Variable And Absorption Costing y2c3b

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3i3n4

Overview 26281t

& View Variable And Absorption Costing as PDF for free.

More details 6y5l6z

- Words: 893

- Pages: 13

Absorption vs. Variable Costing Gerald M. Myers BUSA 323 School of Business Pacific Lutheran University Copyright © 2005 Gerald M. Myers All rights reserved

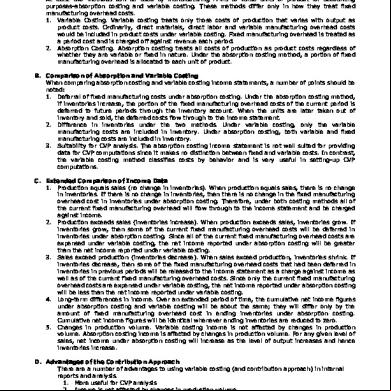

Absorption costing is required for GAAP • Absorption costing charges fixed overhead to production • Fixed overhead is expensed as cost of goods sold is written off against revenues

Absorption costing: how it works • Suppose production is greater than sales. – We’re adding to finished goods inventory – A pro-rata share of variable and fixed production costs are held back in finished goods until the product is sold – Less than 100% of the total fixed overhead will be written off in the current period

• Under FIFO, the “old” production costs will be expensed in the next fiscal period, along with the costs of the new production that is actually sold

Absorption costing: how it works, continued • But, suppose we have the reverse situation; sales exceeds production and we draw down inventory – Now we’re selling all of the current production, plus some of whatever we had sitting around on the shelf – As a result, we’ll write off all of the current year’s fixed overhead, plus some fixed overhead from the previous year

But what happens under variable costing • Under variable costing, 100% of fixed costs are expensed in the period incurred. Zero (zip, nada) fixed costs are charged to inventory.

Let’s use the Widget Works data to illustrate the difference between absorption and variable costing. Here’s the original information again. STANDARDS

PRICE OR RATE

Direct material cost/foot

$2.50

Direct labor cost/DLH

$4.50

Variable ohd rate/DLH

$2.80

Budgeted fixed overhead Planned output (denominator ) Fixed overhead rate/DLH Budgeted unit sales Budgeted sales price Variable selling & expenses Fixed selling & expenses

STANDARD COST/UNIT Direct material Direct labor Variable overhead Total variable cost Fixed overhead Absorption cost/unit

$

QUANTITY PER UNIT

$157,500 35,000 units 3.00 35,000 $29.95 $2.00 $140,000

$7.50 6.75 4.20 $18.45 4.50 $22.95

ACTUAL OUTCOMES COSTS

3.0 Direct material purchased

$330,000

1.50 Direct material used

VOLUME

110,000 feet 105,000 feet

Direct labor used

$255,000

Variable overhead Fixed overhead Actual production Units sold Variable selling & exp Fixed Selling & exp Selling price/unit

$147,900 $160,000

52,000 DLH

36,000 units 34,000 units $2.05 $143,690 $29.50

CALCULATION OF TOTAL ACTUAL COST Direct material purchased $330,000 Less: direct material not used (at standard cost) 5,000 $ 2.50 (12,500) Direct labor used $255,000 Variable overhead $147,900 Fixed overhead $160,000 Total actual costs $ 880,400 Total std cost of production 36,000 22.95 $ 826,200 Total variance $ 54,200

What would a variable costing income statement look like here? Standard variable costing income statement Revenue $1,003,000 Less variable cost of goods sold Material 255,000 Labor 229,500 Variable overhead 142,800 Total variable manufacturing costs 627,300 Less variable S & A expenses 69,700 Contribution margin at standard $ 306,000 Adjust for variable cost variances 56,200 Adjusted contribution margin $ 249,800 Less fixed costs Overhead 160,000 S & A Expenses 143,690 Net income $ (53,890)

But absorption costing net income was... Sales revenue Cost of goods sold Gross profit @ standard Variable selling & exp Fixed selling & exp Net income

$ $ $ $ $ $

1,003,000 834,500 168,500 69,700 143,690 (44,890)

Hmmm…that’s a difference of $9,000! We’re better off (smaller loss), but where did the $9,000 come from?

Absorption and variable costing net income reconciliation • Recall that we produced 36,000 units and sold 34,000 units. – 2,000 units wound up in inventory – The fixed costs of those 2,000 units is: • $3.00/DLH * 1.5 DLH/unit * 2,000 units, or $9,000!

• Therefore under absorption costing, $9,000 of fixed overhead is held back in inventory. Under variable costing, that amount is expensed in the period incurred.

This leads directly to the following conclusions. Ceteris paribus, • when production > sales, absorption costing net income will be greater than variable costing net income due to the current period fixed costs held in inventory. • when production < sales, absorption costing net income will be less than variable costing net income due to the “old” fixed costs released from inventory. • when production = sales, absorption costing net income and variable costing net income will be equal.

Now suppose you find yourself in the following situation: • Your bonus is a function of profit • 4th quarter sales are off; prospects for that bonus are looking less and less favorable • The factory has excess production capacity • How can you take advantage of this set of circumstances to improve the likelihood of getting the bonus?

Answer? • Crank up production! – What doesn’t get sold will just go to inventory. – The variable costs of the unsold output won’t affect profits anyway – The fixed costs per unit will drop as production increases. – We’ll write off less fixed overhead resulting in higher profits, even if total sales are unchanged.

Ethical? • Not really, but it happens. • During a period when its sales were taking a hit in the 1960s, Chrysler Corporation kept building cars for inventory in order to drive up apparent profits. • They rented cow pastures, vacant lots, any space they could find to store the unsold vehicles • It got to the point that the rent and security costs (vandalism got to be a serious problem) were a substantial expense.

Absorption costing is required for GAAP • Absorption costing charges fixed overhead to production • Fixed overhead is expensed as cost of goods sold is written off against revenues

Absorption costing: how it works • Suppose production is greater than sales. – We’re adding to finished goods inventory – A pro-rata share of variable and fixed production costs are held back in finished goods until the product is sold – Less than 100% of the total fixed overhead will be written off in the current period

• Under FIFO, the “old” production costs will be expensed in the next fiscal period, along with the costs of the new production that is actually sold

Absorption costing: how it works, continued • But, suppose we have the reverse situation; sales exceeds production and we draw down inventory – Now we’re selling all of the current production, plus some of whatever we had sitting around on the shelf – As a result, we’ll write off all of the current year’s fixed overhead, plus some fixed overhead from the previous year

But what happens under variable costing • Under variable costing, 100% of fixed costs are expensed in the period incurred. Zero (zip, nada) fixed costs are charged to inventory.

Let’s use the Widget Works data to illustrate the difference between absorption and variable costing. Here’s the original information again. STANDARDS

PRICE OR RATE

Direct material cost/foot

$2.50

Direct labor cost/DLH

$4.50

Variable ohd rate/DLH

$2.80

Budgeted fixed overhead Planned output (denominator ) Fixed overhead rate/DLH Budgeted unit sales Budgeted sales price Variable selling & expenses Fixed selling & expenses

STANDARD COST/UNIT Direct material Direct labor Variable overhead Total variable cost Fixed overhead Absorption cost/unit

$

QUANTITY PER UNIT

$157,500 35,000 units 3.00 35,000 $29.95 $2.00 $140,000

$7.50 6.75 4.20 $18.45 4.50 $22.95

ACTUAL OUTCOMES COSTS

3.0 Direct material purchased

$330,000

1.50 Direct material used

VOLUME

110,000 feet 105,000 feet

Direct labor used

$255,000

Variable overhead Fixed overhead Actual production Units sold Variable selling & exp Fixed Selling & exp Selling price/unit

$147,900 $160,000

52,000 DLH

36,000 units 34,000 units $2.05 $143,690 $29.50

CALCULATION OF TOTAL ACTUAL COST Direct material purchased $330,000 Less: direct material not used (at standard cost) 5,000 $ 2.50 (12,500) Direct labor used $255,000 Variable overhead $147,900 Fixed overhead $160,000 Total actual costs $ 880,400 Total std cost of production 36,000 22.95 $ 826,200 Total variance $ 54,200

What would a variable costing income statement look like here? Standard variable costing income statement Revenue $1,003,000 Less variable cost of goods sold Material 255,000 Labor 229,500 Variable overhead 142,800 Total variable manufacturing costs 627,300 Less variable S & A expenses 69,700 Contribution margin at standard $ 306,000 Adjust for variable cost variances 56,200 Adjusted contribution margin $ 249,800 Less fixed costs Overhead 160,000 S & A Expenses 143,690 Net income $ (53,890)

But absorption costing net income was... Sales revenue Cost of goods sold Gross profit @ standard Variable selling & exp Fixed selling & exp Net income

$ $ $ $ $ $

1,003,000 834,500 168,500 69,700 143,690 (44,890)

Hmmm…that’s a difference of $9,000! We’re better off (smaller loss), but where did the $9,000 come from?

Absorption and variable costing net income reconciliation • Recall that we produced 36,000 units and sold 34,000 units. – 2,000 units wound up in inventory – The fixed costs of those 2,000 units is: • $3.00/DLH * 1.5 DLH/unit * 2,000 units, or $9,000!

• Therefore under absorption costing, $9,000 of fixed overhead is held back in inventory. Under variable costing, that amount is expensed in the period incurred.

This leads directly to the following conclusions. Ceteris paribus, • when production > sales, absorption costing net income will be greater than variable costing net income due to the current period fixed costs held in inventory. • when production < sales, absorption costing net income will be less than variable costing net income due to the “old” fixed costs released from inventory. • when production = sales, absorption costing net income and variable costing net income will be equal.

Now suppose you find yourself in the following situation: • Your bonus is a function of profit • 4th quarter sales are off; prospects for that bonus are looking less and less favorable • The factory has excess production capacity • How can you take advantage of this set of circumstances to improve the likelihood of getting the bonus?

Answer? • Crank up production! – What doesn’t get sold will just go to inventory. – The variable costs of the unsold output won’t affect profits anyway – The fixed costs per unit will drop as production increases. – We’ll write off less fixed overhead resulting in higher profits, even if total sales are unchanged.

Ethical? • Not really, but it happens. • During a period when its sales were taking a hit in the 1960s, Chrysler Corporation kept building cars for inventory in order to drive up apparent profits. • They rented cow pastures, vacant lots, any space they could find to store the unsold vehicles • It got to the point that the rent and security costs (vandalism got to be a serious problem) were a substantial expense.