Lone Pine Cafe 4lg6q

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3i3n4

Overview 26281t

& View Lone Pine Cafe as PDF for free.

More details 6y5l6z

- Words: 789

- Pages: 4

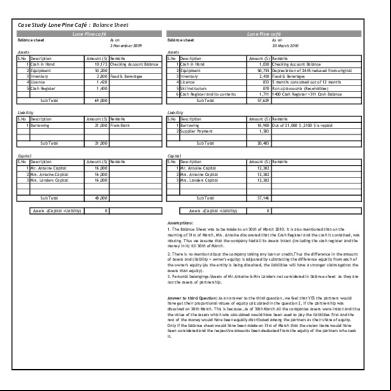

Case Study Lone Pine Café : Balance Sheet Lone Pine café Balance sheet

Lone Pine café As on 2 November 2009

Assets S.No

Cash in Hand Equipment Inventory Licence Cash Sub Total

Amount ($) Remarks

Description 1 2 3 4 5 6

Cash in Hand Equipment Inventory Licence Ski Instructors Cash and its contents

69,000

Sub Total

Amount ($) Remarks 1,030 50,755 2,430 833 870 1,711

Checking Balance Depreciation of 2445 reduced from original Food & Beverages 5 months consumed out of 12 months Run up s (Receivables) 1400 Cash +311 Cash Balance

57,629

Liability

Description 1 Borrowing

Sub Total

Amount ($) Remarks

S.No

21,000 From Bank

Description 1 Borrowing 2 Supplier Payment

21,000

Capital S.No

S.No

10,172 Checking Balance 53,200 2,800 Food & Beverages 1,428 1,400

Liability S.No

As on 30 March 2010

Assets Description

1 2 3 4 5

Balance sheet

Sub Total

Amount ($) Remarks 18,900 Out of 21,000 $ ,2100 $ is repaid 1,583 20,483

Capital

Description 1 Mr. Antoine Capital 2 Mrs. Antoine Capital 3 Mrs. Landers Capital

Sub Total Assets -(Capital +Liability)

Amount ($) Remarks 16,000 16,000 16,000

S.No

Description 1 Mr. Antoine Capital 2 Mrs. Antoine Capital 3 Mrs. Landers Capital

48,000 0

Sub Total Assets -(Capital +Liability)

Amount ($) Remarks 12,382 12,382 12,382

37,146 0

Assumptions: 1. The Balance Sheet was to be made as on 30th of March 2010. It is also mentioned that on the morning of 31st of March, Mrs. Antoine discovered that the Cash and the cash it contained, was missing. Thus we assume that the company had all its assets intact (including the cash and the money in it) till 30th of March. 2. There is no mention about the company taking any loan or credit.Thus the difference in the amount of assets and (liability + owner's equity) is adjusted by subtracting the difference equally from each of the owner's equity (As the entity is being dissolved, the liabilities will have a stronger claim against the assets than equity). 3. Personal belongings/Assets of Mr.Antoine & Mrs Landers not considered in balance sheet as they are not the assets of partnership.

Answer to third Question: As an answer to the third question, we feel that YES the partners would have got their proportional values of equity calculated in the question 2, if the partnership was dissolved on 30th March. This is because, as of 30th March all the companies assets were intact and thus the value of the assets which was calculated would have been used to pay the liabilities first and the rest of the money would have been equally distributed among the partners as their share of equity. Only if the balance sheet would have been made on 31st of March that the stolen items would have been considered and the respective amounts been deducted from the equity of the partners who took it.

Cash Balance Calculation Opening Balance ($)(A) Description

2 November 2009 Amount ($)

Parterner's Equity & Borrowing

69,000

(16,000$x3 +21,000 )

Cash Movement ($)(B) Description

Amount ($)

Equipment Inventory(Food &Beverages) Licence Cash Sub Total

53,200 2,800 1,428 1,400 58,828

Closing Balance ($)* Description (A)-(B) *Deposited in checking

Amount ($) 10,172

1

2

On 30th of March, Calculation of Owner's Equity for the balance sheet as on 30th March The total assets of the company had a value of $57,629 The total liabilities of the company had a value of $20,243 The initial amounts that three of the partners had put in as equity was $48,000 Thus, if we add the values of liability and the initial owner's equity values, we get a sum of $68,483 which exceeds the value of assets by $10,854. We know that in case an entity is dissolved, the Liabilities are a stronger claim against the assets than equity. Thus the owners have to suffer on their equity amounts for compensating the loss. In the start of business it was agreed that the partnership would share the profits proportianally as per their contributed capital. As in this case the partners contributed equal amounts as equity, the loss would also be shared equally. Thus one third of $10,854 which amounts to $3618 is deducted from $16000 to get the value of each of the owner's equity, which amounts to $12382.

Calculation of the remaining value of Local Operating License Cost An amount of $1,428 was paid for local operating licenses and good for one year beginning November 1. As the business had operate for 5 months as on March 30th 2010, the value of 5 months of operation was calculated and deducted from $1,428. The remaining amount ($833) was put as an asset. 1428 - (1428 * 5/12) = 833

Lone Pine café As on 2 November 2009

Assets S.No

Cash in Hand Equipment Inventory Licence Cash Sub Total

Amount ($) Remarks

Description 1 2 3 4 5 6

Cash in Hand Equipment Inventory Licence Ski Instructors Cash and its contents

69,000

Sub Total

Amount ($) Remarks 1,030 50,755 2,430 833 870 1,711

Checking Balance Depreciation of 2445 reduced from original Food & Beverages 5 months consumed out of 12 months Run up s (Receivables) 1400 Cash +311 Cash Balance

57,629

Liability

Description 1 Borrowing

Sub Total

Amount ($) Remarks

S.No

21,000 From Bank

Description 1 Borrowing 2 Supplier Payment

21,000

Capital S.No

S.No

10,172 Checking Balance 53,200 2,800 Food & Beverages 1,428 1,400

Liability S.No

As on 30 March 2010

Assets Description

1 2 3 4 5

Balance sheet

Sub Total

Amount ($) Remarks 18,900 Out of 21,000 $ ,2100 $ is repaid 1,583 20,483

Capital

Description 1 Mr. Antoine Capital 2 Mrs. Antoine Capital 3 Mrs. Landers Capital

Sub Total Assets -(Capital +Liability)

Amount ($) Remarks 16,000 16,000 16,000

S.No

Description 1 Mr. Antoine Capital 2 Mrs. Antoine Capital 3 Mrs. Landers Capital

48,000 0

Sub Total Assets -(Capital +Liability)

Amount ($) Remarks 12,382 12,382 12,382

37,146 0

Assumptions: 1. The Balance Sheet was to be made as on 30th of March 2010. It is also mentioned that on the morning of 31st of March, Mrs. Antoine discovered that the Cash and the cash it contained, was missing. Thus we assume that the company had all its assets intact (including the cash and the money in it) till 30th of March. 2. There is no mention about the company taking any loan or credit.Thus the difference in the amount of assets and (liability + owner's equity) is adjusted by subtracting the difference equally from each of the owner's equity (As the entity is being dissolved, the liabilities will have a stronger claim against the assets than equity). 3. Personal belongings/Assets of Mr.Antoine & Mrs Landers not considered in balance sheet as they are not the assets of partnership.

Answer to third Question: As an answer to the third question, we feel that YES the partners would have got their proportional values of equity calculated in the question 2, if the partnership was dissolved on 30th March. This is because, as of 30th March all the companies assets were intact and thus the value of the assets which was calculated would have been used to pay the liabilities first and the rest of the money would have been equally distributed among the partners as their share of equity. Only if the balance sheet would have been made on 31st of March that the stolen items would have been considered and the respective amounts been deducted from the equity of the partners who took it.

Cash Balance Calculation Opening Balance ($)(A) Description

2 November 2009 Amount ($)

Parterner's Equity & Borrowing

69,000

(16,000$x3 +21,000 )

Cash Movement ($)(B) Description

Amount ($)

Equipment Inventory(Food &Beverages) Licence Cash Sub Total

53,200 2,800 1,428 1,400 58,828

Closing Balance ($)* Description (A)-(B) *Deposited in checking

Amount ($) 10,172

1

2

On 30th of March, Calculation of Owner's Equity for the balance sheet as on 30th March The total assets of the company had a value of $57,629 The total liabilities of the company had a value of $20,243 The initial amounts that three of the partners had put in as equity was $48,000 Thus, if we add the values of liability and the initial owner's equity values, we get a sum of $68,483 which exceeds the value of assets by $10,854. We know that in case an entity is dissolved, the Liabilities are a stronger claim against the assets than equity. Thus the owners have to suffer on their equity amounts for compensating the loss. In the start of business it was agreed that the partnership would share the profits proportianally as per their contributed capital. As in this case the partners contributed equal amounts as equity, the loss would also be shared equally. Thus one third of $10,854 which amounts to $3618 is deducted from $16000 to get the value of each of the owner's equity, which amounts to $12382.

Calculation of the remaining value of Local Operating License Cost An amount of $1,428 was paid for local operating licenses and good for one year beginning November 1. As the business had operate for 5 months as on March 30th 2010, the value of 5 months of operation was calculated and deducted from $1,428. The remaining amount ($833) was put as an asset. 1428 - (1428 * 5/12) = 833