Competitive Structure Of Industries 3e316t

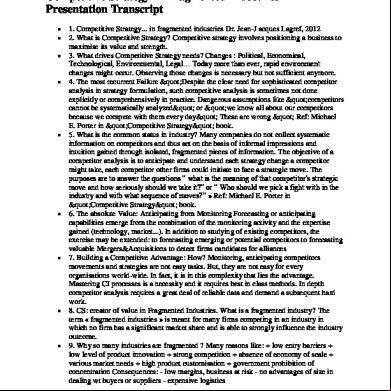

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3i3n4

Overview 26281t

& View Competitive Structure Of Industries as PDF for free.

More details 6y5l6z

- Words: 3,258

- Pages: 68

Chapter 2 Summary Business Competitive Environment

Review of Objectives To clearly understand competition: Definition of Competitiveness Competitive Advantage Global Competition Role of the nation: Role of government within a nation.

Definition of Competitiveness

Objective of a business is to make a profit. Profit based on providing value to customers.

How can a business assure value to customers? A good competitor knows: Which products and services it offers. Who its customers are. Who its competitors are.

Competitive Advantage To assure positioning for profit, a company must maintain competitive advantage. Methods that are achievable and sustainable. Work smarter. Assess whether Information Systems are appropriate to gaining a competitive advantage? Focus on three primary inputs: HR , Capital, Technology.

Global Competition The Global Market will come to you if you don’t go to it. By staying in your home country, you assume a defensive position. There are advantages and disadvantages to going global. These need to be considered carefully.

Role of the Nation Study states that increased competitiveness of the Nation will stimulate the economy. 6 recommended steps to stay competitive. Only companies can sustain and achieve competitive advantage. Government should serve as a catalyst and a challenger.

Competitiveness: A Link to National Goals Human Resources

Capital

Technology

Trade Policy

Improved Domestic Performance

New Competition

Decreased Budget Deficit

Increased World Market Competitiveness Reduced Trade Deficit

Stronger National Security

More and Better Jobs

Increased Standard of Living Figure 2-1

Chapter 3 Introduction The Porter Competitive Model for Industry Structure Analysis

Key Chapter Objectives Basic understanding of Porter Competitive Model How the model can be used to analyze a company’s competitive position within its environment (its industry). How IS infrastructure can influences a companies responsiveness to its changing business environment.

The Porter Competitive Model Used to understand and evaluate the structure of an industry’s business environment and the threats of competition to a specific company.

Porter Competitive Model Potential New Entrants

Bargaining Power of Suppliers

Intra-Industry Rivalry Strategic Business Unit

Bargaining Power of Buyers

Substitute Products and Services Source: Michael E. Porter ―Forces Governing Competition in Industry Harvard Business Review, Mar.-Apr. 1979

Figure 3-1

Two Strategic Objectives

Create effective links with customers and suppliers

Create barriers to new entrants and substitute products

Primary and ing Strategies Differentiation Strategy (Primary) Low Cost Strategy (Primary) Innovation (ing) Growth (ing) Alliance (ing)

Value Chain

Developed by Michael Porter but different from competitive model because it focuses within the company.

Analyzes the cross-functional flow of products or services within an organization that add value to customers.

ACTIVITIES

Generic Value Chain FIRM INFRASTRUCTURE HUMAN RESOURCE MANAGEMENT TECHNOLOGY DEVELOPMENT PROCUREMENT

INBOUND LOGISTICS

OPERATIONS OUTBOUND LOGISTICS

MARKETING AND SALES

SERVICE

PRIMARY ACTIVITIES Adapted with the permission of the Free Press, an imprint of Simon & Schuster Inc.. from COMPETITIVE ADVANTAGE: Creating and Sustaining Superior Performance by Michael Porter. Copyright © 1985 by Michael E. Porter.

Figure 3-6

Value Chain and IS The Value Chain can be used to determine where IS can strengthen the flow of primary and activities within an organization. Every segment of an organization needs IT and IS to be competitive. So this model is essential to visualizing the flow of activities within segments through the use of IS and IT.

Chapter 3 Porter Competitive Model for Industry Structure Analysis

Awareness of competitive forces can help a company stake out a position in its industry that is less vulnerable to attack. Michael E. Porter

Competitive Strategy

Porter Competitive Model • Was not developed for IS use. • Breaks an industry into logical parts, analyzes them and puts them back together. • Avoids viewing the industry too narrowly. • Provides an understanding of the structure of an industry’s business environment. • Provides an understanding of competitive threats into an industry.

Why Do You Care? The collective strength of the industry forces determines the ultimate profit potential of an industry. The strongest competitive forces are of greatest importance in formulating competitive strategies. Every industry has an underlying structure, or a set of fundamental economic and technical characteristics that gives rise to these competitive forces.

Why Do You Care? This view of competition pertains to industries selling products and those dealing in services.

A few characteristics are often key to the strength of each competitive force.

Key Industry Analysis Factors • Collecting the data. • Determining which data is important.

• Selecting an appropriate overall approach. • Deciding on the logical starting point.

Basic Objectives of the SBU 1. To create effective links with buyers and suppliers. 2. To build barriers to new entrants and substitute products.

Porter Competitive Model Potential New Entrants

Bargaining Power of Suppliers

Intra-Industry Rivalry Strategic Business Unit

Bargaining Power of Buyers

Substitute Products and Services Source: Michael E. Porter ―Forces Governing Competition in Industry Harvard Business Review, Mar.-Apr. 1979

Figure 3-1

Rivalry Likelihood • Profit margins.

• Industry growth rate and potential. • A lack of capacity to satisfy the market. • Fixed costs. • Competitor concentration and balance. • Diversity of competitors.

• Existing brand identity. • Switching costs. • Exit barriers.

A Buyer Has Power If: 1. It has large, concentrated buying power that enables it to gain volume discounts and/or special or services. 2. What it is buying is standard or undifferentiated and there are multiple alternative sources. 3. It earns low profit margins so it has great incentive to lower its purchasing costs. 4. It has a strong potential to backward integrate. 5. The product is unimportant to the quality of the buyers’ products or services.

A Supplier Has Power If: 1. There is domination of supply by a few companies. 2. Its product is unique or at least differentiated. 3. It has built up switching costs. 4. It provides benefits through geographic proximity to its customers. 5. It poses a definite threat to forward integrate into

its customers’ business. 6. A long time working relationship provides unique capabilities.

Definitions New Entrant:

An existing company or a startup that has not previously competed with the SBU in its geographic market. It can also be an existing company that through a shift in business strategy begins to compete with the SBU. Substitute Product or Service:

An alternative to doing business with the SBU. This depends on the willingness of the buyers to substitute, the relative price/performance of the substitute and/or the level of the switching cost.

Possible Barriers to Entry • Economies of scale.

• Strong, established cost advantages. • Strong, established brands. • Proprietary product differences. • Major switching costs. • Limited or restrained access to distribution. • Large capital expenditure requirements. • Government policy. • Definite strong competitor retaliation.

Substitute Threats • Buyer propensity to substitute. • Relative price/performance of substitutes. • Switching costs.

Competitive Strategies • What is driving competition in my current or future industry? • What are my current or future competitors likely to do and how will we respond? • How can we best posture ourselves to achieve and sustain a competitive advantage?

Strategy Options According to Michael Porter Primary Strategies 1. Differentiation 2. Least Cost ing Strategies 1. Innovation 2. Growth 3. Alliance

Can Information Systems: 1. Build barriers to prevent a company from entering an industry? 2. Build in costs that would make it difficult for a customer to switch to another supplier? 3. Change the basis for competition within the industry? 4. Change the balance of power in the relationship that a company has with customers or suppliers? 5. Provide the basis for new products and services, new markets or other new business opportunities?

Porter Competitive Model Heavyweight Motorcycle Manufacturing Industry North American Market

• Parts Manufacturers • Electronic Components • Specialty Metal Suppliers • Machine Tool Vendors • Labor Unions • IT Vendors

Bargaining Power of Suppliers • Automobiles • Public Transportation • Mopeds • Bicycles

• Foreign Manufacturer

Potential New Entrant

Intra-Industry Rivalry SBU: Harley-Davidson Rivals: Honda, BMW, Suzuki, Yamaha

Substitute Product or Service

• Established Company Entering a New Market Segment • New Startup

Bargaining Power of Buyers • Recreational Cyclist • Young Adults • Law Enforcement • Military Use • Racers

Business Strategy Model - Motorcycle Manufacturing Industry Product Strategy Type/Purpose/Size

Heavyweight Off-Road Dual Purpose Road Racing Café Racer Price Strategy

Entry Level Law Enforcement

Moderate Market Strategy

Military Recreational Professional Young Adult

North American

Europe Japan/Asia Manufacturing Strategy

Vertically Integrated

Vendor Emphasis

Latin America Outsource

Sales/Distribution Strategy Distributors

Independent Dealers Franchised Dealers Company Structure

Independent

Alliances

t Ventures/Subsidiaries

Information Systems Engineering

Product Design

Manufacturing

Sales/Distribution

Business

Business Strategy Model – Food Service Industry Product Strategy Limited Specialized Products

Broad Range of Specialized Products

Wide Range of Non-specialized Products

Health Conscious Products

Customer Strategy Young Adults Parents Teenagers with Social with Focus Kids

Time Conscious Adults

Leisure Adults

Senior Citizens

Store Format Strategy Dine In Wait Service

Dine In Counter Service or Buffet

Take Out

Drive Through

Vendor Strategy Competitive Bids

Long Term Contracts

Alliances

Vertically Integrated

Market Strategy Local

Regional

National

International

Ethnic Focus

Company Structure Strategy Independent

Alliances

Franchises

Subsidiary

Information Systems Strategy Customer Systems

Store Logistical Systems

Product Analysis System

Business Systems

Porter Competitive Model Analysis for the San Francisco 49ers New Entrants

Suppliers

Intra-Industry Rivalry SBU: SF Giants

Substitute Products and Services

Buyers

Porter Competitive Model Analysis for the San Francisco 49ers Bay Area Market New Entrants •Canadian Football •Professional Hockey •Professional Soccer •Sumo Tournaments

Suppliers

Buyers

•Players Union •City of SF •Transportation Services •Food Service •Sovereigns •Police and Sanitation Service •Utilities •Stadium Employees

•Die Hard 49er Fans •Die Hard Football Fans Intra-Industry Rivalry •Fair Weather Football Fans SBU: SF 49ers •Non-football Fans •Rivals: Oakland Raiders •Out of Town Visitors •Arena Football •Opposing Team Fans •S.F. 49ers •Age Group Segments •Golden State Warriors •Groups Versus Individuals •College Athletic Events •Corporate Sponsors •High School Athletic Events •Sports Writers and Media •Movies, Stage Plays, etc. Outlets •General Travel and Travel Packages

Substitute Products and Services •Televised Football Games - Free or Cable Service at Home •Televised Games at Sports Bars • Radio Broadcasts of Football Games • Rotisserie Leagues, Trading Cards, Memorabilia

Porter Competitive Model Tips 1. To incorrectly define the industry can cause major problems in doing Section I of the analysis term paper. 2. You must identify the specific market being evaluated. 3. Your analysis company is the Strategic Business Unit. 4. Identify rivals by name for majors, by category for minor rivals if needed to present the best possible profile of

rivals.

Porter Competitive Model 5. Be sure to address the power implications of both customers and suppliers. Power buys them what? 6. Identify buyers and suppliers by categories versus companies. 7. Summarize your Porter Model analysis.

Computer Industry Why is this industry more of a challenge to evaluate using the Porter Competitive Model?

Old Computer Industry Layer 5 Distribution Layer 4 Application Software Layer 3 Operating System Software Layer 2 Computing Platforms Layer 1 Basic Circuitry IBM

DEC

HP

Fujitsu

NCR Figure 3-3

The New Computer Industry Layer 5 Distributors

Computer Dealers

Super Stores

Mass Clubs Merchandisers

Mail Order

Value-add Resellers

Direct Sales Force

Other

Layer 4 Applications Lotus 1-2-3

•Spreadsheets •Word Processors •Database

Layer 3 Operating System Software Layer 2 Computer Platforms

Layer 1 Microprocessor

MS DOS Novell Netware

IBM

Compaq

Intel X86

Microsoft Excel

Windows

Quattro Pro

OS/2

Banyan

Unix IBM

Other Intel-Based PCs

Motorola

Apple Others

Apple Macs

RISC

Other

Power PC

Figure 3-4

The Computer Industry Layer 6 Sales and Distribution Layer 5 Application Software •Enterprise •Specific Layer 4 Database & Networking Software Layer 3 Operating System Software Layer 2 Computer Hardware Platforms

Layer 1 Microprocessor

Computer Stores

Super Stores

Mass Mail Merchandisers Order

Value-add Resellers

Direct Sales Force

Internet Direct

Desktop Suites Enterprise Resource Planning Supply Chain Management Other Word Processors Spread Sheets Publishing Groupware Data Warehouse Other

LAN, WAN and Internet Software Interfaces, Browsers and Search Engines Hierarchical Database

Windows

Unix

Relationship Database

Linux

Supercomputer Mainframe Midrange Workstation PC

Intel X86

Motorola

Apple

Handheld Device

RISC

Power PC

Computer Industry Hardware • Processors • Input/Output Devices • Storage Devices

Networking Equipment?

Multiple processor segments in the computer industry. Processor companies versus specialized hardware companies.

Software

• Systems Software • Operating Systems • Database Systems

• Network Systems • Utility Software • Performance and Security Software • Development Software • Programming Languages • CASE Software • Applications Software

Hardware vendors versus independent software companies.

Applications Software Specific application software to do numerous things. Running on a range of processors. Applications suites (integrated applications) Some call these integrated enterprise applications Is game software from Sony a part of the computer industry? Is software to run numerical control machine tools part of the computer industry? Is software to analyze automobile smog tests part of the computer industry?

Worldwide Computer Hardware Sales 2000

1999

1998

Supercomputer 1997

Mainframe Midrange Workstation

1996

Personal Computer 1995

Source: Dataquest 1994

Millions of Dollars

1993

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

Worldwide Hardware Sales 2002 PCs Total Hardware

2001

Billions of $s

2000 0

100

200

300

Billions of $s Source: Dataquest

What is a PC? 1. A desktop tool—word processor, spreadsheet, publishing tool, data store. 2. An entertainment device.

3. Communication device—email. 4. Information source—Internet sources. 5. A collaboration tool.

PC Industry Segment 1. ed $100 billion in sales in the first ten years. 2. Growth and competition was based on industry standards like never before.

3. This has spawned thousands of niche companies. 4. The PC has fundamentally restructured the Computer Industry. 5. Industry pioneers believe the revolution is no more than half over.

Change Relative to Selling PCs 1. Languages 2. Application Packages

3. Connectivity and Compatibility 4. Multimedia

5. Communication Device--Groupware

PC Industry Change • Atari

• Dell

• Cromemco

• Gateway

• Fortune Systems

• IBM

• Wicat Systems

• HP (Compaq)

• Kaypro

• NEC

• Morrow Designs • Osborne Computer • Victor Technologies

The Future Computer Industry 1. Traditional US Companies (large). 2. Asian Electronic Companies. 3. The New Strategy Companies. Why has the US continued to be the world leader in the computer industry?

Porter Value Chain Basic Concept:

1. Deals with core business processes. 2. Enables tracking a new idea to create a new product and/or service from origination all the way to customer satisfaction.

Porter Value Chain Manufacturing Industry Value Chain

Research and Development

Production Engineering and Manufacturing

Sales Marketing and Distribution

Service

Retail Industry Value Chain

Partnering with Vendor

Managing Buying Inventory

Distributing Operating Inventory Stores

Marketing and Selling

Value Chain Things to 1. Value to customer objective is not clear. 2. Relay team concept is too time consuming and doesn’t work in the current competitive environment.

3. Maximize the value-add activities and eliminate as much as possible the things that do not add value. 4. Make sure that each step in the overall process (each function) does things consistent with the overall objective of value to customer.

ACTIVITIES

Generic Value Chain FIRM INFRASTRUCTURE HUMAN RESOURCE MANAGEMENT TECHNOLOGY DEVELOPMENT PROCUREMENT

INBOUND LOGISTICS

OPERATIONS OUTBOUND LOGISTICS

MARKETING AND SALES

SERVICE

PRIMARY ACTIVITIES Adapted with the permission of the Free Press, an imprint of Simon & Schuster Inc.. from COMPETITIVE ADVANTAGE: Creating and Sustaining Superior Performance by Michael Porter. Copyright © 1985 by Michael E. Porter.

Figure 3-6

Property and Casualty Industry Value Chain FIRM INFRASTRUCTURE

-Financial Policy

HUMAN RESOURCE MANAGEMENT

-Regulatory Compliance

- ing

Agent Training

Actuary Training Actuarial Methods Investment Practices

TECHNOLOGY DEVELOPMENT

- Legal

Product Development Market Research

Claims Training Claims Procedures

I/T Communications

PROCUREMENT

•Policy Rating

• Underwriting • Investment

•Independent Agent Network •Billing and Collections

•Policy Sales •Policy Renewal •Agent Management •Advertising

INBOUND LOGISTICS

OPERATIONS

OUTBOUND LOGISTICS

MARKETING AND SALES

•Claims Settlement •Loss Control

SERVICE

Included with permission of Michael E. Porter based on ideas in Competitive Advantage: Creating and Sustaining Superior Performance, copyright 1985 by Michael E. Porter.

Figure 3-7

Technologies in the Value Chain Information System Technology Planning and Budgeting Technology Office Technology

FIRM INFRASTRUCTURE

Training Technology Motivation Research Information Technology

HUMAN RESOURCE MANAGEMENT

Product Technology Computer-Aided Design Pilot Plant Technology

TECHNOLOGY DEVELOPMENT

Software Development Tools Information Systems Technology

Information Systems Technology Communication System Technology Transportation System Technology

PROCUREMENT •Transportation Technology •Material Handling Technology •Storage and Preservation Technology •Communication System Technology •Testing Technology •Information Technology

INBOUND LOGISTICS

•Basic Process Technology •Materials Technology •Machine Tools Technology •Materials Handling Technology •Packaging Technology •Testing Technology •I/nformation Tech.

OPERATIONS

•Transportation Technology •Material Handling Technology •Packaging Technology •Communications Technology •Information Technology

•Multi-Media Technology •Communication Technology •Information Technology

•Diagnostic and Testing Technology •Communications Technology •Information Technology

OUTBOUND LOGISTICS

MARKETING AND SALES

SERVICE

Adapted with the permission of the Free Press, an imprint of Simon & Schuster Inc.. from COMPETITIVE ADVANTAGE: Creating and Sustaining Superior Performance by Michael Porter. Copyright © 1985 by Michael E. Porter., p. 167.

Figure 3-8

Business Awareness Questionnaire 2. The world’s largest corporation based on annual revenue is Wal-Mart. 3. CTO – Chief Technical Officer CFO – Chief Financial Officer

CMO – Chief Marketing Officer CIO – Chief Information Officer COO – Chief Operating Officer CEO – Chief Executive Officer 4. Large number of well known business success books.

5. Business Week, Fortune, Forbes, The Economist, Harvard Business Review Information Week, Datamation, Computer World A. Larry Ellison – Oracle B. Scott McNealy – Sun Microsystems C. John Chambers – Cisco Systems D. Carly Fiorina – Hewlett-Packard E. Craig Barrett – Intel Corp. F. Steve Balmer – Microsoft G. Jeff Bezos – Amazon.com

A. Sam Walton – Wal-Mart Stores B. Fred Smith – Federal Express C. Gordon Moore – Intel Corp. D. Herb Kelleher – Southwest Airlines E. David Filo – Yahoo! F. George Zimmer – Men’s Wearhouse A. Michael Porter – Business Competitiveness B. Michael Hammer – Process Reengineering C. W. Edwards Demming – Total Quality Management D. Tom Peters – Managing by Walking Around E. Warren Bennis – Business Leadership

Significant Business Events During 2000:

1. Enron collapse 2. HP-Compaq merger 3. United Airlines bankruptcy 4. Survival of Amazon.com and continued success of eBay. 1. Amazon.com is definitely the standard by which eCommerce companies are compared. eBay is uniquely profitable as an Internet company. 2. NASDAQ lists more than technology companies.

3. The News, Life, Sports and Weather is a description of USA Today and not the Wall Street Journal. 4. Japan, not , is the world’s second largest economy.

5. Saturn is owned by GM and not Ford. 6. Burn rate is the rate at which a startup uses up its cash position on a daily or weekly basis.

7. A balance sheet indicates assets and liabilities. The profit and loss statement indicates profit. 8. A general sentiment is that established companies with a solid brick and mortar foundation can move to the Internet with a winning approach. 9. The big three of the airline industry are American, United and Delta—not Northwest.

1. To start a new business requires: E. all of the above. 2. Of the factors in question 1, not having sufficient operating capital is the cause of most business failures.

3. Never listed as first on the Fortune Most ired List are Cisco Systems, Intel and Wal-Mart Stores. 4. Industries that have dominated the least ired list are the Savings and Loan Industry and the Airline Industry. 5. A money source for a startup that is not realistic in most cases is commercial banks. 6. IPO stands for initial public offering. 7. Marketing is determining what to sell and sales is selling what you have.

Review of Objectives To clearly understand competition: Definition of Competitiveness Competitive Advantage Global Competition Role of the nation: Role of government within a nation.

Definition of Competitiveness

Objective of a business is to make a profit. Profit based on providing value to customers.

How can a business assure value to customers? A good competitor knows: Which products and services it offers. Who its customers are. Who its competitors are.

Competitive Advantage To assure positioning for profit, a company must maintain competitive advantage. Methods that are achievable and sustainable. Work smarter. Assess whether Information Systems are appropriate to gaining a competitive advantage? Focus on three primary inputs: HR , Capital, Technology.

Global Competition The Global Market will come to you if you don’t go to it. By staying in your home country, you assume a defensive position. There are advantages and disadvantages to going global. These need to be considered carefully.

Role of the Nation Study states that increased competitiveness of the Nation will stimulate the economy. 6 recommended steps to stay competitive. Only companies can sustain and achieve competitive advantage. Government should serve as a catalyst and a challenger.

Competitiveness: A Link to National Goals Human Resources

Capital

Technology

Trade Policy

Improved Domestic Performance

New Competition

Decreased Budget Deficit

Increased World Market Competitiveness Reduced Trade Deficit

Stronger National Security

More and Better Jobs

Increased Standard of Living Figure 2-1

Chapter 3 Introduction The Porter Competitive Model for Industry Structure Analysis

Key Chapter Objectives Basic understanding of Porter Competitive Model How the model can be used to analyze a company’s competitive position within its environment (its industry). How IS infrastructure can influences a companies responsiveness to its changing business environment.

The Porter Competitive Model Used to understand and evaluate the structure of an industry’s business environment and the threats of competition to a specific company.

Porter Competitive Model Potential New Entrants

Bargaining Power of Suppliers

Intra-Industry Rivalry Strategic Business Unit

Bargaining Power of Buyers

Substitute Products and Services Source: Michael E. Porter ―Forces Governing Competition in Industry Harvard Business Review, Mar.-Apr. 1979

Figure 3-1

Two Strategic Objectives

Create effective links with customers and suppliers

Create barriers to new entrants and substitute products

Primary and ing Strategies Differentiation Strategy (Primary) Low Cost Strategy (Primary) Innovation (ing) Growth (ing) Alliance (ing)

Value Chain

Developed by Michael Porter but different from competitive model because it focuses within the company.

Analyzes the cross-functional flow of products or services within an organization that add value to customers.

ACTIVITIES

Generic Value Chain FIRM INFRASTRUCTURE HUMAN RESOURCE MANAGEMENT TECHNOLOGY DEVELOPMENT PROCUREMENT

INBOUND LOGISTICS

OPERATIONS OUTBOUND LOGISTICS

MARKETING AND SALES

SERVICE

PRIMARY ACTIVITIES Adapted with the permission of the Free Press, an imprint of Simon & Schuster Inc.. from COMPETITIVE ADVANTAGE: Creating and Sustaining Superior Performance by Michael Porter. Copyright © 1985 by Michael E. Porter.

Figure 3-6

Value Chain and IS The Value Chain can be used to determine where IS can strengthen the flow of primary and activities within an organization. Every segment of an organization needs IT and IS to be competitive. So this model is essential to visualizing the flow of activities within segments through the use of IS and IT.

Chapter 3 Porter Competitive Model for Industry Structure Analysis

Awareness of competitive forces can help a company stake out a position in its industry that is less vulnerable to attack. Michael E. Porter

Competitive Strategy

Porter Competitive Model • Was not developed for IS use. • Breaks an industry into logical parts, analyzes them and puts them back together. • Avoids viewing the industry too narrowly. • Provides an understanding of the structure of an industry’s business environment. • Provides an understanding of competitive threats into an industry.

Why Do You Care? The collective strength of the industry forces determines the ultimate profit potential of an industry. The strongest competitive forces are of greatest importance in formulating competitive strategies. Every industry has an underlying structure, or a set of fundamental economic and technical characteristics that gives rise to these competitive forces.

Why Do You Care? This view of competition pertains to industries selling products and those dealing in services.

A few characteristics are often key to the strength of each competitive force.

Key Industry Analysis Factors • Collecting the data. • Determining which data is important.

• Selecting an appropriate overall approach. • Deciding on the logical starting point.

Basic Objectives of the SBU 1. To create effective links with buyers and suppliers. 2. To build barriers to new entrants and substitute products.

Porter Competitive Model Potential New Entrants

Bargaining Power of Suppliers

Intra-Industry Rivalry Strategic Business Unit

Bargaining Power of Buyers

Substitute Products and Services Source: Michael E. Porter ―Forces Governing Competition in Industry Harvard Business Review, Mar.-Apr. 1979

Figure 3-1

Rivalry Likelihood • Profit margins.

• Industry growth rate and potential. • A lack of capacity to satisfy the market. • Fixed costs. • Competitor concentration and balance. • Diversity of competitors.

• Existing brand identity. • Switching costs. • Exit barriers.

A Buyer Has Power If: 1. It has large, concentrated buying power that enables it to gain volume discounts and/or special or services. 2. What it is buying is standard or undifferentiated and there are multiple alternative sources. 3. It earns low profit margins so it has great incentive to lower its purchasing costs. 4. It has a strong potential to backward integrate. 5. The product is unimportant to the quality of the buyers’ products or services.

A Supplier Has Power If: 1. There is domination of supply by a few companies. 2. Its product is unique or at least differentiated. 3. It has built up switching costs. 4. It provides benefits through geographic proximity to its customers. 5. It poses a definite threat to forward integrate into

its customers’ business. 6. A long time working relationship provides unique capabilities.

Definitions New Entrant:

An existing company or a startup that has not previously competed with the SBU in its geographic market. It can also be an existing company that through a shift in business strategy begins to compete with the SBU. Substitute Product or Service:

An alternative to doing business with the SBU. This depends on the willingness of the buyers to substitute, the relative price/performance of the substitute and/or the level of the switching cost.

Possible Barriers to Entry • Economies of scale.

• Strong, established cost advantages. • Strong, established brands. • Proprietary product differences. • Major switching costs. • Limited or restrained access to distribution. • Large capital expenditure requirements. • Government policy. • Definite strong competitor retaliation.

Substitute Threats • Buyer propensity to substitute. • Relative price/performance of substitutes. • Switching costs.

Competitive Strategies • What is driving competition in my current or future industry? • What are my current or future competitors likely to do and how will we respond? • How can we best posture ourselves to achieve and sustain a competitive advantage?

Strategy Options According to Michael Porter Primary Strategies 1. Differentiation 2. Least Cost ing Strategies 1. Innovation 2. Growth 3. Alliance

Can Information Systems: 1. Build barriers to prevent a company from entering an industry? 2. Build in costs that would make it difficult for a customer to switch to another supplier? 3. Change the basis for competition within the industry? 4. Change the balance of power in the relationship that a company has with customers or suppliers? 5. Provide the basis for new products and services, new markets or other new business opportunities?

Porter Competitive Model Heavyweight Motorcycle Manufacturing Industry North American Market

• Parts Manufacturers • Electronic Components • Specialty Metal Suppliers • Machine Tool Vendors • Labor Unions • IT Vendors

Bargaining Power of Suppliers • Automobiles • Public Transportation • Mopeds • Bicycles

• Foreign Manufacturer

Potential New Entrant

Intra-Industry Rivalry SBU: Harley-Davidson Rivals: Honda, BMW, Suzuki, Yamaha

Substitute Product or Service

• Established Company Entering a New Market Segment • New Startup

Bargaining Power of Buyers • Recreational Cyclist • Young Adults • Law Enforcement • Military Use • Racers

Business Strategy Model - Motorcycle Manufacturing Industry Product Strategy Type/Purpose/Size

Heavyweight Off-Road Dual Purpose Road Racing Café Racer Price Strategy

Entry Level Law Enforcement

Moderate Market Strategy

Military Recreational Professional Young Adult

North American

Europe Japan/Asia Manufacturing Strategy

Vertically Integrated

Vendor Emphasis

Latin America Outsource

Sales/Distribution Strategy Distributors

Independent Dealers Franchised Dealers Company Structure

Independent

Alliances

t Ventures/Subsidiaries

Information Systems Engineering

Product Design

Manufacturing

Sales/Distribution

Business

Business Strategy Model – Food Service Industry Product Strategy Limited Specialized Products

Broad Range of Specialized Products

Wide Range of Non-specialized Products

Health Conscious Products

Customer Strategy Young Adults Parents Teenagers with Social with Focus Kids

Time Conscious Adults

Leisure Adults

Senior Citizens

Store Format Strategy Dine In Wait Service

Dine In Counter Service or Buffet

Take Out

Drive Through

Vendor Strategy Competitive Bids

Long Term Contracts

Alliances

Vertically Integrated

Market Strategy Local

Regional

National

International

Ethnic Focus

Company Structure Strategy Independent

Alliances

Franchises

Subsidiary

Information Systems Strategy Customer Systems

Store Logistical Systems

Product Analysis System

Business Systems

Porter Competitive Model Analysis for the San Francisco 49ers New Entrants

Suppliers

Intra-Industry Rivalry SBU: SF Giants

Substitute Products and Services

Buyers

Porter Competitive Model Analysis for the San Francisco 49ers Bay Area Market New Entrants •Canadian Football •Professional Hockey •Professional Soccer •Sumo Tournaments

Suppliers

Buyers

•Players Union •City of SF •Transportation Services •Food Service •Sovereigns •Police and Sanitation Service •Utilities •Stadium Employees

•Die Hard 49er Fans •Die Hard Football Fans Intra-Industry Rivalry •Fair Weather Football Fans SBU: SF 49ers •Non-football Fans •Rivals: Oakland Raiders •Out of Town Visitors •Arena Football •Opposing Team Fans •S.F. 49ers •Age Group Segments •Golden State Warriors •Groups Versus Individuals •College Athletic Events •Corporate Sponsors •High School Athletic Events •Sports Writers and Media •Movies, Stage Plays, etc. Outlets •General Travel and Travel Packages

Substitute Products and Services •Televised Football Games - Free or Cable Service at Home •Televised Games at Sports Bars • Radio Broadcasts of Football Games • Rotisserie Leagues, Trading Cards, Memorabilia

Porter Competitive Model Tips 1. To incorrectly define the industry can cause major problems in doing Section I of the analysis term paper. 2. You must identify the specific market being evaluated. 3. Your analysis company is the Strategic Business Unit. 4. Identify rivals by name for majors, by category for minor rivals if needed to present the best possible profile of

rivals.

Porter Competitive Model 5. Be sure to address the power implications of both customers and suppliers. Power buys them what? 6. Identify buyers and suppliers by categories versus companies. 7. Summarize your Porter Model analysis.

Computer Industry Why is this industry more of a challenge to evaluate using the Porter Competitive Model?

Old Computer Industry Layer 5 Distribution Layer 4 Application Software Layer 3 Operating System Software Layer 2 Computing Platforms Layer 1 Basic Circuitry IBM

DEC

HP

Fujitsu

NCR Figure 3-3

The New Computer Industry Layer 5 Distributors

Computer Dealers

Super Stores

Mass Clubs Merchandisers

Mail Order

Value-add Resellers

Direct Sales Force

Other

Layer 4 Applications Lotus 1-2-3

•Spreadsheets •Word Processors •Database

Layer 3 Operating System Software Layer 2 Computer Platforms

Layer 1 Microprocessor

MS DOS Novell Netware

IBM

Compaq

Intel X86

Microsoft Excel

Windows

Quattro Pro

OS/2

Banyan

Unix IBM

Other Intel-Based PCs

Motorola

Apple Others

Apple Macs

RISC

Other

Power PC

Figure 3-4

The Computer Industry Layer 6 Sales and Distribution Layer 5 Application Software •Enterprise •Specific Layer 4 Database & Networking Software Layer 3 Operating System Software Layer 2 Computer Hardware Platforms

Layer 1 Microprocessor

Computer Stores

Super Stores

Mass Mail Merchandisers Order

Value-add Resellers

Direct Sales Force

Internet Direct

Desktop Suites Enterprise Resource Planning Supply Chain Management Other Word Processors Spread Sheets Publishing Groupware Data Warehouse Other

LAN, WAN and Internet Software Interfaces, Browsers and Search Engines Hierarchical Database

Windows

Unix

Relationship Database

Linux

Supercomputer Mainframe Midrange Workstation PC

Intel X86

Motorola

Apple

Handheld Device

RISC

Power PC

Computer Industry Hardware • Processors • Input/Output Devices • Storage Devices

Networking Equipment?

Multiple processor segments in the computer industry. Processor companies versus specialized hardware companies.

Software

• Systems Software • Operating Systems • Database Systems

• Network Systems • Utility Software • Performance and Security Software • Development Software • Programming Languages • CASE Software • Applications Software

Hardware vendors versus independent software companies.

Applications Software Specific application software to do numerous things. Running on a range of processors. Applications suites (integrated applications) Some call these integrated enterprise applications Is game software from Sony a part of the computer industry? Is software to run numerical control machine tools part of the computer industry? Is software to analyze automobile smog tests part of the computer industry?

Worldwide Computer Hardware Sales 2000

1999

1998

Supercomputer 1997

Mainframe Midrange Workstation

1996

Personal Computer 1995

Source: Dataquest 1994

Millions of Dollars

1993

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

Worldwide Hardware Sales 2002 PCs Total Hardware

2001

Billions of $s

2000 0

100

200

300

Billions of $s Source: Dataquest

What is a PC? 1. A desktop tool—word processor, spreadsheet, publishing tool, data store. 2. An entertainment device.

3. Communication device—email. 4. Information source—Internet sources. 5. A collaboration tool.

PC Industry Segment 1. ed $100 billion in sales in the first ten years. 2. Growth and competition was based on industry standards like never before.

3. This has spawned thousands of niche companies. 4. The PC has fundamentally restructured the Computer Industry. 5. Industry pioneers believe the revolution is no more than half over.

Change Relative to Selling PCs 1. Languages 2. Application Packages

3. Connectivity and Compatibility 4. Multimedia

5. Communication Device--Groupware

PC Industry Change • Atari

• Dell

• Cromemco

• Gateway

• Fortune Systems

• IBM

• Wicat Systems

• HP (Compaq)

• Kaypro

• NEC

• Morrow Designs • Osborne Computer • Victor Technologies

The Future Computer Industry 1. Traditional US Companies (large). 2. Asian Electronic Companies. 3. The New Strategy Companies. Why has the US continued to be the world leader in the computer industry?

Porter Value Chain Basic Concept:

1. Deals with core business processes. 2. Enables tracking a new idea to create a new product and/or service from origination all the way to customer satisfaction.

Porter Value Chain Manufacturing Industry Value Chain

Research and Development

Production Engineering and Manufacturing

Sales Marketing and Distribution

Service

Retail Industry Value Chain

Partnering with Vendor

Managing Buying Inventory

Distributing Operating Inventory Stores

Marketing and Selling

Value Chain Things to 1. Value to customer objective is not clear. 2. Relay team concept is too time consuming and doesn’t work in the current competitive environment.

3. Maximize the value-add activities and eliminate as much as possible the things that do not add value. 4. Make sure that each step in the overall process (each function) does things consistent with the overall objective of value to customer.

ACTIVITIES

Generic Value Chain FIRM INFRASTRUCTURE HUMAN RESOURCE MANAGEMENT TECHNOLOGY DEVELOPMENT PROCUREMENT

INBOUND LOGISTICS

OPERATIONS OUTBOUND LOGISTICS

MARKETING AND SALES

SERVICE

PRIMARY ACTIVITIES Adapted with the permission of the Free Press, an imprint of Simon & Schuster Inc.. from COMPETITIVE ADVANTAGE: Creating and Sustaining Superior Performance by Michael Porter. Copyright © 1985 by Michael E. Porter.

Figure 3-6

Property and Casualty Industry Value Chain FIRM INFRASTRUCTURE

-Financial Policy

HUMAN RESOURCE MANAGEMENT

-Regulatory Compliance

- ing

Agent Training

Actuary Training Actuarial Methods Investment Practices

TECHNOLOGY DEVELOPMENT

- Legal

Product Development Market Research

Claims Training Claims Procedures

I/T Communications

PROCUREMENT

•Policy Rating

• Underwriting • Investment

•Independent Agent Network •Billing and Collections

•Policy Sales •Policy Renewal •Agent Management •Advertising

INBOUND LOGISTICS

OPERATIONS

OUTBOUND LOGISTICS

MARKETING AND SALES

•Claims Settlement •Loss Control

SERVICE

Included with permission of Michael E. Porter based on ideas in Competitive Advantage: Creating and Sustaining Superior Performance, copyright 1985 by Michael E. Porter.

Figure 3-7

Technologies in the Value Chain Information System Technology Planning and Budgeting Technology Office Technology

FIRM INFRASTRUCTURE

Training Technology Motivation Research Information Technology

HUMAN RESOURCE MANAGEMENT

Product Technology Computer-Aided Design Pilot Plant Technology

TECHNOLOGY DEVELOPMENT

Software Development Tools Information Systems Technology

Information Systems Technology Communication System Technology Transportation System Technology

PROCUREMENT •Transportation Technology •Material Handling Technology •Storage and Preservation Technology •Communication System Technology •Testing Technology •Information Technology

INBOUND LOGISTICS

•Basic Process Technology •Materials Technology •Machine Tools Technology •Materials Handling Technology •Packaging Technology •Testing Technology •I/nformation Tech.

OPERATIONS

•Transportation Technology •Material Handling Technology •Packaging Technology •Communications Technology •Information Technology

•Multi-Media Technology •Communication Technology •Information Technology

•Diagnostic and Testing Technology •Communications Technology •Information Technology

OUTBOUND LOGISTICS

MARKETING AND SALES

SERVICE

Adapted with the permission of the Free Press, an imprint of Simon & Schuster Inc.. from COMPETITIVE ADVANTAGE: Creating and Sustaining Superior Performance by Michael Porter. Copyright © 1985 by Michael E. Porter., p. 167.

Figure 3-8

Business Awareness Questionnaire 2. The world’s largest corporation based on annual revenue is Wal-Mart. 3. CTO – Chief Technical Officer CFO – Chief Financial Officer

CMO – Chief Marketing Officer CIO – Chief Information Officer COO – Chief Operating Officer CEO – Chief Executive Officer 4. Large number of well known business success books.

5. Business Week, Fortune, Forbes, The Economist, Harvard Business Review Information Week, Datamation, Computer World A. Larry Ellison – Oracle B. Scott McNealy – Sun Microsystems C. John Chambers – Cisco Systems D. Carly Fiorina – Hewlett-Packard E. Craig Barrett – Intel Corp. F. Steve Balmer – Microsoft G. Jeff Bezos – Amazon.com

A. Sam Walton – Wal-Mart Stores B. Fred Smith – Federal Express C. Gordon Moore – Intel Corp. D. Herb Kelleher – Southwest Airlines E. David Filo – Yahoo! F. George Zimmer – Men’s Wearhouse A. Michael Porter – Business Competitiveness B. Michael Hammer – Process Reengineering C. W. Edwards Demming – Total Quality Management D. Tom Peters – Managing by Walking Around E. Warren Bennis – Business Leadership

Significant Business Events During 2000:

1. Enron collapse 2. HP-Compaq merger 3. United Airlines bankruptcy 4. Survival of Amazon.com and continued success of eBay. 1. Amazon.com is definitely the standard by which eCommerce companies are compared. eBay is uniquely profitable as an Internet company. 2. NASDAQ lists more than technology companies.

3. The News, Life, Sports and Weather is a description of USA Today and not the Wall Street Journal. 4. Japan, not , is the world’s second largest economy.

5. Saturn is owned by GM and not Ford. 6. Burn rate is the rate at which a startup uses up its cash position on a daily or weekly basis.

7. A balance sheet indicates assets and liabilities. The profit and loss statement indicates profit. 8. A general sentiment is that established companies with a solid brick and mortar foundation can move to the Internet with a winning approach. 9. The big three of the airline industry are American, United and Delta—not Northwest.

1. To start a new business requires: E. all of the above. 2. Of the factors in question 1, not having sufficient operating capital is the cause of most business failures.

3. Never listed as first on the Fortune Most ired List are Cisco Systems, Intel and Wal-Mart Stores. 4. Industries that have dominated the least ired list are the Savings and Loan Industry and the Airline Industry. 5. A money source for a startup that is not realistic in most cases is commercial banks. 6. IPO stands for initial public offering. 7. Marketing is determining what to sell and sales is selling what you have.