel is not enough for construction. Good engineering and something good to concretise should also go hand in hand. This is why the idea of RMC struck us.

Factory capacity and production The total installed capacity at the factory is 750 tons or 16,000 bags of cement per day. The annual production becomes 5.2 million bags of cement. Our production target is 60 percent of the total capacity, ie, 3.1 million bags of cement per year. But due to various factors mentioned above, production met only 67 percent of the target. The production this year has been 2.3 million bags. This is the data of Ordinary Portland Cement (OPC). Some years ago, HCI had been producing Portland Slag Cement (PSC). The production of PSC ceased due to poor supplement of slag, the raw material that comes from steel industries. Even India is having a difficult time getting slag. Profits The profit was Rs 65.7 million in the fiscal year 2061/2062, Rs 24.5 million in 2062/2063. The decrease was a result of the insurgency. This year, the factory is at marginal profit within the range of Rs 100 to 130 million, although exact figures are yet to be calculated. Challenges and plans Power cuts is the enduring problem. We asked for a double circuit line so that we could get power 24 hours a day. They say that power is limited with the fluctuation of the Kulekhani power plant. Load shedding, voltage drop and frequent tripping of power all add to our woes. Frequently tripped power supply even damaged Production capacity With the two factories, we can produce 400 cubic metres of RMC per day, ie, we can cater to 40 small houses a day. Transit mixers that deliver RMC have capacity ranging from three cubic metres to six cubic metres. Three cubic metres cover 300 square feet area of construction. We have 12 transit mixers at present. We have factories in two locations, Jadibuti and Thankot so that we can cater to the needs of customers. We are equipped with a lot of transit mixers and other infrastructure. Clientele Major clients are general households. They are the main sufferers during construction because of space, time, cost and other hassles. Secondly, we are targeting big project sites. We have set an understanding with some of the big contractors, consultants, and we are trying to work closely with building contractors including MK Nirman Sewa and Alliance Insurance, to name a few. We believe that this product will pick up market demand quickly. With the rise in building multi-storey houses in the valley, the demand of RMC will also rise. RMC placement technology We have different grades of RMC. RMC grade is chosen as per the requirement of the structure of the building. RMC is delivered by transit mixers and placement is done by cranes and/or pumping units. RMC can be pumped up to 30 metres height. In inaccessible gullies,

the kiln and other machineries. Efficiency of the machineries drops drastically by irregularity in power supply. HCI pays the highest amount for electricity in the area, so we demand special attention of continuous power supply to the factory. HCI is helpless in getting adequate power supply. NEA maintains that the whole industrial corridor in the area suffers the same problems. We are calling on all top s of electricity in the area to shed load in a systematic way in order to get rid of irregular power tripping. Research must be carried out to find optimum sources of power, be it coal or other fuels; only this can improve efficiency and reduce costs. Demand and supply HCI along with other cement industries in our country fulfill only about 30 percent of the market demand. We have huge reserves of cement grade limestone but production is still very low and consumers have to depend on cement from India. Government should seriously update its policies and bring the reserves spread throughout the country into good use. Foreign cement encroachment The import of Indian cement has never affected HCI’s market. Indian cement come into use only after HCI runs out of stock. HCI has maintained its production standard, and this is the fact why Indian cement cannot compete with

RMC delivery is done using wheel barrows. Pros and cons for contractors and labourers Some labourers and contractors may be displaced. That is the reason why we did not launch this everywhere. It has been launched on need basis. But it also speeds up construction work and helps in bringing more construction projects. The contractors have more jobs to take. Therefore, they need to change their mindset. Difference from other mortars RMC is a proven technology. We are using the aggregate, sand or water that is tested. We use good quality cement, aggregate, double/

our product. HCI has been using the limestone reserves with 43 to 53 percent CaO content which is not found in Indian cement industries. Even if Indian cement is introduced at cheaper prices, people’s first priority will be quality Nepali cement. Nepalis have a good concept of maintaining standard in building houses as Nepal is a highly earthquake prone country. Declining cement production Declining cement production is directly proportional to power crisis. Other requisites do not have many serious effects as most are imported without much difficulty. Contribution of the private sector has been improving gradually although some ed parties have still failed to operate. Private companies in Butwal and Arghakhanchi districts have started cement production via limestone exploitation, which until now was only done by state owned industries. This trend should continue to lessen the import of clinker from India. The time bound licensing strategy will definitely yield much in the field of cement in Nepal. Environmental protection measures HCI has been using ESP equipments to produce cement in environmentally responsible manner, but the equipment have worn down and operate now at 50 percent efficiency. The retrofitting of this equipment

triple washed sand, water and chemicals that strengthen bonding. We provide a guarantee certificate. These are the parameters that ordinary mortars cannot guarantee. Cement brands used We mostly use Udayapur cement. Some local cement is under test. Main objective is to promote Nepali cement. In case of scarcity, we use Indian brands like Ultratec and JP. Market Competition There is no competition in the market, but there is a lot of pain to start something new. We bear all the pain to educate the customers and one fine day someone else may take the advantage once the market is built.

is quite costly. Therefore, we are planning to introduce another technology for minimising pollution. We are preparing documents to get reverse air bag house (RABH) equipment which is more effective. It is eco-friendly, easy to handle and equipped with recycling of dust which otherwise would go to waste. Along with this, we are planning minor modifications in the overall machinery to improve efficiency and production. Past records have demonstrated that we can exceed production of 20,000 tons per month.

OUT OF THE BOX

AVOID HAZARD The hype of earthquake along the Himalayan range was hot last month. It was an irrational rumour but seismologists from around the world have investigated and predicted high Richter scale earthquakes along the Himalayan range in near future. In Nepal, main cities are located in the high earthquake hazard zones. The government has also been making the people aware of the probable hazard. The government has formulated certain guidelines for construction of earthquake resistant buildings and made people follow them. The major component in construction is concrete that includes cement, sand, aggregates and water. Following are the tips on selection of building materials provided by Structural Engineers’ Association Nepal. TIPS ON CEMENT USAGE: • Only high grade cement does not increase the strength of concrete. • Grade of cement used should be just higher than the grade of concrete. • Higher grade cement produces more heat of hydration and increases the risk for cracks. • Just the quantity of cement does not increase strength; the water-cement ratio should also be optimum.

NOTE: • You can replace switch, bulb, finishing, but not the structure (cement, sand and aggregate). The cost of structure is only 30 to 40 percent of total cost. • For good quality of construction you have to pay only 10 to12 percent more. • After addition of water, concrete and/or mortar should be placed at position within three hours. • More water does not give the compaction and leads to porous and weak concrete.

to subscribe online: www.readtheboss.com 15 Sep - 14 Oct 2007 the boss 7