Sample Poultry Farming Business Plan 34250

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3i3n4

Overview 26281t

& View Sample Poultry Farming Business Plan as PDF for free.

More details 6y5l6z

- Words: 15,054

- Pages: 43

Sample Poultry Farming Business Plan Poultry House Farming CC

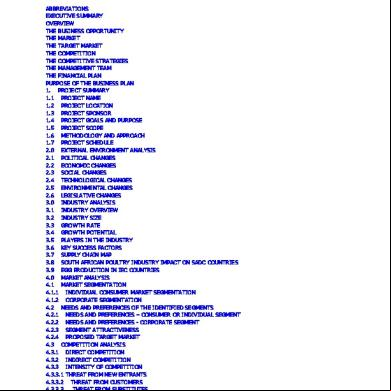

CONTENTS ABBREVIATIONS EXECUTIVE SUMMARY OVERVIEW THE BUSINESS OPPORTUNITY THE MARKET THE TARGET MARKET THE COMPETITION THE COMPETITIVE STRATEGIES THE MANAGEMENT TEAM THE FINANCIAL PLAN PURPOSE OF THE BUSINESS PLAN 1. PROJECT SUMMARY 1.1 PROJECT NAME 1.2 PROJECT LOCATION 1.3 PROJECT SPONSOR 1.4 PROJECT GOALS AND PURPOSE 1.5 PROJECT SCOPE 1.6 METHODOLOGY AND APPROACH 1.7 PROJECT SCHEDULE 2.0 EXTERNAL ENVIRONMENT ANALYSIS 2.1 POLITICAL CHANGES 2.2 ECONOMIC CHANGES 2.3 SOCIAL CHANGES 2.4 TECHNOLOGICAL CHANGES 2.5 ENVIRONMENTAL CHANGES 2.6 LEGISLATIVE CHANGES 3.0 INDUSTRY ANALYSIS 3.1 INDUSTRY OVERVIEW 3.2 INDUSTRY SIZE 3.3 GROWTH RATE 3.4 GROWTH POTENTIAL 3.5 PLAYERS IN THE INDUSTRY 3.6 KEY SUCCESS FACTORS 3.7 SUPPLY CHAIN MAP 3.8 SOUTH AFRICAN POULTRY INDUSTRY IMPACT ON SADC COUNTRIES 3.9 EGG PRODUCTION IN IEC COUNTRIES 4.0 MARKET ANALYSIS 4.1 MARKET SEGMENTATION 4.1.1 INDIVIDUAL CONSUMER MARKET SEGMENTATION 4.1.2 CORPORATE SEGMENTATION 4.2 NEEDS AND PREFERENCES OF THE IDENTIFIED SEGMENTS 4.2.1 NEEDS AND PREFERENCES – CONSUMER OR INDIVIDUAL SEGMENT 4.2.2 NEEDS AND PREFERENCES - CORPORATE SEGMENT 4.2.3 SEGMENT ATTRACTIVENESS 4.2.4 PROPOSED TARGET MARKET 4.3 COMPETITION ANALYSIS 4.3.1 DIRECT COMPETITION 4.3.2 INDIRECT COMPETITION 4.3.3 INTENSITY OF COMPETITION 4.3.3.1 THREAT FROM NEW ENTRANTS 4.3.3.2 THREAT FROM CUSTOMERS 4.3.3.3 THREAT FROM SUBSTITUTES 4.3.3.4 THREAT FROM SUPPLIERS 4.3.3.5 INTENSITY OF RIVALRY 5.0 INTERNAL ENVIRONMENT ANALYSIS 5.1 SHARED VALUES AND PRINCIPLES 5.2 UNDERSTANDING OF THE STRATEGIC PLANNING PROCESS 5.3 ORGANISATIONAL STRUCTURE 5.4 LEADERSHIP STYLE

5.5 STAFF REQUIREMENTS 5.6 SKILLS AND COMPETENCIES 5.7 SYSTEMS 6.0 SWOT ANALYSIS 6.1 STRENGTHS 6.2 WEAKNESSES 6.3 OPPORTUNITIES 6.4 THREATS 7. STRATEGIC INTENT 7.1 VISION 7.2 MISSION 7.3 VALUES AND PRINCIPLES 8.0 PROJECT STRATEGIES 8.1 LONG TERM STRATEGIES 8.2 MEDIUM TERM STRATEGIES 8.3 SHORT TERM STRATEGIES 8.3.1 FINANCIAL STRATEGIES 8.3.2 MARKETING STRATEGIES 8.3.3 OPERATIONAL STRATEGIES 8.3.4 HUMAN RESOURCE STRATEGIES 9. IMPLEMENTATION PLAN 9.1 ORGANISATIONAL STRUCTURE 9.2 MANPOWER REQUIREMENTS 9.2.1 MANPOWER PLAN 9.2.2 MAN POWER BUDGET 9.2.3 ROLES AND RESPONSIBILITIES 10. TECHNICAL AND OPERATIONAL PLAN 10.1 RAW MATERIAL REQUIREMENTS 10.2 MACHINERY AND EQUIPMENT REQUIREMENTS 10.3 LAYOUT OF THE BUSINESS PREMISES 10.4 GROWTH MANAGEMENT AND QUALITY ASSURANCE 10.4.1 DISEASE CONTROL AND PREVENTION 10.5 EGG PRODUCTION PROCESS 11. MARKETING PLAN 11.1 PRODUCT 11.2 PROMOTION 11.3 PRICING 11.4 PACKAGING 11.5 PLACE 11.5.1 LOCATION OF THE PROJECT 12. KEY FINANCIAL MANAGEMENT CONTROLS 12.1 BOOKEEPING AND FINANCIAL ISTRATION REQUIREMENTS 12.3 IMPORTANCE OF BOOKKEEPING AND FINANCIAL ISTRATION 12.4 COMPUTERISED BOOKEEPING AND FINANCE SYSTEM 13. MONITORING AND EVALUATION PLAN 14. RISK ANALYSIS 15. PROJECTED FINANCIAL STATEMENTS 15.1 ASSUMPTIONS 15.2 APPLICATION OF FUNDS 15.3 BUDGET 15.4.1 COMPUTATION OF COST PER UNIT PRODUCED 15.3.2 AVERAGE CONTRIBUTION MARGIN CALCULATION 15.4 INCOME STATEMENT PROJECTIONS 15.5 CASH FLOW STATEMENT PROJECTIONS 15.6 BALANCE SHEET PROJECTIONS 15.7 RATIO ANALYSIS 15.8 BREAKEVEN ANALYSIS 15.9 SENSITIVITY ANALYSIS

EXECUTIVE SUMMARY OVERVIEW Poultry House Project CC is a community based project that was conceptualised by three ionate, committed and enthusiastic social entrepreneurs. This exciting project is the brainchild of Thando, Tsegofatso and Pearl. Poultry House Project CC was set up to promote the creation of jobs, women and youth empowerment, economic development and poverty alleviation. It features key stakeholders such as the youth and women, and workers of the project, customers, suppliers and the wider community. The project will specialise in the production and sale of eggs. The project will essentially purchase ‘ready to lay’ pullets and raise them through their productive cycle. The project have already identified a suitable location for the project and have entered into discussions in connection with leasing a farm. The project shall be based in the outskirts of Rustenburg (North West Province), South Africa.

THE BUSINESS OPPORTUNITY The of the project have realised that there is great demand for eggs by hotels, bed and breakfast providers, guest houses, holiday resorts and other related entities. These entities usually procure their eggs from as far as Ventersdorp and are inconvenienced financially as well as time wise by transportation activities and their associated costs and risks. There are currently few reliable egg producers and suppliers based in the outskirts of Rustenburg. Poultry House Project CC wishes to exploit the opportunities presented by engaging in the production and sale of eggs. This shall be by means of purchasing ready to lay pullets, which shall be kept and nourished at the premises of the project during the productive phase of their lifespan. The eggs produced shall be collected, sorted, packaged and thereafter sold and distributed to the target market of the project - which primarily encomes, small to medium sized hospitality related entities.

THE MARKET The identified key segments for the project include, individual and corporate consumer market segments. In of similarities, both individual and corporate clients seek the health and taste benefits of eggs. They regard eggs as an excellent source of protein, which is at times an alternative to red or white meat. As for the differences, the quantities required and purchased by corporate clients supersedes that of individuals. The corporate market segment is more lucrative as compared to the individual consumer market segment. This is attributed to the fact that the segment has a greater growth rate, growth potential and is more profitable.

THE TARGET MARKET The selection of a lucrative market is imperative to the success of Poultry House Project CC. Key factors were considered prior to selecting a lucrative market for the project. These encom profitability, growth, growth potential, size of the market, risks associated with the market and the capacity of the business to serve the selected market. The proposed target market for Poultry House Project CC shall be primarily composed of consumers within the corporate arena. The business will target resorts; essentially the customers shall emanate from bed and breakfast providers, guest houses, mine kitchens and hostels, tertiary institutions as well as small scale and emerging community stores within the outskirts of Rustenburg. The project shall primarily target hospitality businesses near Sun City as well as attraction centers such as Pilanesberg National Park. Additionally, the project shall strive to secure contracts to supply eggs to prominent hotels on a regular basis.

THE COMPETITION The market is composed of both direct and indirect competitors. Direct competitions will emanate from small scale poultry farms in close proximity to the business. These include Phokeng Poultry Farm and other small scale commercial farmers. The project will face indirect competitors from well established players such as Rainbow Chickens, OBC Chickens, Chubby Chicks, Supreme Poultry, California Chickens, Big Chicken Company and other premier commercial farmers.

THE COMPETITIVE STRATEGIES

In of competitive advantages, the project will focus on having a thorough understanding of the needs and preferences of the customers. The business will strive to ensure that it has a better understanding of the customer’s needs and preferences as compared to its direct and indirect competitors. Meeting the expectations of customers will be a key priority for the business. Efficient and effective marketing will be important to drive the sales and profits of Poultry House Project CC. Emphasis will be placed on establishing a strong brand for the project that provides an excellent positioning for the project.

THE MANAGEMENT TEAM The Close Corporation is made up of a strong management team of three committed and dedicated women. They will share various roles and responsibilities in the identified business functions such as marketing, human resources, operations, finance and many more. The three will represent the ownership of the project but specific management and operational functions will be given to each member. One of the three will be given the responsibility of the overall management of the project and will report to the other who will act like a board.

THE FINANCIAL PLAN The project will require R2 394 500 in total in order to finance its capital asset requirements (R1 067 000) as well as its working capital (R578 000 – includes funds for feed). The main requisitions shall include: poultry houses for layers, feeding systems, a delivery van, feed, vaccines, medicine, office furniture, equipment, fixtures and fittings and much more.

PURPOSE OF THE BUSINESS PLAN The purpose of the business plan is to serve as a motivation document to source the required funding for Poultry House Project CC. The business plan shall also be instrumental in the following ways:

To further understand the project To understand the macroeconomic factors affecting the project To understand the microeconomic factors affecting the project To understand the industry that the project will operate in To understand the dynamics of the market To draw up a SWOT analysis and devise a vision and mission for the project To develop strategic objectives and strategies for the project To improve the performance of the project To focus on a profitable activities and customers

1.

PROJECT SUMMARY

1.1

PROJECT NAME

The name of the project is Poultry House Project CC.

1.2

PROJECT LOCATION

The project shall be situated in the outskirts of Rustenburg.

1.3

PROJECT SPONSOR

Poultry House Project CC is sponsored by the three project . The project shall seek financial and nonfinancial from the local Municipality as well equity funding from local businesses and community . Debt financing shall also be sought from reputable commercial banks should the need arise.

1.4

PROJECT GOALS AND PURPOSE

The purpose of the project is to contribute towards improving the community, women and youth empowerment as well as add value to the lives of the stakeholders of the project. The project is expected to realise the following goals:

1.5

To empower women and youth To create sustainable employment for women and youth To contribute towards poverty alleviation To ultimately create women’s participatory self-sustaining development at local levels

PROJECT SCOPE

The scope of work at (business planning stage) includes an analysis of the industry, market, competition, external and internal environment. The business plan shall also be coverage of the technical/operational aspects of the project, the legal aspects, human resources and financial requirements of Poultry House Project CC.

1.6 METHODOLOGY AND APPROACH The following methodology and approach will be used to help Poultry House Project CC achieve its purpose and objectives:

Project Initiation

The key milestones in the project initiation phase encom the following:

A consultation session with the key stakeholders of the project The development of a project charter The development of a business case

Project Plan

The project plan will provide a detailed guideline aimed at helping Poultry House Project CC realise its purpose and objectives.

Project Execution

This will primarily involve the implementation of the proposed solutions in the project plan.

Project Evaluation

This stage will evaluate the performance of the project in order to render the necessary actions and learn from the project for future reference.

Project Closure

This will mark the closure of the project and confirm that all deliverables have been provided and accepted.

1.7

PROJECT SCHEDULE

The main phases in the project include: the project initiation, project plan, project execution and project closure. The progress of the project will be guided by the project timeline shown below

2.0

EXTERNAL ENVIRONMENT ANALYSIS

This section is coverage of the external environment analysis in order to identify opportunities and threats facing the poultry farming concern.

2.1

POLITICAL CHANGES

AgriBEE presents an opportunity for the project in of ownership, management and procurement. AgriBEE strives to create linkages, partnerships and networks for balanced, mutually benefiting results for all concerned. It enhances competitiveness and sustainable development for agricultural business concerns

The promotion of SMME development in South Africa has been intensified. In light of the poultry industry, the establishment of the Developing Poultry Farmers Organisation (DPFO) has been a great development as it is in line with the thinking of the Government i.e. strategies relating to Broad-Based Black Economic Empowerment, Job Creation and SMME development

The project is likely to benefit from agricultural based skills development and training as a result of the establishment of AgriSETA

The performance of the Agricultural sector was affected by the fact that it was deregulated. The sector is now moving towards being more competitive as the government is no longer strictly regulating the industry

The Spatial Development Framework stipulates and categorises areas for development. Key areas have been earmarked for businesses, residential occupancy, farming and other uses. This is an opportunity for the project as dedicated land for agriculture will be available for the agricultural project

Women and youth empowerment is one of the key agendas for the South African Government (currently). The availability of programmes such as The National Youth Development Programme will be an opportunity in of financial and non-financial for the project

The availability of funds for agricultural from programmes such as Mafisa is an opportunity for the project as it will potentially have access to funding for project expansion or improvement

The potential for increased for the Poultry Industry is a reality as the Industry is considered to ‘feed the nation’. This is certainly considered to be an opportunity for the project

Opportunities to access the export market as well as benefit from export initiatives by organisations such as Small Enterprise Development Agency (SEDA) are open to projects such as Poultry House Project CC. This is likely to open up opportunities for the project in having a vivid presence in neighboring countries to South Africa, other parts of Africa and the overseas market

The movement against anti-competitive behavior by the competition commission is an opportunity for the project

The assistance by DTI to women involved in entrepreneurial projects will be an opportunity for the project

2.2

There is potential for financial and non-financial by the Development of Southern Africa Small business development programmes seek to help small businesses improve the quality of their products as well as their well-being. This shall be an opportunity for Poultry House Project CC

ECONOMIC CHANGES The global recession seems to be slowly phasing out as a result of the bail outs and other interventions. The recession still remains live as various industries are still suffering as evident from unsatisfactory outputs, the layoff of employees and declining profits. As an outlook, the recession is a threat to the project as people are cautious or careful when buying products nowadays. Consumers are buying less of luxury products and moving

towards necessities. As eggs are somewhat necessities, consumers continue to purchase these products in satisfactory amounts

In of the local economy – South Africa is intensifying communication about reports that it is out of the recession. Various industries are peaking in output, profits and general well-being. Government has increased spending on factors such as infrastructure which has resulted in more jobs being created for the people of South Africa. Other initiatives such as reducing the interest rates have contributed towards cushioning the adverse effects of the recession. This is promising for most businesses such as Poultry House Project CC can access funds at a lower cost of borrowing

There is a potential for Eskom to increase electricity prices by at least 24.8%. This is a threat to the project as its operations will be more costly and thus force the project to on the additional costs to consumers. This is a threat to the project as it has potential to result in reduced sales and profits

The potential for a further increase in petrol prices will be a threat to the business as this will render the cost of transporting the products of the project to be relatively high. An increase in petrol prices usually results in an overall increase in the price of commodities and this burden is usually pushed towards consumers

Rising Inflation or the rising of costs is a threat to the project as this could potentially reduce the market for the business. The tradeoff between inflation and employment is another factor to take into consideration

Interest rates are currently moderate – this is encouraging as the cost of borrowing funds is not as high

The use of maize for producing bio fuel has led to the reduced importance of using maize for feeding chicken – thus being a threat to the project

2.3

Fluctuating exchange rates are likely to adversely affect the cost of imported items such as disease prevention and control medications for the layers – this will result in lower gross profit margins as a result of the increase in the cost of goods sold

SOCIAL CHANGES

Unemployment still remains high and as an outlook this adversely affects the market for the project. Low employment is linked to more money in the pockets of people and if this is not the case then projects such as Poultry House Project CC will have a reduced active market

Poverty levels are currently still high in some areas of South Africa. Poverty levels mostly affect the youth and women. The low skilled are hard hit by increased poverty. This unfortunately goes hand in hand with increased crime levels. The high crime rate will be a threat for the project. Moreover, high poverty levels imply that there are less people with money in their pockets, thus a reduced market for the project

The continued increase in the per capita consumption of eggs and chicken will be an opportunity for the project

The increase in the budget for social grants will see more people having money in their pockets thus building on the potential market for the poultry project

The growth of the middle income group and double income families have led to increased disposable income allowing for more people access to products and services

2.4

The increasing population will result in more potential consumers for the project The Government is committed towards improving the quality of education in South Africa. This is an opportunity for the project as it is likely to benefit from a quality labor supply. It will also result in consumers that are aware of the nutritional benefits of eating food such as eggs – thus enhancing the quality and quantity of potential consumers for the business

TECHNOLOGICAL CHANGES

The new developments in technology for poultry farming present lucrative opportunities for the business to enhance productivity and expand its horizons. The current technologies in the poultry industry mostly concern specialized poultry equipment which includes the latest designs from abroad and a small percentage of some locally developed designs. The project is open to benefit from advanced technology in key areas such as production/ operations, distribution, marketing and back office .

Operations can also be simplified and made efficient as a result of advanced technologies on the market; for example, activities such as feeding of the layers, ventilation, lighting and room temperature control can be aided by the use of automated technologies

With regard to distribution, trucks equipped with advanced cooling systems are within reach of the project The business can also render significant improvements to its marketing efforts by making use of technology. This can be by means of having a static or dynamic ecommerce website for the business that could provide marketing literature to clients and also possibly facilitate enquiries and orders for the project. Branding material such as business cards, business logos, business letterheads, presentations and brochures can also be made using computer technology

In of back office , technology in the form of computers and software is available on the market to facilitate and simplify back office activities such as record keeping, ing, logistics management and much more.

Additionally, technology will be an opportunity for the business in the sense that it can be used for market intelligence purposes

2.5

ENVIRONMENTAL CHANGES

Environmental Impact Assessment (EIA) – It will be imperative for an Environmental Impact Assessment to be conducted. It will assess as to the positive or negative impact that the proposed project shall have on the environment. Where the effects are not very detrimental, the project shall be given the go ahead to commence operations

The use of chemicals to prevent and control diseases associated with poultry could impose a negative impact on the environment. The business will have to take all the necessary precaution to ensure that the environment is protected

The pollution of underground water is a key concern. The project will need to take underground water into consideration by ensuring that all waste resulting from the poultry houses is well managed

2.6

LEGISLATIVE CHANGES The project may face a compliance threat in of observing the Occupational Health and Safety Act Full compliance with other Acts such as those relating to Basic Conditions of Employment Act, Employment Equity, labor relations and many more could be seen as a threat to the business

Meeting the standard specifications of SABS can be perceived as a threat should the project have difficulties attaining high standards

3.0 3.1

INDUSTRY ANALYSIS INDUSTRY OVERVIEW

The project will form part of the Poultry Industry and the greater Agricultural Industry of South Africa. The Poultry industry is threefold as it is divided into the following sub-industries:

Egg Production Industry The Broiler Industry The Day Old Chick Supply Industry

The specific industry that the project will make direct and valuable contribution to will be the Egg Production Industry. The Southern Africa Poultry Association (SAPA) represents farmers making contribution to the Poultry Industry at large and is responsible for promoting, coordinating and contributing to the welfare of the Poultry Industry in South Africa. The Poultry Industry is highly regarded in South Africa as it is an industry that makes significant contribution towards ‘feeding the nation’. The Poultry Industry provides 61.4% of animal protein consumed in South Africa. The industry has gone through some changes in the past as a result of the Agricultural Industry being deregulated. This saw a reduction in production, lower margins in the early supply chain and a greater share of returns in the retail sector for most agricultural products. Recent studies have shown that the consumption of eggs is increasing steadily. According to the 2008 SAPA Poultry Industry profile, the Poultry Industry is estimated to supply well over 368 000 tonnes of eggs and egg products per annum. The increase in consumption is anticipated to grow in future. Moreover, of the total egg production output, 65-70% is consumed in the household sector, while 30-40% of consumption is attributed to food service, industrial and commercial uses. Key issues influencing the productivity of the industry include the following:

The maize price which is usually influenced by exchange rates, CBOT, local crop size, and SAFEX speculation Poultry related diseases such as Newcastle Disease and Avian Influenza Urbanisation Redistribution of land Imports posing great competition to local players Raw material prices Applicable product standards and regulations

Food safety certification

Trade relations in Southern Africa

3.2

INDUSTRY SIZE

According to the SAPA Industry Profile for 2008, the gross turnover of the Poultry Industry was estimated at R6.03 billion per annum. This refers to the amount that is realised at producer level by the Egg Production Industry. The Egg Industry contributes 22% to the total gross turnover realised by the Poultry Industry. The Poultry Industry generates a total of R24 664 billion. This turnover is made up of R18 624 billion generated by broilers, R6 039 billion for eggs and R3 095 billion for the chick industry. The percentage proportions are shown in the chart below:

3.3

GROWTH RATE

The Egg Industry is growing at an estimated growth rate of 5% per annum. This is on the basis of the 2008 Annual Report from SAPA.

3.4

GROWTH POTENTIAL

With South Africa’s growing potential and increased growth in double income families, there is potential for the Egg Industry to grow in the medium to long term. Essentially, the increasing demand for egg products is likely to drive growth in the industry. The increasing growth potential is substantiated by the increasing per capita consumption in eggs. For example, the per capita consumption for 2008 was 137 eggs per person per annum (an average of 11 eggs per person per month) - this was an increase of 0.25% compared to 2007. Growth was anticipated for the year 2009 and 2010. South Africa has a high per capita consumption of eggs per annum as compared to other countries in Southern Africa.

3.5

PLAYERS IN THE INDUSTRY

The main players in the industry include the following:

3.6

Commercial farmers Emerging and small scale farmers Transporters Drugs and feed suppliers Distributers and agents Wholesalers and retailers Informal traders

KEY SUCCESS FACTORS

The key success factors in the Poultry Industry encom the following:

Focusing on a niche markets rather than targeting the mass market

Employment of technology in raw material processing, production, marketing, distribution and back office .

Responsiveness to disease outbreaks: one disease outbreak can eliminate all the birds used in egg production. It is therefore important to watch out for all disease outbreaks and exercise the necessary prevention and control measures

Convenience: this in of being in close proximity to the customers. Customers usually purchase from suppliers in close proximity to their business in order to cut down on transportation costs

Reliability: this key success factor pertains to delivering the right quality and quantity of eggs to customers at all order or purchase occasions

Affordability: as the industry features many players, customers usually opt for the lowest price. Additionally, considering the fact that eggs are generic products, it is important that the price is always right

Quality and quantity: the nature of the business is such that it is a high volume, low profit margin model. About 60% of the costs are attributed to the feed requirements of the layers. It therefore important to sell in large quantities in order to make a practical return. Quality in of taste and health benefits is another key success factor as most consumers are very particular about these.

3.7

SUPPLY CHAIN MAP

The supply chain map of the Egg Production Industry is as illustrated below:

Farmers

This primarily includes established commercial farmers, emerging small to medium sized poultry farmers. In of forming part of these players, it is relatively difficult as barriers are moderately high. These barriers encom major capital requirements for production, investment in flocks and feed. The fluctuating selling prices are also a key factor to consider.

Packing

Collecting, grading, and packing are done by the entities that own and manage brands. While some farmers brand their own products, others seek the expertise of dedicated brand strategists and other players in the value chain that specialize in branding. Players in the industry such as Starpak Levy & Smith offer specialized grading, sorting and packing solutions. While, there are relatively few players in this arena, it presents

barriers to entry in of the technologies and knowhow required to professionally grade, sort and pack eggs. Transporters

These move the poultry products from the farmers to other players in the value chain such as wholesalers and retailers. Some farmers are well equipped with transportation vehicles while others hire trucks to get their products to egg processors, wholesalers, retailers and ultimately the final consumers.

Egg Marketer

Marketing is essential to drive the products towards the wholesaler, retailers and end consumers. The egg marketers are primarily distributors and agents as well as brand management entities.

Market logistics

This involves all the channels that the product goes through to reach the consumer as well as the marketing involved. The products can be transported directly from the producer or farmer to the final consumer. Alternatively, they can be sold to wholesalers who then sale to retailers; the retailers thereafter sale to customers. Distributors and agents also play a vital role in the market logistics of egg products.

End consumer

This is the domestic consumer or final consumer of the egg products.

3.8 SOUTH AFRICAN POULTRY INDUSTRY IMPACT ON SADC COUNTRIES SADC Country

South Africa

Product Qty (ton)

% share in SADC

Consumption (ton)

Population

Per Capita Eggs

385 000.00

68.7

385 195.00

47 800 000

146.5

Zambia

46 900.00

8.4

46926.00

11 502 010

74.2

United Republic of Tanzania

35 100.00

6.3

35 093.00

37 445 392

17

Zimbabwe

22 000.00

3.9

21 275.00

12 236 805

31.6

Malawi

19 500.00

3.5

19 516.00

13 013 926

27.3

Madagascar

14 900.00

2.7

14 921.00

18 595 469

14.6

Mozambique

14 000.00

2.5

14 147.00

19 686 505

13.1

Democratic Republic of Congo

6 000.00

1.1

7 804.00

62 660 551

2.3

Mauritius

5 250.00

0.9

5 240.00

1 240 827

76.8

Angola

4 300.00

0.8

18 992.00

12 127 071

28.5

Botswana

3 150.00

0.6

3 180.00

1 639 833

35.3

Namibia

1 900.00

0.3

1 900.00

2 044 147

16.9

Lesotho

1 600.00

0.3

1 600.00

2 022 331

14.4

Swaziland

1 050.00

0.2

2 490.74

1 136 334

39.9

Hen eggs in shell SADC comparison The 2008 SAPA Poultry Industry Profile showed that South Africa had the largest percentage share (68.7%) in SADC. It had the highest production of 385 000 tons and per capita consumption of 146.5. South Africa is followed by Zambia with a percentage share of 8.4% and Tanzania with a percentage share of 6.3% and production output of 35 100.

3.9

EGG PRODUCTION IN IEC COUNTRIES

Country

Number of layers (million)

Shell egg production (X 1 000 tonnes)

Egg consumption per capita (total)

Argentina

27.6

484.2

186

Australia

13.8

170.8

155

Austria

4.6

91

227

Belgium

-

232

200

Brazil

98.7

1,367.4

132

Canada

25.9

372.8

260

-

29

340

Colombia

35.2

525.4

205

Czech Republic

10.3

142

244

Denmark

3

67

270

Finland

3

56.1

138

46.5

908

251

36

752

206

Greece

-

94.5

132

Hungry

-

172.4

295

India

115.3

2,403.3

38

Iran

48

570

130

Ireland

1.9

34

171

China

Italy

-

808

219

Japan

136.9

2,420

324

Mexico

-

2,307

351

Netherlands

30.7

575

182

New Zealand

3

46

218

Slovakia

5.7

71

199

South Africa

21

342

146

44.3

770

196

Sweden

5.9

99

198

Switzerland

1.9

40

184

Thailand

35.6

623

150

United Kingdom

28.6

540

173

288.1

4,736.9

256

Spain

United States

Egg Production in IEC countries – Source IEC Annual Review 08 The table above shows data pertaining to egg production in IEC countries. The top egg producers are Argentina, Australia, Austria, Belgium, Brazil, Canada and China. South Africa ranked number 25th in the IEC Annual Review 08 with a shell egg production of 342 000 tonnes and per capita consumption of 146. According to the report, high increases were observed in Thailand, Mexico, Argentina and South Africa. Countries such as Thailand showed a dramatic increase due to their recovery from the impact of the avian influenza outbreaks.

4.0 MARKET ANALYSIS 4.1

MARKET SEGMENTATION

This section divides the market into similar groups with common characteristics so as to identify a lucrative market segment for the products of Poultry House Project CC. Generally, the potential market segments for the poultry farming business are as listed below: Formal market sector

Grading and packaging entities Wholesalers Retailers Franchise store Processing entities Export

Informal market sector

Hawkers Spazas

Spot hen depots

The potential market open to Poultry House Project CC is analyzed as per the following categories:

4.1.1

Individual market segment Corporate market segment

INDIVIDUAL CONSUMER MARKET SEGMENTATION

The individual consumer market segment primarily covers individual consumers as well as households. This segment is further discussed within the context of demographics, psychographics and behavioural segmentation.

Demographic segmentation

While the location of the project is in the outskirts of Rustenburg, the potential clients of the business emanate from the larger Bojanala District and other parts of the North West Province. This market segment features both male and female consumers. Their age categories encom kids, adolescents, teenagers, youth, adults and mature people. The market features low income, medium and high income earners from a diversity of educational backgrounds.

Psychographic segmentation

In of psychographics, the market features consumers with an array of lifestyles. The lifestyles include career oriented men and women, scholars, entertainers, holiday makers, famers and many more. They quest healthy balanced lifestyles and have a positive, ambitious and charismatic personality. They value eating tasty foods that are well prepared - (and are rich in all the essential vitamins and minerals).

Behavioral segmentation

The purchase occasion of consumers is usually once or twice a month. While individual consumers purchase and consume around 18 to 30 eggs per month, families or households purchase and consume around 30 to 60 eggs per month. The key benefits sought by individuals are mainly the taste, quality and health benefits of eggs. The behavior of consumers is also linked to the versatility or wide array of uses of eggs. Eggs have a wide variety of uses. People use them in the preparation of products such as chicken burgers, scotch eggs, salad, and egg soup among others. Apart from home consumption, eggs can be used as leavening agents in baked foods, and as an ingredient in the manufacture of hair shampoo and for the production of egg powder that can later be incorporated into baby food.

4.1.2

CORPORATE SEGMENTATION

The corporate segment can be divided into sub-segments; namely: small businesses, medium businesses and large businesses. The sub-segments are further discussed below: Market Segment

Characteristics

Small businesses

Small businesses generally employ between 1 to 10 employees and have a turnover less than 500 000 per annum. Additionally, small businesses form part of South Africa’s Small, Medium and Micro Enterprises (SMME) sector. Small businesses can be split into micro and small businesses. Micro businesses have assets of less than R50 000 and an annual turnover of less than R50 000. Moreover, micro businesses employ less than 5 people. Small businesses on the other hand have combined assets between R50 000 and R500 000. They have a turnover between R50 000 and R500 000. Small businesses employ between 5 and 10 people. They are mainly made up of sole proprietors, small partnership businesses and formally ed close corporation business entities ranging from small fast food stalls to guest houses.

Medium businesses

Medium enterprises also form part of South Africa’s Small, Medium and Micro Enterprises. Medium businesses employ about 20 to 100 employees and have a turnover that is greater than 500 000 per annum but less than 5 million. Medium businesses range from bed and breakfast accommodation providers, medium sized restaurants, holiday resorts and many more.

Large businesses

This segment features large well established hotels, large wholesalers, large scale exporters as well as eggs processing plants amongst other entities. Most large businesses provide employment to more than 100 employees and have an annual turnover that is greater than 3 million. They mainly consist of public limited companies, private companies and non-governmental organizations.

4.2 4.2.1

NEEDS AND PREFERENCES OF THE IDENTIFIED SEGMENTS NEEDS AND PREFERENCES – CONSUMER OR INDIVIDUAL SEGMENT

Market Segment

Needs and Preferences

Demographic segmentation

As the potential market for the project covers the general outskirts of Brandenburg and the wider Bojanala District, hallmarks such as reliability, convenience and easy access to suppliers of poultry products are key needs and preferences. Additionally, this segment usually looks for affordable products, so value for money is well sought after by this market segment group and particularly by the low to medium income earners. Cost saving is of prime importance to the low and medium income earners. The high income earners place high priority on quality poultry products. Ultimately value is highly sought after by customers.

Psychographic segmentation

For most individuals, preference is driven by diets, health and taste considerations and in some cases religious views on eating meat products. Consumers with a thirst for hospitality seek creative uses of eggs - for example, some people prefer their egg yolk partly fried or fully done. Others prefer them in forms such as Milkshakes, Protein Shakes (mostly for people who like going to the gym), Ice Cream and Baked products – these add quality to the lifestyle of consumers.

Behavioral Segmentation

The benefits sought by individual consumers are primary the health and taste benefits of eggs. Eggs are considered to be a tasty protein source by most individuals and families. Some people prefer eggs to other protein sources such as meat and chicken. Additionally, with regard to behavior, some consumers are particular about whether the eggs are a result of free range layers or caged layers. Other factors include considerations such as the feed used to grow the layers – in most cases eggs from all grain fed layers are preferred.

4.2.2

NEEDS AND PREFERENCES – CORPORATE SEGMENT

Market Segment

Needs and Preferences

Small businesses

Small businesses usually purchase eggs in packs of 18 to 30. They seek products from businesses that take affordability into consideration. Most small businesses prefer to purchase eggs from retailers such as Pick n Pay, Spar, Shoprite, Fruit and Veg and many more. Some small businesses that require bulk purchases opt for wholesalers and nearby farms. For small businesses, reliability, affordability, nutritional value, convenience and effective delivery of egg/ poultry products are instrumental preferences.

Medium businesses

The quantity purchased by medium businesses is more than that of small businesses. Medium businesses usually prefer to buy eggs in bulk packs of 30 to 60 eggs. Medium businesses such as wholesalers and retailers require a bulk supply of the poultry products. They also have a preference for well established brands on the market that

the retailers and end consumers can identify with. Medium sized retailers buy an ample amount of poultry products and prefer to sale in units at a cost plus price. They have a preference for well-known brands. Other retailers such as Pick n Pay prefer to brand their own products. Medium sized businesses focus on healthy products that are delivered in a professional manner. They normally buy the products in bulk as they cater for a considerable number of people. Large businesses

4.2.3

Large businesses usually require and procure egg products in bulk as they serve a wider consumer base. They require a supplier of eggs that can deliver large quantities of eggs at prices that reflect economies of scale. Additionally, they require suppliers that are reliable, convenient and are capable of delivering the right quality and quantity of eggs at the right time and place. Additionally, large businesses usually have a procurement policy which stipulates standard specification of the products they procure. These specifications - in the context of egg products might specify as to the grade of egg products required, nutritional value of the products, whether all grain or eggs resulting from free range chickens.

SEGMENT ATTRACTIVENESS Market segment Individual market segment Low

Medium

Corporate market segment High

Low

Medium

High

Size Growth Growth potential Profitability Risk Competition

The attractiveness of the various market segments is based on the market size, growth potential of the segment, profitability, the risk associated with the segment and the nature of competition in the market segment. The corporate market segment supersedes the individual market segment in of size, growth potential and profitability. Corporate consumers are more reliable customers (taking into consideration the fact that they usually buy in bulk orders, makes the segment more attractive). There is a risk of delayed payment on part of some corporate entities. Nevertheless, with effective payment collection systems, the risk can be mitigated.

4.2.4

PROPOSED TARGET MARKET

The project will target small and medium businesses as this segment shows a distinctive consumer need for exploitation. The project will essentially focus on small and medium sized lodges, mine kitchens, bed and breakfasts and guest houses near Sun City and other resorts in close reach to the project. This segment has potential for future growth and has a few direct competitors of a similar nature to the project. They ability of Poultry House Project CC to serve this consumer segment has also been taken into consideration.

4.3

COMPETITION ANALYSIS

4.3.1

DIRECT COMPETITION

Direct competition

4.3.2

Direct competition will emanate from small and emerging players in the poultry industry that are in close proximity to Poultry House Project CC and target a similar market as the project.

INDIRECT COMPETITION

Rainbow Chickens

Rainbow Chickens is a well-established brand that distributes its meat and egg products throughout Rustenburg and other parts of South Africa. It will pose direct competition to Poultry House Project CC as it serves a similar market. Rainbow Chicken benefits from economies of scale and also enjoys greater profit as they are active in key areas of the poultry farming value chain.

OBC Chickens

This is an established wholesaler that has also developed a national profile. OBC currently operates a franchise model that has 65 branches nationwide in its network. In North West, OBC has 10 different branches spread in major cities of the province. OBCs business model consists of buying broilers in bulk, warehouses centrally and delivers to the stores quickly and efficiently ensures both quality and pricing. With around 22 years of operation OBC has rapidly developed to become a major supplier in the whole South African Market, and they are now introducing hot food counters with a select range of prepared meals.

Chubby Chicks

Started far back in 1955 and has a presence in the North West Province, Chubby Chicks is often described as one of the success stories of the South African poultry sector. They intend doubling their production to over a million birds per week. They have invested around 200 million Rand in new capacity and are expecting to invest a further 300 million Rand in the coming years to cope with the soaring demand of their products. Chubby Chicks supplies its products to Woolworths Food, the South African up market fashion and food retailer. The company operates two breeder rearing farms, two breeder laying farms, two hatcheries, nine broiler farms, three free range farms, a processing plant and a rendering plant. They are part of the main brands that control the poultry sector, albeit with less significant market share (4%) like Astral and Rainbow who combine control 55% of the market.

Commercial and subsistence

There are a number of commercial and subsistence farmers that are well established in Rustenburg and sale a range of meat and poultry products (primarily eggs) at affordable prices. Their products are fresh and usually sell very generously. Competition will emanate from Haagners Poultry Farm, Fouries Poultry Farm and SerfonteinPluimvee Poultry Farm. Some consumers in the outskirts of Rustenburg drive to places as far as Ventersdorp to access poultry products.

Other indirect competitors

Indirect competition for the project is also posed by foreign entities that sell chicken and egg products in South Africa. There is a stream of imports into South Africa, predominately from Brazil, which have great competitive advantages in of economies of scale. Where local demand is restricted, imports play an even more important role as they enjoy a favourable price differential. Indirect competition also emanates from the considerable proportions of eggs being sold through informal sectors by small players, small scale farmers and hawkers.

4.3.3

INTENSITY OF COMPETITION

4.3.3.1 THREAT FROM NEW ENTRANTS The threat from new entrants in to the market is relatively low taking in to the huge capital required in order to establish a poultry farm. There is also a high level of knowledge, skills, competencies and expertise required to manage the poultry farm. Knowledge on livestock farming and poultry disease prevention and control is also

important and a limiting factor for new entrants. The investment required also hinders people wishing to participate in poultry farming.

4.3.3.2

THREAT FROM CUSTOMERS

There is a threat emanating from the dynamics in the needs and preferences of consumers. Customer demands and expectations must be met and products attractively priced, otherwise the customers could opt for other providers. The threat is demonstrated by the scenario that the customers can buy from anywhere as well as the fact that the price of the egg product is somewhat dictated by the market.

4.3.3.3

THREAT FROM SUBSTITUTES

While there is potentially no immediate substitute for an egg, the number of alternative providers of eggs based in greater Rustenburg as well as areas as far as Ventersdorp is moderately high that the threat from substitutes is a reality.

4.3.3.4

THREAT FROM SUPPLIERS

This threat is relatively minimal as there are many suppliers of layers and the essential stock feed and other requisitions required to maintain layers used for egg production. A key source of layer birds is Ventersdorp where key suppliers are present. A threat may emanate from a scenario where suppliers decide to channel most of their maize raw material used in the production of chicken feed towards the emerging biofuel manufacturing industry.

4.3.3.5

INTENSITY OF RIVALRY

The intensity of rivalry is centred on factors such as price, reliability, quality, and brand recognition. The intensity of rivalry in the Industry is relatively high as evidenced by the high frequency of marketing campaigns, internet advertising, and number of new players entering the market, new strategic alliances being formed and the subsequent closure of certain poorly performing businesses in the market. Major players in the industry such as Rainbow Chickens, Chubby Chicks appear to control strategic areas of the value chain.

5.0

INTERNAL ENVIRONMENT ANALYSIS

The internal environment analysis is coverage of the scanning of factors considered internal to the project and within the control of the business. Internal environment scanning is important in order to deduce the strengths and weaknesses of the project. The identified strengths shall be capitalised on and the weakness shall be mitigated.

5.1

SHARED VALUES AND PRINCIPLES

The project have great ion and commitment for the project. Shared values and principles regarding the team are as follows:

5.2

Customer Intimacy Process Efficiency Transparency ability Honesty and Integrity Convenience Consistency Reliability Hygiene and good health

UNDERSTANDING OF THE STRATEGIC PLANNING PROCESS

The need an understanding of effective opportunity identification and exploitation by means of external and internal environmental scanning, coming up with a strategic intent, formulating strategies, implementing, monitoring and evaluating plans. It shall be important for the project to have a good understanding of the industry (global and regional perspective), the market, competition, government policies and the available opportunities.

5.3

ORGANISATIONAL STRUCTURE

A formal organizational structure demonstrating clear lines of communicating and reporting needs to be drawn up. This shall be accompanied by an on the roles and responsibilities of each person in the team. At present, the project has a chairperson, treasurer and supervisors. A recommended formal organizational structure and an on roles and responsibilities have been provided under the staffing or human resource plan of this business plan.

5.4

LEADERSHIP STYLE

The have a strong participative and democratic style of leadership. This style of leadership is appropriate for the project as all will appreciate the fact that their voices with regard to the direction of the business are heard and that their contributions towards important decision making are valued.

5.5

STAFF REQUIREMENTS

In of staff, the project is well staffed as all three shall work full time in the project. The project has great potential to create employment for more people subsequent to the attainment of optimum operation levels.

5.6

SKILLS AND COMPETENCIES

The project demands skills in livestock farming with particular reference to rearing of chickens for egg production. An understanding of poultry disease control and prevention is also important. Furthermore, the project requires essential skills, competencies and expertise in key areas such as financial management, project management, strategic planning, marketing, costing and business management and istration. The of the project currently have experience and expertise in general business istration and management. It will be important for the project to seek advanced training in poultry farming and poultry disease control and prevention.

5.7

SYSTEMS

Currently the of the business have a general understanding of systems. It is important for the to gain further understanding of systems as well as know how to implement them. The following systems are deemed important for the business:

6.0 6.1

Management Information Systems Quality Control Systems Performance Management Systems ing System Risk Management System

SWOT ANALYSIS STRENGTHS

The shared values of the project with particular reference to teamwork, commitment and perseverance

The strong participative and democratic style of leadership demonstrated by the of the project

6.2

The business management skills of the project The managing of the project are energetic, knowledgeable, creative and enthusiastic

WEAKNESSES

6.3

The lack of advanced financial management skills The lack of a comprehensive understanding of the strategic planning framework Lack of trained human resource in the field of poultry farming and livestock disease prevention and control The lack of a comprehensive marketing strategy and plan The lack of funding to procure equipment and other assets The low owners contribution as compared to the amount requested from external funders

OPPORTUNITIES

The opportunities in of ownership and procurement presented by AgriBEE

Technologies such as solar energy will be an opportunity for the project as there is potential for a 24.8% increase in electricity prices by Eskom

Access to funding programmes such as Mafisa and the National Empowerment fund

Increased emphasis on women and youth as demonstrated by financial and non-financial by agencies such as The National Youth Development Agency.

Increased small business as demonstrated by the increase in small business forums, Small Enterprise Development agency and many more

The opportunity to supply government institutions such as prisons, collages, departments and other government units will be an opportunity for the business

6.4

The opportunities in of skills development by means of training presented by AgrSETA The Utilisation of Information Technology to enhance the front Office and back office operations as well as key areas such as processing, marketing and distribution

The increasing per capita consumption of eggs The increasing population of South Africa and double income families will be an opportunity for the business The reduced interest rates will mean lower costs incurred as a result of borrowed money Government of the Poultry Industry as it is one of the industries that is considered to be ‘feeding the nation’

THREATS

Compliance with various acts and laws such as the Livestock Improvement Act, Occupational Health and Safety Act, Labour Relations Act and the Basic Conditions of Employment Act

The threat from well-established competitors such as Chubby Chicks, Rainbow Chicken and many more

Indirect competition from distant emerging commercial and subsistence farmers and other small players in the industry

The intensity of rivalry amongst players

The threat from rising electricity prices. Eskom shall increase electricity prices by at least 24.8%, this is a threat to the project as its operations will be more costly and thus force the project to on the additional costs to consumers. This is a threat to the project as it has potential to result in reduced sales and profits

The threat from suppliers – in the case of feed, there is a threat of rising feed costs The threat from substitutes or alternative protein rich food The threat from changes in customer preferences as well as the fact that eggs are generic products that customers can buy from other food stores

7.

STRATEGIC FOCUS

7.1

VISION

The vision of the project is to be a women and youth empowerment community project that is renowned for promoting a healthy well balanced eating within the society

7.2

MISSION

To contribute towards promoting good health and vitality as well as empowering women and youth and ultimately adding value to the lives of all the stakeholders of the project

7.3

VALUES AND PRINCIPLES

Values and principles shall guide the actions of the of the project and form the very essence of the culture of the project. They include,

Respect and value for stakeholders as well as establishing long term value laden relationships in order to realise mutual growth based upon mutual trust

The fostering of a corporate culture that enhances individual creativity, innovation and teamwork

Integrity, honesty and understanding that success depends upon unswerving adherence to the standards and principles of the project

The creation of value for clients by valuing their opinions and ensuring quality poultry products

The provision of excellent working conditions in of health and safety for the employees and other business stakeholders

Productivity in of being results driven and materializing value added achievements Being efficiency in operations and other areas of the business Working together in harmony as a team and cultivating a team spirit oriented business culture Customer centric: this is a core value for the project as it strives to understand the needs and preferences of its customers and superseding their expectations

8.

PROJECT STRATEGIES

8.1

LONG TERM STRATEGIES

Expansion and diversification through the formation of strategic relationships and strengthening relationships with strategic alliances. This will be aimed at establishing at least two more poultry farms within the district. Diversification will focus at moving into the broiler and day old chick industry

Enter new markets such as the export market

8.2

8.3

MEDIUM TERM STRATEGIES Focus on competitiveness by striving to achieve the desired positioning in the market Focus on customer intimacy and process efficiency Focus on niche markets Focus on quality Grow the market share of the project by understanding the needs and expectations of the customers better than the competitors

SHORT TERM STRATEGIES

Formalise the organisational structure

8.3.1

FINANCIAL STRATEGIES

Standardization of processes and procedures Training and development of staff

Enhance the profitability of the business by setting a sales mix that results in the most profitable contribution margin

Minimise operating expenses by monitoring against the budget on a weekly and monthly basis

8.3.2

Minimise the bad debts by having a strict debt issue and collection policy

MARKETING STRATEGIES

Improve awareness of the project by advancing publicity, having presence on the internet by developing a website and other marketing efforts

Improve the competitiveness of the project by implementing market intelligence initiatives such as improving the competitive advantages of the business, studying the competition, conducting market surveys and being more customer intimate

Improve the image of the business by branding the business and its products as well as provide excellent customer service and delivering promptly

8.3.3

OPERATIONAL STRATEGIES

Improve the efficiency of operations by ensuring that tasks are completed timely and that process and procedures are evaluated so as to eliminate redundancies in workflow

Improve operations by standardizing processes

8.3.4

Employ technology Regular audits in processes Improve health and safety for the customers and employees by conducting regular audits to ensure that all health and safety related regulations and standards are being met

HUMAN RESOURCE STRATEGIES

Improve the skills, knowledge and competencies of the and employees of the project and eliminate the risks associated with the loss of key man in the project by providing on going skills development and training.

Employ a performance management system Align the values of the individuals to team values

HUMAN RESOURCE PLAN 9.1

ORGANISATIONAL STRUCTURE

The following graph depicts the proposed organizational structure of Poultry House Project CC. This organizational structure is expected to change when the business starts expanding and diversifying its product base.

Organizational Structure for Poultry House Project CC

9.2

MAN POWER REQUIREMENTS

Position

2010 2011 2012 2013 2014 2015

General Manager

1

1

1

1

1

1

Finance and istration

1

1

1

1

1

1

Disease Prevention and Control Officer

1

1

1

1

1

1

Marketing and Distribution Officer

1

1

1

1

1

1

Operations Officer

1

1

1

1

2

2

Human Resource (this role shall be carried out by the General Manager)

1

1

1

1

1

1

Quality Control Officer

1

1

1

1

1

1

Nutrition and Feeding Officer

1

1

1

1

1

1

Housing and Equipment officer

1

1

1

1

2

2

Security Guard

1

1

1

1

1

1

General Assistant

1

1

1

1

1

1

11

11

11

11

13

13

Total

9.2.2

MAN POWER BUDGET

Position

General Manager

Total Cost to Company (Monthly)

Number Total

10,000

1

10,000

Finance and istration Officer

6,000

1

6,000

Disease Prevention and Control Officer

5,000

1

5,000

Marketing and Distribution Officer

5,000

1

5,000

Sales and Promotions Officer

4,000

1

4,000

General Assistant - Packaging and distribution

1,000

1

1,000

Operations officer

5,000

1

5,000

Housing and Equipment Officer

5,000

1

5,000

Quality Control Officer Human Resources (this role will be carried out by the managing ) General Assistant Security Officer

5,000

1

5,000

-

-

-

1,000

1

1,000

900

1

900

Total

9.2.3

12

52,900

ROLES AND RESPONSIBILITIES

Position

Responsibilities

Project Sponsor

The project sponsors shall assist the project with the required funding and oversee the responsible and able use of the funds by the project. They will also act as a board to ensure that the project achieves the set objectives and ultimately its vision.

Project

The project shall be responsible for strategic planning and strategic decision making in the project.

General Manager

The General Manager shall be responsible for the implementation of the strategy as well as ensure the smooth running of the project.

Finance and istration Officer

The officer responsible for the finance and ing portfolio will be responsible for the following:

Disease Prevention and Control Officer

Compiling input for the management information system of the business by engaging in tasks such as the filling of paper work in the business as well as drawing

Handling of supplier and customer invoices. The preparation of monthly and annual financial statements Maintenance of the general ledger Reconciliations Preparations of budgets and forecasts Ensuring that gross profit margins are accurate

The Disease Prevention and Control Officer will be responsible for being on the lookout for poultry disease outbreaks and taking preventative measures so as to ensure that the poultry houses are disease free.

Marketing and The Marketing and Distribution Officer shall ensure that the marketing mix - that Distribution Officer is, the product, place, price, promotion and packaging meets the expectations and needs of the target market. The Marketing and Distribution Officer will offer solutions to the clients of the project in of how they can best create awareness for their businesses, improve sales and ultimately profits. The Marketing and Distribution Officer shall also be responsible for developing relationships with appropriate organisations and associations within the industry and implementing a customer relationship management system for Poultry House Project CC and the clients it serves. Sales and Promotions Officer

The Sales and Promotion Officer will be responsible for direct and indirect promotions of the product.

Operations Officer

The Operations Officer will oversee the operations of the project. The officer will essentially ensure the efficiency and effectiveness of all processes involved in operations.

Housing and Equipment Officer

The Human Resource Officer will be responsible for the recruitment, selection, performance and appraisal requirements of the project. The responsibilities will also encom the learnership and development requirements of the project.

General Assistant

The general assistant will be responsible Responsible for feeding the layer chickens

Security Guard

for

the

following:

Assisting with the collection of eggs and ensure that the system for the eggs to roll safely from the nests into collection or distribution troughs without breaking is in good order

The General Assistant will be responsible sorting and packing the eggs in preparation for distribution. The assistant will also help with the distribution and logistics needs of the project.

Other poultry related general tasks

The project will recruit one Security Guard. The Security Guard will be responsible for guarding and protecting the property of the business.

10. TECHNICAL AND OPERATIONAL PLAN 10.1

RAW MATERIAL AND REQUIREMENTS

10.2

MACHINERY AND EQUIPMENT

Item

Details

Layer houses

These shall be in the form of layer battery cages that are put under a roofed house. These will accommodate 2 500 layers. The cages are made up of cells which accommodate 2 layers each. The layer houses will be such that they protect the layers from direct sunlight, excessive wind, rain, extreme heat or cold, wild birds and theft.

Feeding Systems

Feeding systems will be required to easily distribute feed and water to the birds. The feeding systems can be automatic or manual. An automatic feeding system is preferable. A Silo will therefore be important to store the feed.

Ventilation Systems

Ventilation will be important to ensure that the air quality and temperature is appropriate for the layers.

Motor Vehicle

A motor vehicle shall be needed to purchase layers, feed and other requisitions for the project. Additionally, a motor vehicle is essential for distribution purposes and other logistical needs of the project. A van or bakkie shall be appropriate for the project.

Office Equipment

Equipment in of office chairs, tables, desks and cabinets shall be necessary for the istration building of the project.

Consideration shall also need to be given to the following areas:

10.2.1

Water Supply

A reliable fresh water supply will be important for the poultry business. A borehole or other reliable source of water

will be imperative for the business. The business should also consider an overhead water tank of about 10 000 litres capacity.

10.2.2

Electricity Supply

The provision of 250 KVA supply of electricity will need to be made for the project. Where possible uninterrupted supply of electricity will also need to be facilitated by means of generators.

10.3

LAYOUT OF THE BUSINESS PREMISES

Shown below is the suggested layout of the business premises for Poultry House Project CC. The sections within the business premises will include:

10.4

Reception Back office Back office storeroom Cooling / Storage area Sorting, Grading and packing Toilets Shower Layer houses Footbath

GROWTH MANAGEMENT AND QUALITY ASSURANCE

The factors shown in the schematic above are essential for managing the growth of the layer birds. To improve the quality of the birds and eggs produced as well as better manage the layers, the following aspects must be taken into . The raw material requirements for the project include the following: Environment

Managing the environment surrounding the birds in of lighting, temperature, ventilation (air quantity and quality) and other climate related factors will be important to improve the quality of the eggs produced.

Nutrition

It is important to provide feed containing enough nutrients in the correct proportions. Water supply is also important as it plays a role in keeping the birds rehydrated.

Health

The immune status of the birds should be monitored so as to prevent and control diseases.

10.4.1

DISEASE CONTROL AND PREVENTION

The point of lay pullets or layers will be pre vaccinated by the supplier. It will however be important to be on the lookout for any disease outbreaks as well as take the necessary measures to prevent diseases. Good hygiene, management as well keeping wild birds away from the poultry houses will help prevent diseases. The entity should consult the nearest veterinarian or extension officer for a vaccination programme as well as report any signs of diseases noticed. The community project should look out for the following diseases: Disease

Description

Symptom

New castle disease

Highly contagious disease caused by a virus. Difficulty in breathing, paralysis Disease can stay alive in a chicken carcass for and death, diarrhea month

Infectious Bronchitis

Highly contagious disease caused by a virus. Disease can stay alive in a chicken carcass for month

Breathing problems, gasping, sneezing, watery nasal discharge, squeaky lung sounds

Coryza

Spread through dirty water or air

Watery nasal discharge, selling of the face and eyes

Gumboro disease

Infectious bursal disease, usually affects chicks up to the age of six weeks. Transmitted by wild birds, rodents and humans

White, watery diarrhea, dirty cloacas and ruffled feathers

Mycoplasmosis

Infectious disease which can affect egg production

Sneezing, squeaky lungs, gasping for air and sometimes discharge from the eyes

Bird flu

Often spread by the migration of wild birds. Virus can also affect people if they come into with an infected bird.

Little signs of disease and death occurs suddenly

HEALTHY LAYERS The activities that will contribute towards the raising of healthy layers that are less vulnerable to diseases are as provided in the schematic below:

10.5 EGG PRODUCTION PROCESS

The process shown above will be followed by the project. The layers shall produce the eggs and these will be collected and thereafter sorted according to the grade (i.e. grade 1, 2 and under grade). The eggs will then be packaged and then placed in the storeroom while pending marketing and distribution.

11. MARKETING PLAN The marketing efforts will focus on identifying and understanding the ever changing needs and preferences of the customers in order to satisfy them. The marketing mix will drive the customer value proposition of the project. The following is an on the product, promotion, place and packaging that will be applied to the selected market segment.

11.1

PRODUCT

The main products of the project shall be the eggs produced by the layer birds. The project will strive to improve the quality of the eggs produced and sold by providing the right nutrition and environment condition for the layers. Other products to be sold by the project will include the manure resulting from chicken droppings. Manure is a desirable fertilizer that is highly sought after by farmers and flower growers. Additionally, the project will sell layers (cull hens) that become unproductive (around 70 -110 weeks). Cull hens are considered to be a delicacy for most consumers and as such, the business will be in position to sell these at lucrative prices.

11.2

PROMOTION

Poultry House Project CC will use a combination of push and pull strategies to create awareness for the business and appraise leads and sales. Communication will essentially be directed to small and medium sized entities such as lodges, bed and breakfasts and lodges. The target consumers will ideally pull the product through the distribution channel forcing the wholesalers and retailers to stock the products of the project. The marketing efforts of the business will be designed such that they create attention, interest, desire and ultimately cause the target audience to take action by purchasing the products of the business. The project will make use of the marketing and distribution officer so as to ensure that the promotion efforts are well executed. The marketing officer will also assist the business in establishing a brand for the business i.e. Poultry House Project CC and promote it so that the customers

are able to identify the project and product. Branding will also assist in of positioning or creating a picture in the minds of the consumers about the project and the products it provides. It shall encom the following:

A project website

The project will a domain name and engage a web design consultant to develop a website for the project that provides information to potential clients. This will not only give the project a local presence but also open up opportunities for an international presence.

Project logo

A business or project logo will be developed for the project. This will be a ‘graphical icon’ that will help customers easily identify the project.

Professional letterhead

The professional letterhead will be developed for the project. It will be used to write letters to suppliers, customers and other stakeholders. The letterhead will form part of the branding for the project as it will essentially be used for communication purposes

Flyers

A4 and A5 sized flyers will be made to promote the products of the business.

Business cards These will be small wallet sized cards that will be made for each member of the business. The cards will show the name of each member as well as their details. The business cards will be given to potential clients in order to engage further communication Business slogan

The business will have a catchy and creative slogan that will form part of its branding and business culture.

Poultry House Project CC will establish a unique selling advantage as it will look into all aspects of adding value in of customer intimacy and value based pricing. This will be communicated to the clients via promotion means. Appropriate and effective forms of advertising will include word-of-mouth, hand-delivered flyer promotion – to promote any specials that the project might have. This can be extremely effective if coupled with client referrals as a base with constant monitoring and follow-ups. Market intelligence; that is, being aware of the market and changes within the market will be vitally important. For example – new competitors, keeping customers aware of any new developments or products will be an integral part of the promotion efforts of the project. Keeping the name current in the mind of the consumers will also be of utmost importance. Clearly targeted and consistent advertising will increase sales, improve the market share and earns the project greater profits while hopefully developing new entries into new markets. The promotion initiatives of the project are categorized and summarized in the following table: Promotion Avenue

Details

Publicity and public relations

Publicity and public relations will encom the stimulation of demand by interacting with the community via articles in local releases as well as making the community informed about the project and the value it adds to society. This will be done at public gatherings, churches and other appropriate places

Advertising

This will encom non-personal presentation and promotion of the products of Poultry House Project CC through media channels such as flyers and local radio stations. The advertising will be in such a way that it educates the target audience about the nutritional benefits of eating eggs.

Sales promotion

This will be coverage of impersonal and short term or occasional offering of incentives such as small discounts on bulk purchases of eggs or ‘buy one get one free’ campaigns

Personal selling The project will make use of dedicated sales and marketing personnel that will be responsible for communicating the benefits or value of the products of the project to potential customers.

11.3

PRICING

The business will make use of ing and costing systems to determine the unit cost of the eggs. This way of pricing is justified as the business needs to sell at a price higher than the cost per unit and essentially cover other related costs and expenses. It will be important for the project to monitor the costs such as feed, vaccines, labour and other direct cost as these can be 60 – 70% of the cost of goods sold. Poultry House Project CC will also monitor the prices of its competitors so as to promote competitiveness.

The pricing of the egg products will also depend on the grade of the egg. Given below is a breakdown on the suggested price per dozen of eggs in accordance to the grades. These are based on the average market prices for 2010.

Grade

Weight

Selling price per dozen

Grade one

51g - 59g

R14.00

Grade two

41g - 50g

R12.50

Under grade

Below 41g

R11.00

11.4

PACKAGING