Sm 3-internal Analysis 3b2x3m

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3i3n4

Overview 26281t

& View Sm 3-internal Analysis as PDF for free.

More details 6y5l6z

- Words: 1,239

- Pages: 27

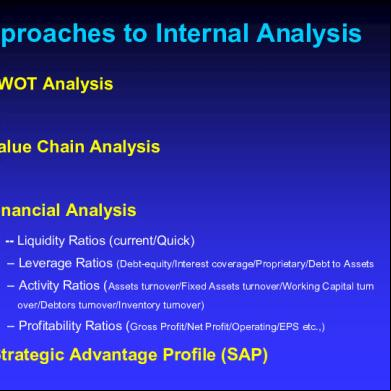

Approaches to Internal Analysis 1. SWOT Analysis

2. Value Chain Analysis

3. Financial Analysis -- Liquidity Ratios (current/Quick) -- Leverage Ratios (Debt-equity/Interest coverage/Proprietary/Debt to Assets -- Activity Ratios (Assets turnover/Fixed Assets turnover/Working Capital turn over/Debtors turnover/Inventory turnover)

-- Profitability Ratios (Gross Profit/Net Profit/Operating/EPS etc.,)

4. Strategic Advantage Profile (SAP)

Strategic Advantage Profile (SAP) • SAP tries to find out Organizational Strengths and weaknesses in relation to the CRITICAL SUCCESS FACTORS within a particular industry •CRITICAL SUCCESS FACTORS are small but extremely important factors that are essential for successfully gaining and maintaining Competitive Advantage •CRITICAL SUCCESS FACTORS have significant bearing on the overall growth of a firm within an industry. The four major sources of CRITICAL SUCCESS FACTORS : --- Industry Characteristics --- Competitive Position --- General Environment --- Organizational Development

Strategic Advantage Profile (SAP)

Matching the Strengths and Weaknesses • After the analyses of External and Internal Environments, the analysts must try to find the FIT between Corporate internal strengths and external opportunities . One of the means useful in doing this is ETOP.

ETOP ETOP is the acronym for environmental threat and opportunity profile .It is nothing but a summarized picture of the environmental factors and their likely impact on the organization

The preparation of ETOP helps a firm to identify the segments in a chosen field of activity, presenting excellent growth opportunities

ETOP

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Inbound Logistics

Activities

Primary Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Operations

Inbound Logistics

Activities

Primary Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Outbound Logistics

Operations

Inbound Logistics

Activities

Primary Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Primary Activities

Marketing & Sales

Outbound Logistics

Operations

Inbound Logistics

Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Primary Activities

Service

Marketing & Sales

Outbound Logistics

Operations

Inbound Logistics

Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Activities

Primary Activities

Service

Marketing & Sales

Outbound Logistics

Operations

Inbound Logistics

Procurement

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Technological Development

Primary Activities

Service

Marketing & Sales

Outbound Logistics

Operations

Procurement Inbound Logistics

Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Human Resource Management Technological Development

Primary Activities

Service

Marketing & Sales

Outbound Logistics

Operations

Procurement Inbound Logistics

Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Firm Infrastructure Human Resource Management Technological Development

Primary Activities

Service

Marketing & Sales

Outbound Logistics

Operations

Procurement Inbound Logistics

Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Firm Infrastructure

Primary Activities

Service M A RG IN

Marketing & Sales

Outbound Logistics

Operations

Procurement Inbound Logistics

Activities

Human Resource Management MA R G IN Technological Development

Outsourcing

Strategic Choice to Purchase Some Activities From Outside Suppliers

Firm Infrastructure

Primary Activities

Service M A RG IN

Marketing & Sales

Outbound Logistics

Operations

Procurement Inbound Logistics

Activities

Human Resource Management MA R G IN Technological Development

Outsourcing Strategic Choice to Purchase Some Activities From Outside Suppliers

Firm Infrastructure

Human Resource Management

Operations

Marketing & Sales

Outbound Logistics

Operations

Inbound Logistics

Outbound Logistics

Primary Activities

Service M A RG IN

more efficiently

Procurement Inbound Logistics

Activities

M Human Resource Management Firms often purchase a portion A Technological R activities of their value-creating G suppliers Development from specialty external IN Technological Development Procurement who can perform these functions

Marketing & Sales

Service

Value Creating Activities Common to a Cost Leadership Business Level Strategy Simplified Planning Practices to Reduce Planning Costs Consistent Policies to Reduce Turnover Costs

Relatively Few Management Layers to Reduce Overhead

M A

Effective Training Programs to Improve Worker Efficiency and Effectiveness Easy-to-Use Manufacturing Investments in Technology in Technologies order to Reduce Costs Associated with Manufacturing Processes Systems and Procedures to find Frequent Evaluation Processes the Lowest Cost Products to to Monitor Suppliers’ Purchase Raw Materials Performances Highly Efficient Efficient Plant Delivery Small, Highly Effective Product Systems to Link Scale to Schedule that Trained Sales Installations to Suppliers’ Minimize Reduces Costs Force Reduce Frequency and Products with Manufacturing Selection of Low Products Priced Severity the Firm’s Costs Timing of Asset Cost Transport to Generate Production of Recalls Purchases Carriers Sales Volume Processes

Human Resource Management Technological Development

R G IN

Organizational Learning

Interrelationship s with Sister Units

Primary Activities

National Scale Advertising

M Service A R G IN

Located in Close Policy Choice of Efficient Order Plant TechnologySizes Proximity with Suppliers

Marketing & Sales

Outbound Logistics

Operations

Procurement

Inbound Logistics

Activities

Firm Infrastructure

Cost Effective MIS Systems

How to Obtain a Cost Advantage 1. Determine and Control Cost Drivers 2. Reconfigure the Value Chain as needed Alter production process Change in automation New distribution channel New advertising media Direct sales in place of indirect sales

New raw material Forward integration Backward integration Change location relative to suppliers or buyers

Core Competencies--Cautions and Reminders Never take for granted that core competencies will continue to provide a source of competitive advantage All core competencies have the potential to become Core Rigidities Core Rigidities are former core competencies that sow the seeds of organizational inertia and prevent the firm from responding appropriately to changes in the external environment Strategic myopia and inflexibility can strangle the firm’s ability to grow and adapt to environmental change or competitive threats

Competitive Advantage

Discovering Core Competencies

Gained through

Core Competencies

Strategic Competitiveness

Core Competencies

Discovering Core Competencies

Above-Average Returns

Sources of Competitive Advantage

Capabilities

Criteria of Sustainable Advantages

Teams of Resources

Resources * Tangible * Intangible

* * * *

Valuable Rare Costly to Imitate Nonsubstitutable

Value Chain Analysis

* Outsource

Formulating Long term Strategies • Concentration • Market Development • Product Development • Horizontal Integration • Vertical Integration • Tapered Integration • Quasi Integration • Diversification

• Tapered integration is a combination of Vertical integration and market exchange. • In addition to making a particular input in-house, a firm also buys from outside. • Coke and Pepsi having their own bottling units and also have s with outside bottlers. • Adv: at low costs. Use external sources as yardstick for bench marking • Disadv: lack of economies of scale difficult coordination & monitoring

Quasi Integration refers to the establishment of a relationship between vertically related businesses • Can be long term contracts to full ownership • Some of the forms are: Minority equity investment, Loans or Loan guarantees, Pre-purchase credits, exclusive dealing agreements, Cooperative R&D etc., Adv: Can achieve the benefits of vertical integration without incurring all costs, can create greater interest between the parties lowering unit costs and reducing the risk of demand /supply interruptions Quasi integration does not require full capital investment for achieving integration

Qualitative Factors in the Strategy Evaluation and Selection Process • Qualitative Factors in the Strategy Evaluation and Selection Process: This process requires the decision makers to constantly reassess the future, to find new congruencies as they unfold, and to blend the organization’s resources into new balances to meet the constantly changing conditions. Under this evaluation process, the following factors need to be studied:

Qualitative Factors in the Strategy Evaluation and Selection Process i. Managerial attitudes toward risk ii. Environment of the organization iii. Organizational culture and power relationships iv. Competitive actions and reactions v. Influence of previous organizational strategies vi. Timing considerations

2. Value Chain Analysis

3. Financial Analysis -- Liquidity Ratios (current/Quick) -- Leverage Ratios (Debt-equity/Interest coverage/Proprietary/Debt to Assets -- Activity Ratios (Assets turnover/Fixed Assets turnover/Working Capital turn over/Debtors turnover/Inventory turnover)

-- Profitability Ratios (Gross Profit/Net Profit/Operating/EPS etc.,)

4. Strategic Advantage Profile (SAP)

Strategic Advantage Profile (SAP) • SAP tries to find out Organizational Strengths and weaknesses in relation to the CRITICAL SUCCESS FACTORS within a particular industry •CRITICAL SUCCESS FACTORS are small but extremely important factors that are essential for successfully gaining and maintaining Competitive Advantage •CRITICAL SUCCESS FACTORS have significant bearing on the overall growth of a firm within an industry. The four major sources of CRITICAL SUCCESS FACTORS : --- Industry Characteristics --- Competitive Position --- General Environment --- Organizational Development

Strategic Advantage Profile (SAP)

Matching the Strengths and Weaknesses • After the analyses of External and Internal Environments, the analysts must try to find the FIT between Corporate internal strengths and external opportunities . One of the means useful in doing this is ETOP.

ETOP ETOP is the acronym for environmental threat and opportunity profile .It is nothing but a summarized picture of the environmental factors and their likely impact on the organization

The preparation of ETOP helps a firm to identify the segments in a chosen field of activity, presenting excellent growth opportunities

ETOP

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Inbound Logistics

Activities

Primary Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Operations

Inbound Logistics

Activities

Primary Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Outbound Logistics

Operations

Inbound Logistics

Activities

Primary Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Primary Activities

Marketing & Sales

Outbound Logistics

Operations

Inbound Logistics

Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Primary Activities

Service

Marketing & Sales

Outbound Logistics

Operations

Inbound Logistics

Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Activities

Primary Activities

Service

Marketing & Sales

Outbound Logistics

Operations

Inbound Logistics

Procurement

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Technological Development

Primary Activities

Service

Marketing & Sales

Outbound Logistics

Operations

Procurement Inbound Logistics

Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Human Resource Management Technological Development

Primary Activities

Service

Marketing & Sales

Outbound Logistics

Operations

Procurement Inbound Logistics

Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Firm Infrastructure Human Resource Management Technological Development

Primary Activities

Service

Marketing & Sales

Outbound Logistics

Operations

Procurement Inbound Logistics

Activities

Value Chain Analysis

Identifying Resources and Capabilities That Can Add Value

Firm Infrastructure

Primary Activities

Service M A RG IN

Marketing & Sales

Outbound Logistics

Operations

Procurement Inbound Logistics

Activities

Human Resource Management MA R G IN Technological Development

Outsourcing

Strategic Choice to Purchase Some Activities From Outside Suppliers

Firm Infrastructure

Primary Activities

Service M A RG IN

Marketing & Sales

Outbound Logistics

Operations

Procurement Inbound Logistics

Activities

Human Resource Management MA R G IN Technological Development

Outsourcing Strategic Choice to Purchase Some Activities From Outside Suppliers

Firm Infrastructure

Human Resource Management

Operations

Marketing & Sales

Outbound Logistics

Operations

Inbound Logistics

Outbound Logistics

Primary Activities

Service M A RG IN

more efficiently

Procurement Inbound Logistics

Activities

M Human Resource Management Firms often purchase a portion A Technological R activities of their value-creating G suppliers Development from specialty external IN Technological Development Procurement who can perform these functions

Marketing & Sales

Service

Value Creating Activities Common to a Cost Leadership Business Level Strategy Simplified Planning Practices to Reduce Planning Costs Consistent Policies to Reduce Turnover Costs

Relatively Few Management Layers to Reduce Overhead

M A

Effective Training Programs to Improve Worker Efficiency and Effectiveness Easy-to-Use Manufacturing Investments in Technology in Technologies order to Reduce Costs Associated with Manufacturing Processes Systems and Procedures to find Frequent Evaluation Processes the Lowest Cost Products to to Monitor Suppliers’ Purchase Raw Materials Performances Highly Efficient Efficient Plant Delivery Small, Highly Effective Product Systems to Link Scale to Schedule that Trained Sales Installations to Suppliers’ Minimize Reduces Costs Force Reduce Frequency and Products with Manufacturing Selection of Low Products Priced Severity the Firm’s Costs Timing of Asset Cost Transport to Generate Production of Recalls Purchases Carriers Sales Volume Processes

Human Resource Management Technological Development

R G IN

Organizational Learning

Interrelationship s with Sister Units

Primary Activities

National Scale Advertising

M Service A R G IN

Located in Close Policy Choice of Efficient Order Plant TechnologySizes Proximity with Suppliers

Marketing & Sales

Outbound Logistics

Operations

Procurement

Inbound Logistics

Activities

Firm Infrastructure

Cost Effective MIS Systems

How to Obtain a Cost Advantage 1. Determine and Control Cost Drivers 2. Reconfigure the Value Chain as needed Alter production process Change in automation New distribution channel New advertising media Direct sales in place of indirect sales

New raw material Forward integration Backward integration Change location relative to suppliers or buyers

Core Competencies--Cautions and Reminders Never take for granted that core competencies will continue to provide a source of competitive advantage All core competencies have the potential to become Core Rigidities Core Rigidities are former core competencies that sow the seeds of organizational inertia and prevent the firm from responding appropriately to changes in the external environment Strategic myopia and inflexibility can strangle the firm’s ability to grow and adapt to environmental change or competitive threats

Competitive Advantage

Discovering Core Competencies

Gained through

Core Competencies

Strategic Competitiveness

Core Competencies

Discovering Core Competencies

Above-Average Returns

Sources of Competitive Advantage

Capabilities

Criteria of Sustainable Advantages

Teams of Resources

Resources * Tangible * Intangible

* * * *

Valuable Rare Costly to Imitate Nonsubstitutable

Value Chain Analysis

* Outsource

Formulating Long term Strategies • Concentration • Market Development • Product Development • Horizontal Integration • Vertical Integration • Tapered Integration • Quasi Integration • Diversification

• Tapered integration is a combination of Vertical integration and market exchange. • In addition to making a particular input in-house, a firm also buys from outside. • Coke and Pepsi having their own bottling units and also have s with outside bottlers. • Adv: at low costs. Use external sources as yardstick for bench marking • Disadv: lack of economies of scale difficult coordination & monitoring

Quasi Integration refers to the establishment of a relationship between vertically related businesses • Can be long term contracts to full ownership • Some of the forms are: Minority equity investment, Loans or Loan guarantees, Pre-purchase credits, exclusive dealing agreements, Cooperative R&D etc., Adv: Can achieve the benefits of vertical integration without incurring all costs, can create greater interest between the parties lowering unit costs and reducing the risk of demand /supply interruptions Quasi integration does not require full capital investment for achieving integration

Qualitative Factors in the Strategy Evaluation and Selection Process • Qualitative Factors in the Strategy Evaluation and Selection Process: This process requires the decision makers to constantly reassess the future, to find new congruencies as they unfold, and to blend the organization’s resources into new balances to meet the constantly changing conditions. Under this evaluation process, the following factors need to be studied:

Qualitative Factors in the Strategy Evaluation and Selection Process i. Managerial attitudes toward risk ii. Environment of the organization iii. Organizational culture and power relationships iv. Competitive actions and reactions v. Influence of previous organizational strategies vi. Timing considerations