Sara Swat 3x115s

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3i3n4

Overview 26281t

& View Sara Swat as PDF for free.

More details 6y5l6z

- Words: 13,978

- Pages: 47

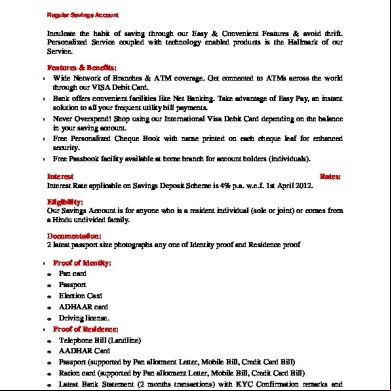

DEPOSITS SCHEME’S Saving Regular Savings

Inculcate the habit of saving through our Easy & Convenient Features & avoid thrift. Personalized Service coupled with technology enabled products is the Hallmark of our Service.

Features & Benefits: Wide Network of Branches & ATM coverage. Get connected to ATMs across the world through our VISA Debit Card. Bank offers convenient facilities like Net Banking. Take advantage of Easy Pay, an instant solution to all your frequent utility bill payments. Never Overspend! Shop using our International Visa Debit Card depending on the balance in your saving . Free Personalized Cheque Book with name printed on each cheque leaf for enhanced security. Free book facility available at home branch for holders (individuals). Interest Rates: Interest Rate applicable on Savings Deposit Scheme is 4% p.a. w.e.f. 1st April 2012. Eligibility: Our Savings is for anyone who is a resident individual (sole or t) or comes from a Hindu undivided family. Documentation: 2 latest port size photographs any one of Identity proof and Residence proof

Proof of Identity: o Pan card o port o Election Card o ADHAAR card o Driving license. Proof of Residence: o Telephone Bill (Landline) o AADHAR Card o port (ed by Pan allotment Letter, Mobile Bill, Credit Card Bill) o Ration card (ed by Pan allotment Letter, Mobile Bill, Credit Card Bill) o Latest Bank Statement (2 months transactions) with KYC Confirmation remarks and Officers signature/designation o ed Leave & License Agreement with proof of permanent address or Notarised Leave & License Agreement with Police N.O.C. with proof of permanent address

Originals & Self-attested copies to be submitted for verification.

CUBS for Kids

No matter how old your kids are, they will always be your precious babies in your eyes! Your child stands for your HOPES & DREAMS. Why

not

instill

Good

Habits

in

your

child

in

their

formative

years!

We at Saraswat Bank understand your needs & therefore have come out with a scheme to inculcate the habit of saving in your child. Your child also receives attractive gifts & a personalized book

Features & Benefits: Initial deposit of Cubs is Rs 50/- and subsequent deposits in multiples of Rs 10/no periodic compulsion for subsequent Deposit. Starting with a small amount of Rs.50/-, a CUB holder has to save Rs. 500 /over a period of one year. Facility to deposit cash in school premises on predetermined days. After completion of 14 years of age minor/student can operate the and is also entitled to a VISA Debit Card facility. Bank does not charge you for non-maintenance of minimum balance for first year. A gift for every child in whose name is opened. A personalized book in the name of the child. Interest Rates Interest Rate applicable on Savings Deposit Scheme is 4% p.a. w.e.f. 1st April 2012.

Eligibility: To be a 'CUBS' holder you should be a minor/student (upto the age of 21 years). Documentation 2 latest port size photographs of the child and parent and any one of the below mentioned Identity proof and Residence proof (of the parent)

Proof of Identity: o Birth Certificate of the child (mandatory) o port o Election Card o ADHAAR card o Driving license. Proof of Residence: o Telephone Bill (Landline) o port(ed by Pan allotment Letter, Mobile Bill, Credit Card Bill) o Ration card(ed by Pan allotment Letter, Mobile Bill, Credit Card Bill) o Latest Bank Statement (2 months transactions) with KYC Confirmation remarks and Officers signature/designation o ed Leave & License Agreement with proof of permanent address or Notarised Leave & License Agreement with Police N.O.C. with proof of permanent address

CAMPUS for College students

Our Bank offers you the Best facilities for young adults to encourage the habit of savings right from Teens. Make your Child aware of the banking operations at the right age. Open his / her CAMPUS

Features & Benefits: Zero balance saving ATM cum VISA Debit Card Free Internet Banking Concessions in Loans o Saraswati Education Loan: 0.25% rebate in rate of interest and 25% waiver in prevailing processing fee o Multipurpose Loan: 1.50% rebate in rate of interest on Loans for two-wheelers, laptops, tablets & mobiles. Free issuance of one Demand Draft or Payorder per month upto Rs. 50000/- favoring Educational Institute

No Annual Maintenance charges in case of Demat for the 1st year

Eligibility: All college students, above 14 years of age and upto 26 years of age, at the time of opening the . Mode

of

Holding:

Single tly or E/S ONLY with parents/guardian

Interest Rates: Interest Rate applicable on campus Deposit Scheme is 4% p.a. w.e.f. 1st April 2012. Documentation: If the

is

opened

in

Single

Name:

Address Proof- Certificate from College authority certifying the address of the student. Permanent Address proof to be obtained within one month. If the is opened tly with parents then the following documents of parents should be submitted: 2 latest port size photographs any one of Identity proof and Residence proof

Proof of Identity: o Pan card o Latest college identity card o port o Election Card o ADHAAR card o Driving license. Proof of Residence: o Telephone Bill (Landline) o AADHAR Card o port (ed by Pan allotment Letter, Mobile Bill, Credit Card Bill) o Ration card (ed by Pan allotment Letter, Mobile Bill, Credit Card Bill) o Latest Bank Statement (2 months transactions) with KYC Confirmation remarks and Officers signature/designation o ed Leave & License Agreement with proof of permanent address or Notarised Leave & License Agreement with Police N.O.C. with proof of permanent address . Akshay Salary

Our Bank offers a scheme for employers and employees to open their salary s with us which offers a host of services which keep you ahead of the Pack. There is no restriction of minimum balance and employees get access to whole gamut of Banking Services. We indulge your employees, thereby enhancing their job satisfaction. Features & Benefits: You are eligible if you are a salaried individual up to 55 years of age working with reputed organization.

Zero Balance . Overdraft facility equivalent to average net monthly salary maximum up to Rs 50000/(salary of last 3 months to be taken into consideration). Easy Loan up to Rs. 2.00 Lakhs under Multi-purpose Loan Scheme with 0.50% concession on applicable rate. Free Net Banking and Mobile Banking facility Two personalized cheque books free. Any Branch Banking for transfer transactions and also for Cash deposit/withdrawal up till Rs 25000/- is free. Preferred weightage to avail other loans from the Bank. Eligibility:

You are eligible if you are a salaried individual up to 55 years of age working with reputed organization. Interest Rates: Interest Rate applicable on Savings Deposit Scheme is 4% p.a. w.e.f. 1st April 2012. Documentation: 2 latest port size photographs any one of Identity proof and Residence proof

Proof of Identity: o Pan card o port o Election Card o ADHAAR card o Driving license.

Proof of Residence: o Telephone Bill (Landline) o AADHAR Card o port(ed by Pan allotment Letter, Mobile Bill, Credit Card Bill) o Ration card(ed by Pan allotment Letter, Mobile Bill, Credit Card Bill) o Latest Bank Statement (2 months transactions) with KYC Confirmation remarks and Officers signature/designation ed Leave & License Agreement with proof of permanent address or Notarised Leave & License Agreement with Police N.O.C. with proof of permanent address

Suvidha Savings

A Savings with all convenient features and that too with '0' balance, that's why we call it Suvidha.

Features & Benefits: Access to our wide network of Branches & ATM. Bank offers convenient facilities like Net Banking and Mobile Banking free of cost. Take advantage of Easy Pay, an instant solution to all your frequent utility bill payments. Personalized Cheque Book facility. No minimum balance charges. No Limit to the number of credit transaction per month. Interest Rates: Interest Rate applicable on Suvidha Savings Deposit Scheme is 4% p.a. with quarterly rest. Eligibility: Our Suvidha Savings is for anyone who is a resident individual (sole or t) or comes from a Hindu undivided family. Documentation: 2 latest port size photographs any one of Identity proof and Residence proof

Proof of Identity: o Pan card o port o Election Card o ADHAAR card o Driving license. Proof of Residence: o Telephone Bill (Landline) o AADHAR Card o port(ed by Pan allotment Letter, Mobile Bill, Credit Card Bill) o Ration card(ed by Pan allotment Letter, Mobile Bill, Credit Card Bill)

o o

Latest Bank Statement (2 months transactions) with KYC Confirmation remarks and Officers signature/designation ed Leave & License Agreement with proof of permanent address or Notarised Leave & License Agreement with Police N.O.C. with proof of permanent address

Service Charges: Maximum of 4 debit transactions are allowed per month free of charge to the customer together for cash withdrawals at branch and for ATM transactions done at Saraswat Bank ATMs. Thereafter, Cash Withdrawal at branch will be charged at Rs 10/- per transaction and Cash Withdrawal at Saraswat Bank ATMs will be offered free of charge. No charges will be applicable for non-operation of or activation of inoperative . Other Points: Holders of Suvidha Savings will not be eligible for opening any other savings bank deposit with our bank. If a customer has any other existing savings bank deposit in our bank then he/she will not be allowed to open Suvidha Savings with our bank. In case he desires to have a Suvidha Savings then his earlier has to be closed. This restriction is applicable incase of existing t also.

ELITE SAVING Elite Savings

Banking with an edge, with Elite Savings we are here to give a host of services just for free all you need to

do

is

maintain

a

minimum

average

quarterly

All the branches of the bank on Core Banking.

Deposit/ Transfer/ Withdraw cash from any of our branches.

balance

of

just

Rs

5000/-.

Features & Benefits:

Bank offers you a higher interest saving as you are offered Sweep in /Sweep out facility wherein excess balance of Rs 10000 would be transferred to a term deposit in multiple units for 1 year.

Free Personal Accident Insurance Cover of Rs 2.00 Lakhs for the first year to the first holder only.

Convenient facilities like Net Banking offered absolutely free.

Never overspend. Shop using your International Visa Debit Card depending on the balance in your saving .

Wide Network of Branches & ATM coverage. Get connected to ATMs across the world through our VISA Debit Card.

Avail of Safe Deposit Locker facilities (subject to availability).

Free unlimited issuance of DD/PO on Saraswat Bank Locations.

Bank provides personalized/non personalized cheque book (50 leaves) every half year FREE.

Pay your electricity bills, telephone bills, Cellular Phone Bills, Insurance & many more through "Easy Pay Facility". Bank does not charge you for availing these services. Eligibility: Individuals (singly or tly), Minor by guardian, Organizations, Co-op. Societies Elite Silver Savings

Enjoy unrestricted access to your and funds at your own free will by maintaining an average quarterly balance of Rs 25000/only. Avail of Sweep in Sweep Out facility by which your funds above the threshold limits can be transferred to Fixed Deposit allowing you to earn further higher interest rate on your deposits.

Features & Benefits: Free cheque books of 25 leaves each every financial year. Free statement of on your ed email address. Free Debit VISA Card for first two years, thereafter Rs 99/- per year. Enjoy zero maintenance Demat for two years. Free usage of ATM of other Banks. Avail of Safe Deposit Locker facilities (subject to availability). Free net banking facility which allows you to access your statement of , transfer your funds and make cheque book requests. Enjoy Personal Accident Cover of Rs 2.00 lakhs completely free for three years and thereafter at Rs 35/- per year. Free Any Branch Banking i.e. you can deposit and withdraw cash, transfer funds from any branch of the Bank without any extra charges. Enjoy concession in interest rates while availing credit under specified schemes and also enjoy 50% waiver on processing fees while availing Car Loan. Free unlimited issuance of DD/PO on Saraswat Bank Locations. Eligibility: Individuals (singly or tly), Minor by guardian, Organizations, Co-op. Societies

Elite Gold Savings

Experience the ultimate benefits that new age banking can off you. Our Elite Gold will make you feel like the king, with banking services and facilities that will delight you all the time. Enjoy unrestricted access to your and funds at your own free will by maintaining an average quarterly balance of Rs 100000/only. Avail of Sweep in Sweep out facility by which your funds above the threshold limits can be transferred to Fixed Deposit allowing you to earn further higher interest rate on your deposits.

Features & Benefits: Free unlimited number of cheque books. Free unlimited issuance of DD/PO on Saraswat Bank Locations. No AMC on VISA Debit Card for lifetime. Enjoy zero maintenance Demat for lifetime. Avail of Safe Deposit Locker facilities (subject to availability). Free usage of ATM of other Banks. Free net banking facility which allows you to access your statement of , transfer your funds and make cheque book requests Enjoy Personal Accident Death Cover of Rs 2.00 lakhs completely free for five years and thereafter at Rs 35/- per year. Free Any Branch Banking i.e. you can deposit and withdraw cash, transfer funds from any branch of the Bank without any extra charges. Enjoy concession in interest rates while availing credit under specified schemes and also enjoy 100% waiver on processing fees while availing Car Loan.

Eligibility: Individuals (singly or tly), Minor by guardian, Organizations, Co-op. Societies CURRENT Current

Banking that helps your business grow faster than you would imagine. The features of our Current make banking a comfortable experience.

Features & Benefits Minimum balance requirement of Rs 5000/- per quarter Free Internet Banking Free Mobile Banking - Check your balance/transaction. Free International Visa Debit Card for the 1st year. Avail of Safe Deposit Locker facilities (subject to availability). Free monthly statement. Avail Personalised chequebook for enhanced security at nominal prices. Take advantage of Easy Pay. An instant solution to all your frequent utility bill payments.

Take advantage of Easy Pay. An instant solution to all your frequent utility bill payments. Eligibility: You can open a Current with us if you are: Public or Private Limited Companies Partnership Firms Proprietorship Concerns Trusts

Public or Private Limited Companies o Certificate of Incorporation and Commencement of Business o Memorandum and Articles of Association o Board resolution authorising the opening and operation of the o PAN or GIR No. or completed Form 60 o List of Directors with residential addresses Partnership Firms o Partnership Deed and Registration Certificate o Shop and Establishment Certificate o Letter from partners approving the persons concerned to open and operate the Proprietorship Concerns o Certificate from State Govt. or Statutory Body or Trade License or Sales Tax Certificate or Shop and Establishment Certificate o Letter of proprietorship, duly signed by the proprietor in his or her individual capacity (with a rubber stamp) o Hindu Undivided Family o Letter of HUF duly signed by Karta and all Co-Parceners o PAN or GIR No. or completed Form 60 o Names of Karta and Co-parceners with residential addresses o Latest port-size photographs of all the authorized signatories Trusts o Copy of the trust deed o Copy of the registration certificate o Copy of the resolution by the trustees authorising the concerned to open and operate the o List of Trustees with residential addresses o Photographs of the operating the Associations or Clubs o Bye-laws of the association or club o Certificate of Registration o Copy of the resolution by the Board authorising the concerned to open and operate the o Photographs of the operating the

Closure

Charges:

If closed within 6 months Rs 500 +charges for unused cheque leaves at Rs 2 per leaf. If closed within 1 year Rs 250 +charges for unused cheque leaf at Rs 2 per leaf. EITE CURRENT

Our Bank offers you freebies and add-ons that enhance your banking experience with us. Open an Elite Current and enjoy plethora of services all by maintaining a minimum balance of Rs 10,000/-. We offer Any Branch Banking to facilitate easy banking for you with the following salient feature. Features & Benefits :

Minimum balance of Rs 10000/- only

Deposit / Withdraw cash from any of our branches

Transfer funds from one to another within Saraswat Bank

Earn interest in your current with our Sweep in/Sweep out facility wherein excess balance of Rs 20,000/- in your current will be transferred to a term deposit in multiple units for 1 year.

Free Internet Banking and Mobile Banking facility that enables you to check your balance and transactions in your .

Shop using your International Visa Debit Card

Free personalized cheque book with "Payable at Par" facility across all cities where Saraswat Bank has a branch

Free use of "Easy Pay Facility" to pay your electricity bills, telephone bills etc.

Current Saraswat bank caters to different category of entities under three current variants. With the specific purpose of catering the needs of SMEs, Corporates and Retail establishment, Bank has launched Current . This will help you avail multiple benefits by maintaining an average quarterly balance of Rs 50000/- in your current . Features & Benefits:

Interest paying current with Sweep in /Sweep out facility wherein excess balance of Rs 1,00,000/-

would be transferred/ auto sweep to a term deposit in multiple units of Rs 50,000/-for 1 year

Unlimited issuance of DD/PO

Free online Interbank funds transfer through NEFT /RTGS

Shop using your International Visa Debit Card depending on the balance in your saving

Enjoy Free Internet Banking and SMS Banking facility

Personalized cheque book free

Free access to other bank ATMs

Free DEMAT , i.e. you do not have to bear any annual maintenance charges for first five years

50% concession on charges for balance certificate and solvency certificate

50% waiver on all charges levied, maximum upto Rs. 1,000/- for the services availed during the financial year*

Pay your electricity bills, telephone bills through “Easy Pay Facility” at no extra cost.

Receipt of Monthly Statement of s by Email at no charges

Apart from the above, any retail loans extended in the name of Firm/Company/Proprietor/Partners/Directors will enjoy 50% concession on processing fees.

TERM DEPOSITS Fixed Deposits

Savings has been an essential part of all the earnings, we at Saraswat Bank, help you earn more on your savings by offering savings schemes which come with suitable tenures and attractive interest rates. Term Deposits A term deposit is an Interest Payout savings scheme which offers interest at half yearly, quarterly and monthly basis. Kalpataru Deposits The Kalpataru Deposit scheme is a cumulative interest scheme, this means that interest earned at the end of every quarter is invested along with the principal helping you make the most of your money. Features & Benefits : TDS applicable Form 15H/15G required to be submitted for exemption of TDS. Nominal member of the bank will also be exempted from TDS. If you are exempt from paying tax, you need to present Form 15H when you open a Fixed Deposit and subsequently at the beginning of the following financial year. A minimum amount of Rs. 1000/- and further rise in multiples of Rs. 100/- is required to open Term Deposits .

Recurring Deposits

Just like little drops make an ocean, see your small investments every month turn into a huge amount at maturity by investing in our Recurring Deposit scheme.

Features & Benefits : Invest little sums every month Facility of Standing Instruction through which the amount can be debited from your savings . NO TDS Attractive Interest Rates Scheme applicable for 12 months to 36 months Amount of installment once fixed, cannot be changed. Recurring deposits are accepted in equal monthly installments of minimum Rs 5

Charges: Penalty for delayed monthly installment Rs. 1.50 per Rs.100 p.a. In case of payment before maturity, Interest upto 15 days will be Nil. Above 15 days 1% less than applicable rate of Interest for the actual period for which deposit is kept with the Bank. Madhukar Tax Saving Deposits

Money does not grow on trees. But by saving and investing wisely one can make money hands over fist. With this intention Bank has come out with a scheme which allows you higher returns compared to other tax savings schemes. Investments under Madhukar scheme offered by Saraswat Bank are exempted under Sec 80C of Income Tax Act. In the Finance Bill of 2006, the government had announced Tax benefits to Bank Term Deposits which are of over 5 year tenure u/s 80C of IT Act, 1961 vide Notification Number 203/2006 and SO1220 (E) dated 28/07/2006.

Features & Benefits : Invest minimum Rs 5000 and in multiples of Rs 100. Maximum amount being Rs 100000 during the calendar year. Maturity Period of the term deposit is minimum 5 years Deposit can be kept in a single name or in t names. Tax benefit under Sec 80C shall be available only to the first holder. Interest on the term deposit is payable Quarterly The term deposit cannot be pledged to secure loan/overdraft or as security to any other asset

neither they can be withdrawn prematurely. **The tax on interest earned is deductible in accordance with the provisions of section 194A or section 195 of the Income Tax Act 1961. Eligibility: Individuals looking for tax saving investment avenues.

Charges: Penalty for delayed monthly installment Rs. 1.50 per Rs.100 p.a. In case of payment before maturity, Interest upto 15 days will be Nil. Above 15 days 1% less than applicable rate of Interest for the actual period for which deposit is kept with the Bank.

RETAIL LOANSRetail Loans Saraswat Co-operative Bank offers various loans to its customers. Bank takes care of its customers by offering comprehensive loan packages at extremely competitive rates, without any hidden costs. Our personalised service coupled with state of the art technology at absolutely market competitive rates shall make your Banking experience a truly memorable one.

PERSONAL Retail Loans

Vastu Siddhi Housing Loan Super Fast Car Loan Super Fast Car loan - High End Car Sajawat Loan Scheme Saraswati Education Loan Education Loan Scheme for disadvantaged groups Pravasi- Travel Loan Gold Loan Yojana Multi Purpose Loan Privilege – Executive Finance E - Stock Advance Property Loan Scheme Samruddhi - Loan against Property Advance Against RBI Bonds Gupt Dhan Yojana-Overdraft against property Doctor Delite Advantage – for Professional

Investment & Insurance

Saraswat Bank provides information of it's various Investment & Insurance products which customers can avail of with the bank.

Insurance

It is our earnest endeavour to offer you new and competitive financial products and services. We have for this purpose tied up with various insurance companies. The details of tie-up and products offered are given below: LIFE INURANCE For Life Insurance products, we have entered into a tie-up with M/s. HDFC Standard Life Insurance Company Limited. We offer following products: Protection Plans Protection Plans help to shield your family from uncertainties in life due to financial losses in of loss of income that may dawn upon them in case of your untimely demise or critical illness. Protection Plans go a long way in ensuring your family’s financial independence in the event of your unfortunate demise or critical illness. They are all the more important if you are the chief wage earner in your family. No matter how much you have saved or invested over the years, sudden eventualities, such as death or critical illness, always tend to affect your family financially apart from the huge emotional loss. Children’s Plan Children’s Plans help to save, so that you can fulfill your child’s dreams and aspirations. These plans go a long way in securing your child’s future by financing the key milestones in their lives even if you are no longer around to oversee them. Children’s Plans help you save steadily over the long term so that you can secure your child’s future needs, be it higher education, marriage or anything else. A small sum invested by you regularly can help you build a decent corpus over a period of time and go a long way in providing your child a secured financial future alongwith. Retirement Plans Retirement Plans provide you with financial security so that when your professional income starts to ebb, you can still live with pride without compromising on your living standards. By providing you a tool to accumulate and invest your savings, these plans give you a lump sum on retirement, which is then used to get regular income through an annuity plan. Given the high cost of living and rising inflation, employer pensions alone are not sufficient. Pension planning has therefore become critical in today's world. Savings and Investment Plans You have always given your family the very best. And there is no reason why they shouldn’t get the very best in the future too. As a judicious family man, your priority is to secure the well-being of those who depend on you. Not just for today, but also in the long term. More importantly, you have to ensure that your family’s future expenses are taken care, even if something unfortunate were to happen to you. Our Savings & Investment Plans provide you

the assurance of lump sum funds for your and your family’s future expenses. While providing an excellent savings tool for your short term and long term financial goals, these plans also assure your family a certain sum by way of an insurance cover. Health Plans Health plans give you the financial security to meet health related contingencies. Due to changing lifestyles, health issues have acquired completely new dimensions becoming more complex in nature. It becomes imperative then to have a health plan in place, which will ensure that no matter how critical your illness is, it does not impact your financial independence. Know more about the products of HDFC Life Insurance. Above products are available through all our branches with expert personalised advice. For more information, please visit our nearest branch or our Customer Service Centre on the Toll Free Number - 1800229999 Please note that Bank is entitled for Commision for marketing the above products of M/S HDFC Standard Life Insurance Co. Ltd. The details of the commission structure are available at our Branches for the information of our customers

MUTUAL FUNDS Home » Personal » Investment & Insurance » Mutual Funds

Mutual Funds

Considering the changes in Indian demographics (more than 70%of the population below the age of 35), changes in investment pattern (rising disposable incomes created a huge potential for investment in Insurance and Mutual Funds), increased competition and thinning of Interest margins, the Indian Banking Industry had to redesign their bouquet of products and introduce marketing of third party products like Insurance and Mutual Funds, to increase fee based income. The Mutual Fund industry currently has 35 Fund houses with 1800 schemes spread across 30 different categories. During this financial year the industry saw 900 new fund offers(equity, debt, liquid and Fixed Maturity Plans included).The AUM (Asset Under Management) of the Mutual fund industry closed at Rs 4,31,901 Cr at the end of October 2008. Our Bank has entered into the Mutual fund distribution business 5 years backand today we have a successful tie up with 21 fund houses with total funds invested at around Rs 100 crores. The major fund houses where our Bank has tie up are as follows: FundHouse Birla Sunlife Mutual Fund Franklin Templeton Mutual Fund HDFC Mutual Fund ICICI Prudential Mutual Fund Kotak Mahindra Mutual Fund

Principal PNB Mutual Fund Reliance Mutual Fund Tata Mutual Fund UTI Mutual Fund The forms of the various schemes of the fund houses are available at all our branches. For any further assistance you may visit our nearest branch or call the Customer Service Centre on our Toll Free Number - 1800229999

Demat

(PAN compulsory for all demat s) Modernisation in the trading and settlement system has been witnessed in the capital market through automated trading mechanism of Demat. The advent of Electronic trading and settlement has brought in transparency in trading and has eliminated risks associated with Bad Delivery and handling huge load of paperwork. The country has made a remarkable growth in the capital market by switching over to electronic trading DEPOSITORY PARTICIPANT CELL: Saraswat Co-operative Bank Limited is a Depository Participant with National Securities Depository Ltd (NSDL) and Central Depository Services Ltd (CDSL). Features & Benefits : Saraswat Bank offers the following attractive features to its clients:

Free AMC for one year – (Regular ). Option of both CDSL and NSDL facilities Portfolio valuation to the customers Free SMS facility Speed-e facility for NSDL online transfer of shares. Free Viewing of Holding /Transaction through internet (Ideas/easi facility) Easiest facility for CDSL clients for Online transfer of shares Demat facility from any branch

Demat opened within 24 hours for Mumbai branches Attractive and competitive tariff structure

Basic merits of holding a demat :

Holding of equity shares and mutual fund units in demat form. Electronic credit in public issue Credit of Rights/ Public Issues/Bonus entitlements through Auto Corporate Action Dividend credit through ECS Immediate transfer and registration of securities Elimination of all risks associated with physical certificates Elimination of Bad deliveries Faster settlement cycles No stamp duty on transfer of securities Facilities ease in recording change of address, transmission , signature, dividend mandate, registration of power of attorney etc. across companies held in demat form by a single request instruction to Demat department. Pledging of securities

At Madhushree,Plot Centre,Sector NAVI MUMBAI - 400 703

No

85,

District

Business 17,Vashi

NRI/FOREX NRI Deposit

Saraswat Bank is the first co-operative bank to obtain permanent license to deal in foreign exchange. Authorised Dealer in Foreign Exchange since 1979.

The International Banking Division plays an active role in forex operations through its ten Forex Centres.

Correspondent Banking relations with 430 centres of various banks spread over 65 countries.

Maintaining foreign currency s in 9 major currencies of the world.

Well equipped Treasury Department.

Member of SWIFT network for speedy, accurate and safe Funds Transfer.

All types of Forex Services rendered to many other Co-operative Banks.

The product suite for NRIs ranges from Bank deposits, Housing Loans and Demat s.

To give further boost to NRI services and in order to cater the growing needs of NRI customers, our Bank has set up a specialized NRI Desk at-

NRI’s can open the following types of s with us. TYPES OF DEPOSIT S

Foreign Currency Non Resident (Bank) Deposit - FCNR (B) Deposit

Non-Resident External (NRE)

Non-Resident Ordinary (NRO)

Resident Foreign Currency

How

to

open

NRI

with

us.

To open an NRI please complete the opening form and forward it to any of our branches of your choice along with the following:

Photocopy of the port.

Photocopy of Visa/Residence permit.

Photograph.

Overseas Address Proof (any one of these - Utility bills/ Driving License/Credit card bills/ Overseas Bank statement).

Local Address Proof

Initial money remittance.

All

documents

are

to

be

self

attested.

Your signature is to be verified by anyone of the following:

Indian Embassy/consulate.

Notary public.

Your bank abroad.

You can authorise a resident close relative to operate your through a Power of Attorney or Letter of Authority. Nomination

facility

available

(nominee

can

be

a

resident

Indian/

or

a

non

resident).

NRI PRESONAL LOANS Personal Loans We

grant

Rupee

loans

to

NRI

customers

Security of funds held in NRO Term Deposits and

Security of funds held in NRE Term Deposits, FCNR (B) Deposits.

Against the security of shares or other securities held in the name of the borrower.

against:-

Please

note

that-

The loan shall be utilized for meeting the borrower’s personal requirements or for his own business purposes; and

The loan shall not be utilized, for any of the activities in which investment by persons resident outside India is prohibited namely;

o

Business of chit fund,

o

Nidhi Company.

o

Agricultural or plantation activities or in real estate business (excluding development of township, construction of residential/commercial premises, (roads or bridges), construction of farm houses;

o

Trading in Transferable Development Rights (TDRs).

o

Investment in capital markets including margin trading and derivatives. The Reserve Bank’s directives on advance against shares/securities/immovable property shall be duly complied with.

The loan amount shall be credited to NRO of the borrower.

The loan amount shall not be remitted outside India.

Repayment

Repayment shall be made by fresh inward remittances from outside Indiathrough normal banking channels.

Out of the local rupee resources in NRE/NRO/FCNR of the borrower

Through sales proceeds of shares or securities or immovable property against which such loan was granted

.

Home Loan Saraswat

Bank

Vastu

Siddhi

Home

Loan

Apply for the Home Loan by submitting the documents at any of our branches. Enjoy the added benefits of hassle free centralized processing, quick turnaround time, attractive take over options and repayment schedule with no

hidden

costs.

We provide housing loan to a non-resident Indian or a person of Indian origin resident outside India, for acquisition of a residential accommodation in India, subject to the following conditions, namely:

The quantum of loans, margin money and the period of repayment shall be at par with those applicable to housing finance provided to a person resident in India.

The loan shall be fully secured by equitable mortgage of the property proposed to be acquired, and if necessary, also by lien on the borrower’s other assets in India.

The installment of loan, interest and other charges, if any, shall be paid by the borrower by remittance from outside Indian through normal banking channels or out of funds in his NRE/FCNR/NRO in India or out of rental income derived from renting out property acquired by utilization of the loan.

The rate of interest on the loan shall conform to the directives issued by the Reserve Bank of India.

Repayment

Repayment shall be made by fresh inward remittances from outside Indian through normal banking channels.

Out of the local rupee resources in NRE/NRO/FCNR of the borrower.

In case of Housing Loan, the close relatives (as defined under Section 6 of the Companies Act 1956) of the borrower in India are allowed to repay the installment of such loans, interest and other charges, if any, through their bank directly to the borrower’s loan with the Bank

.

Sr Currency . N o.

Overseas (Nostro)

Name & Address of the Correspondent

1

US Dollars

Wells Farg Plaza, 4th New York, N.Y.-10001, CHIPS ABA No: FED ABA No: 026005092

Floor, U.S.A. 0509

2

US Dollars

Standard Chartered One Medison Avenue,New NY10010-3603, U.S.A.

Bank York,

3

US Dollars

Bank of 277, Park Avenue, NY10172-0083,U.S.A.

India York,

4

GB.Pounds

New

National Westminster Bank PLC Leval 5, Premier Place ,21/2, Devonshire Square, London EC2M 4BA, U.K.

SORT CODE: 600004 5

Japanese Yen

Wells Fargo Bank NA Yamato International NihonbashiBldg., 8 th Floor,2-13,Nihonbashi Horidomecho,Chuo-Ku, Tokyo-103-0012,JAPAN

6

Swiss Francs

Banque Cantonale Vaudoise Siege Central, Case Postale 300, 1001, Lausanne,SWITZERLAND.

7

Australian Dollars

ANZ 351, Collins P.O.Box No: Melbourne, AUSTRALIABSB: 014-909

8

Canadian Dollar

National Bank of Canada 600,Rue De La Gauchetiere Quest 5th floor, Montreal, QUEBEC,CANADA

9

Euro

Standard Chartered Bank () GMBH Franklinstrasse 46-48,60486, Frankfurt / Main,.

10 Euro

Wells Fargo Bank 1 PLANTATION 30 Fenchurch London,EC 3M UK.

Bank Street, 537-E,

NA PLACE Street 3BD

11 Hong Kong Dollars Bank of 2/FL, Ruttonji 11 Duddell Central, Hong Kong.

India, Centre, Street,

12 Singapore Dollars

India Road, #03-01, Bldg.,

Bank of 138 Robinson #01-01,#02-01, The Corporate Office Singapore-068906

REMITTANCE Travel Related Foreign Exchange Remittance facility available to residents at any of our Forex Centres:

1) Business promotion / visit/ International Upto USD.25,000/- or its equivalent per trip Conferences/ Seminars/ Specialized for visit to any country other than Nepal and training/Study Tour. Bhutan.

2) Private Visit / tour

Upto USD.10,000/- or its equivalent in one financial year for one or more visits to any country except Nepal and Bhutan

3) Employment abroad

Not exceeding USD.100,000/- or its equivalent thereof.

4) Emigration

Not exceeding USD.100,000./- or its equivalent amount prescribed by the country of emigration.

5) Higher Education

Upto the estimate given by an Institution abroad or USD.100,000/- per academic year whichever is higher.

6) Medical abroad

Treatment/Hospitalisation Upto USD.100,000/- or its equivalent.

7) Maintenance expenses of a patient going USD.25,000/- each for the patient and abroad for treatment/check-up and for accompanying attendant. Attendant. 8) Remittances under Remittance Scheme ( LRS)

Liberalised For Resident Individuals upto USD 75,000 per financial year. This is in addition to those already available for private travel, business travel and medical treatment.

MONEY TRANSFER SERVICE MoneyGram

Saraswat Bank has tied up with MoneyGram for Inbound Global Remittances through Thomas Cook (India) Ltd who is principal agent of M/s MoneyGram International Inc.USA. We have launched MoneyGram product for inbound Global remittances at our 191 branches.

It is a person to person money transfer technology which enables a person to send money through any of Network agents of MoneyGram International.

Quick, safe and cheap mode of send money to India. Beneficiary gets payment in India on real time basis.

The remittance scheme conforms to the rules & regulation framed by Reserve Bank of India under Money Transfer Service Scheme (MTSS)

Maximum amount of remittance that receiver can receive in a single transaction will not exceed USD2500 or its equivalent in Indian rupees. Payment in cash to receiver will be made up to and inclusive of Rs.50,000/(Rs. Fifty thousand Only).

Any single beneficiary can receive 30 transactions in a calendar year.

The remitter, who is outside India goes to any of the agents of MoneyGram, fills in the remittance form and tenders the equivalent foreign exchange inclusive of charges to such agent. After processing application through Anti-Money Laundering Guidelines, remitter informs the receiver in India about remittance details, i.e. 8 digit unique reference number.

Our bank verifies payment details submitted by the beneficiary in Receive Form along with the transaction 8 digit unique reference number along with valid photo identification and address proof.

As soon as the beneficiary collects payment from our Bank, the remitter get SMS about the completion of transaction.

Non-permissible Transactions under Money Transfer Service Scheme as per RBI stipulations.

Trade related remittances (export payment, payment of services, etc.)

Remittances towards purchase of property, investments;

Remittance for credit to NRE/FCNR s and

Remittance as donations, contributions to charitable organizations.

Benefits This service is a boon to families of NRI’s as well as foreign students and foreign tourist visiting India. Overseas workers

who

need

to

provide

Receive money as cash in minutes.

No Bank required.

No back-end charges.

financial

to

their

families

in

India.

Xpress Money

Saraswat Bank has entered into a strategic tie-up with UAE Exchange and Financial Services Ltd for facilitating Global Money Transfer Service, Xpress Money, UAE Exchange and Financial Services Ltd is the principal agent for UAE Exchange Centre LLC, Abu Dhabi, for facilitating Xpress Money services in India. We have launched the Xpress Money product at our 191 branches.

It is a person to person money transfer technology which enables a person to send money through any of Network agents of UAEFSL.

Quick, safe and cheap mode of send money to India. Beneficiary get payment in India on real time basis.

The remittance scheme conforms to the rules & regulation framed by Reserve Bank of India under Money Transfer Service Scheme (MTSS)

Maximum amount of remittance that receiver can receive in a single transaction will not exceed USD2500 or its equivalent in Indian rupees. Payment in cash to receiver will be made up to and inclusive of Rs.50,000/(Rs. Fifty thousand Only).

Any single beneficiary can receive 30 transactions in a calendar year. Remitter fills up the Xpress Money form in an Xpress Money outlet abroad and pays the principal amount and charges. Details are entered in the system, a receipt is given to the remitter with a unique 10 digit XPIN, Sender informs beneficiary the XPIN, and the amount remitted.

Beneficiary visits the Receive Agent, fills up the Receive Form with details of XPIN and produces a valid photo identity and address proof. The location confirms the transaction, Beneficiary Receives Cash.

As soon as the beneficiary collects payment from our Bank, the remitter get SMS about the completion of transaction.

Non-permissible Transactions under Money Transfer Service Scheme as per RBI stipulations.

Trade related remittances (export payment, payment of services, etc.)

Remittances towards purchase of property, investments;

Remittance for credit to NRE/FCNR s and

Remittance as donations, contributions to charitable organizations.

Benefits This service is a boon to families of NRI’s as well as foreign students and foreign tourist visiting India. Overseas workers who need to provide financial to their families in India.

Receive money as cash in minutes.

No Bank required.

No back-end charges.

CORPORATE Mid Corporate Products

Bank provides variety of credit facilities to its Corporate Clients as under:

Working Capital Corporate Loan Term Loan Export financing - Pre and Post shipment Import Finance Bank Guarantee Bill discounting Letters of Credit (Inland & Foreign

Property Loan Rental Loans

Micro Finance - Self Help Groups

Since inception the cause of the Small Man lay at the core of Bank’s heart. Bank has grown manifold but basic values have remained the same. Saraswat Bank has therefore launched a scheme for self help groups so as to help them raise the income levels and improve living standards of their . The Bank aims at teaching the of these groups to save and to borrow responsibly. The Bank caters to the self help groups who are involved in following activities 1. Selling fruits, vegetables, milk, fish, etc. 2. Making of brooms, basket weavers, and other bamboo products, etc. 3. Any other activities viz. plumbing, hairdressing, electrician including flowers/vegetable growers, spices and papad making etc. Eligibility

Minimum- 10 ; Maximum -20 Operative Savings A/C for minimum 6 months.

Quantum of Finance

Upto 4 times the amount in savings Maximum 2 lacs per group

Interest Rate

PLR-1%

Security

Guarantee of Group and Third party guarantee on case to case basis.

Repayment period

Not more than 60 months

Processing Fees

Reasonable

Shareholding

Nominal hip

For further details you may Fhone No.- 022 - 24671238-40 / 28725019

our

micro-finance

Or

dept

Small & Medium Enterprises (SMEs)

. For a business on the growth phase with a wide range of opportunities to explore, timely availability of credit is essential to scale new heights. At Saraswat Bank we see ourselves as partners to Clients business

enabling them tofocusontheirbusinessneeds. Bank shall try to dispose of your application for a credit limit or enchancement in existing credit limit up to Rs 5 lakhs within two weeks ,and for credit limit above Rs 5 lakhs and upto Rs 25 lakhs within four weeks, and for credit limit above Rs 25 lakhs within 8 weeks from the date of receipt provided your application is complete in all respects and is accompanied by documents as per check list provided.

Working Capital Import Finance Term Loan Export Finance Bank Guarantees Bill Discounting Letter of Credit (Inland & Foreign) Property Loan Rental Loans

Traders

Our Bank provides credit facilities to Retail Traders in the form of

Working Capital Property Loan Working Capital

We are a Bank with a team of technically qualified competent customer driven relationship managers possessing wide industry experience in various segments Our Bank has taken lot of efforts to understand customers & empathizing with their needs. We can offer you working capital finance by way of cash credit or loans suitably structured to your need and risk profile in consortium or as a lead banker. Our working capital solutions are based on financial , quantitative & qualitative evaluation of your business through our technically qualified experts.

Eligibility

:

Salaried employees with minimum net salary of Rs. 10000 pm (Income of spouse may be added) Professionals, self - employed and others who are income tax assessee having net annual taxable income of Rs. 150000/- for atleast 3 years continuously. Firms / companies having net annual taxable income of Rs. 1.50 Lakhs per annum and in operation for last 3 years making cash profit for last 3 years. Limit Minimum Maximum - Rs. 50 Lakhs

of -

Rs.2

Loan lakhs

Basis of Advance a) 25 times of net salary in case of salaried person Or b) 3 times of net cash accruals.(Net of tax and drawing plus depreciation) Or c) 60% of agreement cost (If the property is less than 3 years old.). In other cases, 60% of value as per valuation report. a,b,c Whichever is lower Rate of Interest :The proposal shall be rated as per the credit rating model followed by the Bank and a good rating can get you a better interest rate. The interest rates are linked to our PLR. PLR is presently 13%. Repayment Period Term Loan Maximum 5 years Cash Credit - with reducing limit (in 60 monthly installment) subject to renewal every year. Security Equitable Mortgage of Residential, commercial or industrial property. Guarantor: Need not be obtained however in case of firms, companies, guarantee of partners, directors to be obtained. Share Holding 2.5% of the loan amount, Maximum 2500 shares, Guarantors as nominal . Processing 1% of loan amount

Charges

Documents Required Others: 1) I.T.Returns for last three years, salary slip for last 3 months. 2) For salaried employees income proof such as Form No.16 along with salary certificate from employer 3) Original Title Deeds of the property offered for mortgage. 4) Other documents as per Vastu Siddhi Loan Scheme EXISTING PLR ON ADVANCES Interest Rate on Advances Trade Finance

Saraswat Bank has emerged as a leading co-operative bank in providing trade finance services. The Bank is Authorised Dealer in Foreign Exchange since 1979. Our bank provides a gamut of products for both exporters and importers.

The International Banking Division plays an active role in forex operations through its ten Forex Centres.

Correspondent Banking relations with 430 centres of various banks spread over 65 countries.

Maintaining

foreign

currency

s

in

nine

major

currencie

Export

Credit

We assist exporters to compete in the International Markets by extending fund based/non fund based credit facilities. We offer credit facility to exporters by way of, 1.

Pre-shipment credit finances:- working capital advance granted to exporters to facilitate execution of export order

Pre shipment credit finance is disbursed in Indian Rupees/Foreign currency.

We offer competitive rate of interest to enable exporters to compete in International Markets.

2.

Post shipment finances:-

Offered by way of timely negotiation of export documents drawn under letter of credit to enable exporters to get finance faster.

Purchase/discount of export bills.

Post shipment advance is disbursed in Indian Rupees/Foreign Currency.

Advising of Letters of credit

Export letters of credit received by Saraswat Bank in your favour are advised to you promptly.

You may instruct your overseas buyer to utilize our services for faster advising of export letters of credit to you.

We also ensure prompt advising of the amendments to the export letters of credit. Export bills on collection basis

Saraswat Bank handles the export bills on collection basis with accuracy and speed.

Documents are dispatched for collection within 24 hours.

Handling of export bills are subject to UDC/URC as the case may be and FEMA provisions and FEDAI rules.

s of the world.

Well equipped Treasury Department.

Member of SWIFT network for speedy, accurate and safe Funds Transfer.

:

Import Letter of Credit

Opening of Import Letter of Credit in major permitted currencies, in favour of overseas suppliers across the globe.

Letters of credit are advised through major International Banks.

Arrangements are also in place to add confirmation of advising Banks to the letters of credit on your or supplier’s request.

For faster advising of letter of credit we have the facility of SWIFT.

Import Bill Received for Collection

We handle import bills received on collection basis sent by your Overseas Suppliers through a Bank, on the basis of documents against payment or on acceptance.

Buyers

Credit

Saraswat Bank makes arrangement for Short Term Buyer’s Credit for Import Trade transaction.

International GuaranteesWe have arrangement for issuance of International Guarantees subject to prevailing RBI regulations.

Execution of overseas projects.

Securing External commercial borrowings.

Advance payment guarantees on of exporters of goods and services.

SERVICES VISA Debit Card

To add to your convenience, your Bank has tied up with VISA for issuing Debit Card. VISA has a long-standing name in the banking industry in India as well as abroad. Visa is a reliable, international brand. Debit Card is basically a convenience card which can be used at a POS for making purchases at Merchant Establishments. This card can also be used as an ATM card for withdrawing cash at all the ATMs bearing VISA logo in India and aboard. Debit Cards This card can be used as an ATM card for withdrawing cash at the following ATMs: 1. Saraswat Bank ATMs 2. NFS ATMs (shared network) 3. Visa enabled ATMs Debit Card looks similar to a credit card, bearing a Visa logo, and can be used wherever Visa logo is displayed. Debit card can be used at Domestic as well as International ATMs, POS machines bearing the Visa logo at merchant establishment and for Purchases/Ticket Booking through Internet that use a secured e-Commerce Payment Gateway. To for Verified by Visa (VbV) click here Debit card can be used upto the balance available in the of cardholder. The maximum amount for transaction (Point of Sale + Online + ATM) is maintained at Rs 25000/- per day. e.g. 1. ATM Cash withdrawal Rs 10,000/- + POS transaction Rs 10,000/- + Online transaction Rs 5,000/2. ATM Cash withdrawal Rs 25,000/- + Nil POS transaction + Nil Online transaction 3. Nil ATM Cash withdrawal + POS transaction Rs 10,000/- + Online transaction Rs

15,000/4. Funds Transfer in linked s on our Bank's ATMs ONLY. Benefits to You: 1. Facilitates electronic transactions and saves the customer from carrying cash or withdrawing cash. 2. Provides access to merchant establishments, eCommerce transactions and ATM access. 3. Offers the customers safety and security. 4. Extensive usage across a number of establishments as VISA is widely recognised in all leading departmental stores, eCommerce sites and retail outlets all over the world. 5. Helps customer stay in control as it tracks their expenses. 6. In case of international traveler, it can save the customer from having to stock up on traveller's cheques or cash when he/she travels. 7. Debit cards may be more readily accepted than cheques, especially in other states or countries as one need not the authenticity of the payment and the merchant is assured of immediate payment. Registration For registration you may your nearest branch .The form for Registration can be ed from the "forms" section in the website. Charges : CHARGES HEAD

CHARGE

Annual Fee

1st Year free From 2nd Year -Rs 99/- p.a. plus taxes

Additional Card

Rs 99/- per card plus taxes.

Replacement Of a Damaged NO CHARGE Debit Card Replacement Of A Lost Rs 99/- per card plus taxes. Debit Card Pin Replacement

Rs 25/-

SARASWAT BANK ATMs FREE Cash Withdrawal / Balance Enquiry ATM for Free for the first five* transactions in a calendar month. From 6th transaction onwards cash withdrawal will be charged at Cash Withdrawal/Balance Rs 20/- per transaction(inclusive of service tax) & balance enquiry will be charged at Rs Enquiry Other banks Savings A/c ,

10/- per transaction(inclusive of service tax)

*Includes both financial (cash withdrawal) & non-financial (balance enquiry) transactions. Other banks ATM for a) Cash Withdrawal- Charges of Rs 20/Current A/c holders and (inclusive of tax) per cash withdrawal for every transaction Overdraft A/c holders b) Balance Enquiry- Free ATM Cash Withdrawal Rs 120/- per transaction. (Outside India) ATM Balance (Outside India)

Enquiry Rs 15/- per enquiry.

Sales Slip Retrieval / Charge Rs 225/Back Processing Fee Combined per day limit for Rs 25,000/ATM Cash Withdrawal / POS Transaction / Online Transaction For usage at Merchant No charges Establishments (POS) For Internet Payments

No charges

For usage at Petrol Pumps

Surcharge @ 2.50% of transaction amount or Rs 10/- (whichever is higher)

For usage at Railway Surcharge @ 2.50% of transaction amount Stations or booking train or Rs 10/- (whichever is higher) tickets through Internet Service Charges For 2.50% of the transaction amount. International Transactions Maximum withdrawal from Other Bank ATM is Rs 10000/- per transaction with an overall limit of Rs 25000/- per day.

SMS Banking

SMS Banking brings the Banking at your fingertips. Bank has introduced the SMS Banking Facility for its customers. Under SMS Banking following facilities are offered to the customers.

Welcome message on New Opening

Latest Balance in the Details of the last 3 transaction in the . Transaction Alert for all transactions through ATM/POS/E-Commerce and Netbanking and other transactions above Rs 5000/Alert for Sweep In Sweep Out facility (Sweep In Sweep Out facility available for Elite s only) Alert for dispatch of Chequebook/Visa Debit Card Kindly note following points before sending an SMS:

All the below-mentioned SMS requests should be sent through theed mobile number only. The keywords are case-sensitive. Please do NOT type the pointed or square brackets in your SMS. There should be a single space between each word in the syntax. You have to type the product (e.g. SBPUB) and the number (e.g.12345) in the keyword. The keywords and their syntax for SMS Requests are given below: Mobile Banking Number - 9223810000 Request

SMS Message

Information

Balance Enquiry

SBAL Gives you the balance for the specified Example: SBAL number. The number is optional. If no SBPUB 10 SBAL number is specified, you will get the balance in your CAPUB 12 primary .

LST3 Gives you the last three transactions in the specified Last 3 Example: LST3 . The number is optional. If no transactions SBPUB 10 LST3 number is specified, then returns last three transactions CAPUB 12 in your primary . Customer has to submit his request for SMS Banking at home branch in format specified which is available under forms section.

Easy Pay

Here is one more exciting facility your Bank has offered to relieve you, our esteemed client, from spending your valuable time standing in a queue for routine utility bill payments. All you have to do is to walk into any of our branch and yourself under : Easy Pay" scheme for all your recurring utility bill payments such as Telephone, Electricity Bills, Cellular Phone Bills, Insurance & many more. Once you are ed all your future bills will be paid automatically through your bank with us. So do visit the nearest branch for few formalities & say "Good Bye" to all the hassles of making routine utility bill payments. You can the form and submit it to nearby branch.

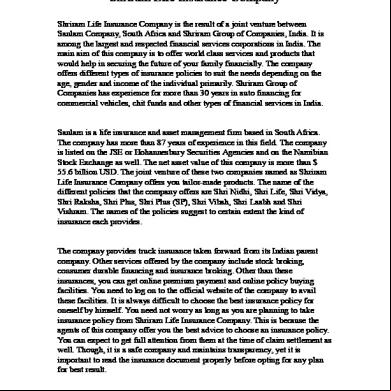

Insurance

It is our earnest endeavour to offer suites of new and competitive financial products and services.We have for this purpose tied up with various insurance companies. The details of tie-up and products offered are given below: LIFE INSURANCE We are the Corporate Agents for the distribution of Life Insurance products, of M/S HDFC Standard Life Insurance Co Ltd. Under this tie up arrangement, we offer following life insurance products: Protection Plans Protection Plans help to shield your family from uncertainties in life due to financial losses in of loss of income that may dawn upon them incase of your untimely demise or critical illness. Protection Plans go a long way in ensuring your family’s financial independence in the event of your unfortunate demise or critical illness. They are all the more important if you are the chief wage earner in your family. No matter how much you have saved or invested over the years, sudden eventualities, such as death or critical illness, always tend to affect your family financially apart from the huge emotional loss. Children’s Plan Children’s Plans help to save,so that you can fulfill your child’s dreams and aspirations. These plans go a long way in securing your child’s future by financing the key milestones in their lives even if you are no longer around to oversee them. Children’s Plans help you save steadily over the long term so that you can secure your child’s future needs, be it higher education, marriage or anything else. A small sum invested by you regularly can help you build a decent corpus over a period of time and go a long way in providing your child a secured financial future alongwith . Retirement Plans Retirement Plans provide you with financial security so that when your professional income starts to ebb, you can still live with pride without compromising on your living standards. By providing you a tool to accumulate and invest your savings, these plans give you a lump sum on retirement, which is then used to get regular income through an annuity plan. Given the high cost of living and rising inflation, employer pensions alone are not sufficient. Pension planning has therefore become critical in today's world. Savings and Investment Plans You have always given your family the very best. And there is no reason why they shouldn’t get the very best in the future too. As a judicious family man, your priority is to secure the well-being of those who depend on you. Not just for today, but also in the long term. More importantly, you have to ensure that your family’s future expenses are taken care, even if something unfortunate were to happen to you. Our Savings & Investment Plans provide you the assurance of lump sum funds for your and your family’s future expenses. While providing an excellent savings tool for your short term and long term financial goals, these plans also assure your family a certain sum by way of an insurance . Health Plans Health plans give you the financial security to meet health related contingencies. Due to changing lifestyles, health issues have acquired completely new dimensions becoming more complex in nature. It becomes imperative then to have a health plan in place, which will ensure that no matter how critical your illness is, it does not impact your financial

independence. Above products are available through all our branches with expert personalised advice. For more information, please visit our nearest branch or our Customer Service Centre on Toll Free Number 1800229999 Please note that Bank is entitled for Commision for marketing the above products of M/S HDFC Standard Life Insurance Co. Ltd. The details of the commission structure are available at our Branches for the information of our customers.

Other Bank (NFS) Network

Bank has ed National Financial Switch (NFS) on 15th October 2010 for providing ATM access to our customers across India. NFS is the network which facilitates routing of ATM transaction through inter connectivity between banks’ switches thereby enabling customers to utilize any ATM of a connected bank. Under this arrangement wide network of ATMs of Nationalised, Foreign, Private and Co-operative Banks are available to our customers using our Bank’s cards, i.e. our ATM card as well as the VISA debit card. GOMO

Mobile Banking - GoMo

"Go-Mo" is a comprehensive Mobile Banking platform that will enable customers to manage their own s with incredible ease from wherever they have mobile connectivity. The product will give customers greater ease of use and a higher degree of convenience through an intuitive and design rich interface. The fund transfer facility offered through mobile banking is provided through the NFS Switch of the National Payments Corporation of India (NPCI). This fund transfer facility comes under Immediate Payment Service (IMPS) of NPCI. IMPS facilitates customers to use mobile instruments as a channel for accessing their bank s and navigate interbank fund transfers in a secured manner with immediate confirmation features. It offers an instant, 24X7, interbank electronic fund transfer service through mobile phones.

"Go-Mo" – Mobile Banking Facility of Saraswat Bank lets you check the balance, view last five transactions, transfer funds within or outside Saraswat Bank, Merchant Payments, request Cheque Book, initiate Stop Payment instructions, Hotlist Card and more. To use the "Go-Mo" facility, you just need your Customer Id, and Transaction . The

customer

can

transact

upto

Rupees

Fifty

Thousand

only

per

day.

The Bank has taken special efforts to ensure the safety of customers' s by implementing two factor authentication for transactions above Rupees Five Thousand as per RBI guidelines. Go-Mo facility will be offered free of cost to our customers. Features of Go-Mo: 1. Check balances of your savings and current s 2. View last five transactions 3. Request for Cheque Book 4. Statement on email id ed with the Bank 5. Stop Payment of Cheque 6. Hotlisting of Card in case of loss of card to avoid misuse 7. Transfer funds upto Rupees Fifty Thousand per day, 24x7x365 days within your linked s or to a third party within the bank or Interbank using IMPS 8. Make payments without need to a beneficiary 9. Merchants Payments facility like Utility Bill Payment, Mobile/DTH Recharge, Credit Card Bills, etc. Click here to know the details of Merchant MMID and Merchant Mobile number for making Merchant Payments. Steps for availing Go-Mo facility: 1. Customer has to submit the application form at his branch and himself for Mobile Banking facility. Click here to the application form. 2. On successful registration, customer will receive a SMS containing Customer Id and a link to the Go-Mo application. Customer can also the application using the linkhttps://gomo.saraswatbank.co.in/saraswat/dl.do After registration, the Branch will provide the customer a Welcome Kit containing Welcome Letter and an informative and attractive Instruction Booklet and separate envelope containing Pin and Transaction , using which he can avail the mobile banking facility.

SHAREHOLDER’S Loan Schemes

Schemes for Shareholders Saraswat Bank provides various benefits to the shareholders under Welfare Scheme of the Bank. General Eligibility Norms :

Shareholding period , minimum 5 years. Minimum shareholding of 50 shares. In case of t shareholding , benefits are given to the Member whose name appears 1st Saraswat Bank's employees are not eligible for the Scheme. ing year is from January to December i.e. Calendar Year. Interest Free Loan Scheme : Bank has introduced this loan scheme for welfare of it's shareholders. In case of major ailments of the member or depending member of his/her family, an interest free loan upto Rs.25000/- will be provided repayable within period of 5 years against two personal sureties acceptable to the bank. The member will have to produce a certificate from his/her doctor/surgeon indicating the nature of ailment and the expenditure likely to be incurred for the treatment/operation. Payment will be made by the bank directly to the concern doctor , hospital. Reimbursement of repayment of debts incurred for such ailment will be at the discretion of the bank. Member desiring to avail of this facility may approach to any branch of the bank convenient to him/her for necessary sanction.

SCHEME FOR FINANCIAL ASSISTANCE TO THE OF THE BANK BY WAY OF REIMBURSEMENT OF MEDICAL EXPENSES. General Eligibility :

A member should be Shareholder of the Bank for a minimum period of five years and should have minimum shareholding of fifty shares. In case of t shareholding, benefits will be given to the member whose name appears first. who are Saraswat Bank's employees are not eligible for the Scheme. ing year is from January to December i.e. Calendar Year. A. MEDICAL CHECK-UP: Expenses on general medical check-up i.e. complete medical check-up made at any reputed private or charitable trust hospital, will be reimbursed subject to a maximum amount of Rs.500/- once during the calendar year. Prescribed application forms for reimbursement of expenses for medical check-up should be submitted along with the original receipt. The receipt should be for complete medical check-up. The scheme is open for the member himself/herself and also for the spouse above the age of 60 yrs. B. REIMBURSEMENT OF MEDICAL EXPENSES : Eligible of the bank will be reimbursed medical expenses upto a maximum of Rs.5,000/- incurred by him/her once during a calendar year for self or his /her spouse or

handicapped children as under :

Expenses up to 50 percent of the original bill/s shall be considered. 50 percent of the difference between the amount claimed and amount settled by the member's employer or from the employer of his/her close relative and the amount settled by the employer of his/her close relative. The maximum amount reimbursable under above (a) or (b) is Rs.5,000/- for the entire calendar year. Illnesses Covered : Cancer, Tuberculosis, Paralysis, Cardiac ailments, Dental Disease, Brain Tumour, Major accident, surgical treatment (like Cataract Operations, etc.) and chronic illness. Charges for spectacles/lenses/Dentures are also included. Reimbursement will not be available for maternity and/or allied operations and ailments. C. SPECIAL MEDICAL ASSISTANCE SCHEME FOR MAJOR CRITICAL ILLNESS The scheme is open for the member above the age of 70 yrs. Eligible of the Bank will be reimbursed medical expenses incurred for self, subject to a maximum of Rs.20,000/once in a life time, on of hospitalization and/or surgical intervention for major specified illnesses given below: Angioplasty, By Surgery, Cancer, Kidney ailments, Neuro Surgery, Paralysis and Major accident. and Conditions:

Expenses up to 50 percent of the original bill/s are considered. 50 percent of the difference between the amount claimed and amount settled by the employer of the member's close relative or insurance company. The maximum amount reimbursable under above (a) or (b) is Rs.20,000/- once in a life time. Member claiming reimbursement for illnesses covered under this scheme shall not be eligible to claim reimbursement for the same illness covered under the Medical Assistance Scheme given under Clause B above, in the same calendar year. OTHER CONDITIONS: A member who gets reimbursement of medical expenses from his/her employer or the employer of his/her close relative is also eligible. Reimbursement of medical expenses will also be available to a person who has been itted to the hip of the bank on transmission of share provided the total duration for which the shares are held by the transmitter and the person becoming a member on transmission is five years or more. The word transmission means inheritance from member by son / daughter or spouse on the death of original shareholder and does not mean transfer from one member to another for the purpose of eligibility under the scheme. A shareholder whose gross income should not exceed Rs.10,000/- p.m. is eligible for assistance under the scheme and should submit the income proof. (Slary slip/ Certificate / latest I.T. Return).

EXPENSES COVERED:

Hospital charges Diagnostic test charges like Pathological tests, E.C.G. etc Medicines, drugs, injections, dressing material, for the illness Surgeon's fees , Anesthetist's fees Blood transfusion and dialysis charges Operation Theatre charges Physicians and /or Consulting Doctor's fees Ambulance charges Any other charges approved by the Board of Directors.

If a member dies, the reimbursement will be available to his/her spouse or to his/her son/daughter who pays the hospital bills of the deceased member, subject to the ceiling stipulated. PROCEDURE FOR SUBMISSION OF APPLICATION FOR REIMBURSEMENT: A member who desires to avail of the benefit under the scheme will have to submit a prescribed application along with the income declaration/ proof, original bill/s from the hospital/medical shops/doctor and doctor's prescription with certificate regarding sickness. The prescribed application may be directly submitted to the Share Department of the Bank at: Madhushree, Navi Tel

sector 17, Plot Mumbai :

No.85,

District -

business 400

Centre,

Vashi, 703. 24671110/24671101.

Claim for reimbursement of medical expenses incurred for current calendar year be submitted once in the same year or latest by 15th March of the next year at the Share Department. A member who gets reimbursement from his/her employer or from the employer of his/her close relative will have to submit a declaration from his/her employer or employer of his/her close relative who has reimbursed a part of medical expenses. If he/she taken medical insurance policy he/she will not be eligible for the financial assistance under the medical schemes. However, if he/she has taken medical insurance policy, reimbursement may be given in case the expenses are not covered by the insurance company subject to his/her declaration that the present claim for reimbursement of original medical bills submitted to bank is not covered by the insurance company. GENERAL:

The Board decision to sanction, reject an application or to sanction only a part of expenses shall be final. Granting of Medical Assistance will be strictly subject to the availability of funds from the Welfare Fund in the calendar year. The Board shall have the discretion to consider on merit any deserving cases and to sanction appropriate/ higher relief, as the Board may consider and deem fit..

Board shall have the absolute discretion at any time or from time to time to add, to amend, to modify or to delete any of the schemes given herein

Miscellaneous Services

Saraswat Bank provides information of it's various Miscellaneous Services customers can avail of with the bank.

Functionalities offered on Internet Banking: 1. 2. 3. 4. 5. 6. 7. 8.

View Linked s Details Statement of s Mini Statements Status of Cheque issued View Loan details Activity Log Report - Check activities carried out at the end of the session Cheque book request Fund Transfer in own – Customer can transfer funds between their linked s. 9. Intra Bank Funds Transfer – Customer can transfer funds to any other customer of Saraswat Bank 10. Inter Bank Funds Transfer (RTGS/NEFT) – Customer is able to transfer funds from one bank to another. 11. 26 AS – View the position of the tax paid during the year as well as for previous year.

Fund transfer through RTGS NEFT for Internet Banking s

Online NEFT/RTGS Registration

'Internet Banking Registration Forms' from ' forms' option given on our bank's site. Fill up the application form, giving the NEFT/RTGS limit required and submit it in your home branch. On registration by the branch, you will receive name, PIN and transaction PIN. In case of existing net banking customer applying for fund transfer facility, Transaction PIN will be sent seperately. RTGS/NEFT Global Limits Savings customer

Savings customers can opt for online NEFT limit within the global limit range of

Rs 1/- to Rs 3.00/- lakhs Online RTGS facility is not available to Savings customers. Savings customer wishing to transfer money through RTGS will have to give his request across the counter as per present practice. Current customer

Current customers can opt for online NEFT/RTGS limit within the global limit range of Rs 1/- to Rs 20.00/- lakhs Combination of NEFT and RTGS limit should not cross Rs 20.00 lakhs. holders already using this feature for lower limits can request to increase their Online NEFT/RTGS limit. 'On-line NEFT/RTGS request Form Timings of NEFT/RTGS

Monday to Friday - RTGS request received from 9.00 a. m to 3.45 p.m. and NEFT request received from 9.00 a. m. to 6.00 p.m. will be executed. Saturday - RTGS request received from 9.00 a. m. to 1.15 p.m. and NEFT request received from 9.00 a. m. to 12.15 p. m. will be executed. System will not accept RTGS/NEFT requests received after cut off time. Steps to 'Online Banking' & 'NEFT/RTGS' transaction Customer would receive name and and Transaction Pin through courier/speed post. Steps for 'Online Banking'

Click on Internet Explorer In address field type 'http://www.saraswatbank.com' to log on to Saraswat bank site. Click on 'Internet Banking' to logon 'Online Banking' Click on 'Online Banking' and in next screen enter your 'name Name' and '' and click on submit button. In case you are using Net Banking facility first time then system will force to change PIN. Even for new Transaction pin, system will force to change the Transaction PIN. Change - pin.

Enter your pin in the field 'Old pin' field. Enter 'New pin' consisting of minimum 8 characters to maximum 16 characters with 1 special characters (like @, %, # etc) in field 'New pin'. While setting the characters should not be repetitive. Confirm Pin in third field Click on 'I agree'. Then the system will logoff automatically.

To again click on 'Online Banking' and in next screen enter your ' name' and newly set . Change - Transaction pin.

To set the new transaction click on 'Change ' In the change field, enter your transaction received in the field 'Old ' Enter your New transaction pin consisting of 8 to 16 characters with 1 special character (like @,%,# etc) in field 'New '. While setting the characters should not be repetitive Please note that the Transaction pin should not be same as pin. Enter same Transaction again in field 'Confirm '. Click on 'Change Transaction ' box. Press OK You will get message "Transaction changed successfully ". has to Re- with 'name' and with 'New '. On , system will display all linked s as well as options available to net banking customer including NEFT/RTGS option. Steps to NEFT/RTGS

Click on 'NEFT/RTGS' option and will get four options namely 'Add New Payee', 'Confirm New Payee', 'Delete Payee' and 'Help' options. Below that system will display Debit and NEFT/RTGS fields. Before doing NEFT/RTGS transaction, should know beneficiary number, IFSC code of beneficiary's bank, name, address and mobile number. To locate IFSC code of beneficiary's bank, click on NEFT/RTGS given in point 1.8 under 'Help'. Then it will link to RBI site and will show name of the banks. Clicking on the required bank, will show the list of branches with IFSC code. Steps for NEFT/RTGS transaction Add New Payee

will have to beneficiary first i.e. to whom he wishes to transfer the money. will click on 'Add New Payee' option to the beneficiary. will enter Payee Name, number, IFSC code in 'Add New Payee' option and will click on 'OK'. Security code will be generated for newly ed payee and will be sent by SMS to on the mobile number ed to your primary . Customer will enter this security code in PRN field and click on submit. Confirm New Payee

After adding new payee will go to 'Confirm new Payee' option.