Adidas Ag Ar2010 Global Operations 6e4w6r

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3i3n4

Overview 26281t

& View Adidas Ag Ar2010 Global Operations as PDF for free.

More details 6y5l6z

- Words: 2,605

- Pages: 4

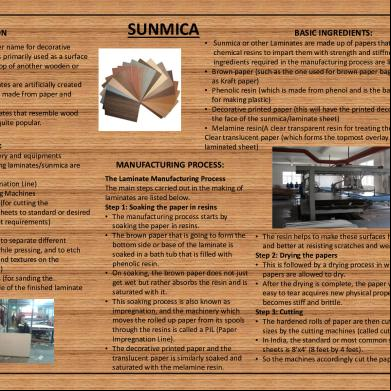

Global Operations The adidas Group’s Global Operations function manages the development, production planning, sourcing and distribution of the majority of our products. The function continually strives to both increase efficiency throughout the Group’s supply chain and to ensure the highest standards in product quality and delivery performance for our customers at competitive costs. Enforced vision: closest to every consumer The vision of the Global Operations function is to be closest to every consumer. By delivering on each of its five strategic pillars see 02, Global Operations strives to provide the right product to consumers – in the right size, colour and style, in the right place, at the right time, across the entire range of the Group’s channels and brands. Global Operations has a strong track record for establishing state-of-the-art infrastructure, processes and systems. Over the last four years, the function has successfully consolidated and improved legacy structures, reducing complexity and operating cost for the Group. By taking strong ownership for quality, cost and availability, we have proven that we are able to respond to the fast-changing requirements of both our consumers and customers. The Route 2015 strategic business plan will require changes in how Global Operations operates within the Group. Global Operations has therefore formulated its strategic plan in close alignment with the needs of our Global Brands and Global Sales functions and in consideration of several external factors impacting the business today. These include anticipated increases in commodity prices, labour and transportation costs, social and regulatory requirements and demand growth as well as increasing demand volatility.

Throughout the next five years, Global Operations will focus on five strategic priorities ed by 15 initiatives for the Group: – Ensuring cost competitiveness – Providing industry-leading availability – Enabling later ordering – ing the Group’s growth projects – Modernising the Group’s infrastructure.

106

Global Operations

Group Management Report – Our Group

By delivering on these initiatives, the function will not only enable the Group to achieve its Route 2015 goals, but will also ensure our supply chain remains a competitive advantage in making us the partner of choice for both consumers and customers. The first two priorities in Global Operations’ 2015 strategic plan ensure the function continues to deliver upon the Group’s basic requirements. The remaining three priorities are aimed at positioning Global Operations ahead of industry competition.

01

Global Operations in go-to-market process

global operations

Marketing

Design

Product Development

Sourcing

Supply Chain Management

Sales Subsidiaries

Briefing

Concept

Product creation

Manufacturing

Distribution

Sales

Business Solutions Processes and infrastructure of the future

Ensuring cost competitiveness: As part of this priority, Global Operations will focus on further optimising product creation through a more efficient material and colour selection process. This, coupled with increased automation in manufacturing, will enhance productivity, shorten lead times and improve overall quality. These improvements are expected to enhance profitability for the Group and ensure we provide our consumers with the best value proposition in the industry. The Profitability Management department within Global Operations assumes a central role in realising cost competitiveness by driving our strategic costing efforts and optimising our buying strategies. This includes monitoring macroeconomic trends, to identify the future impact on product costs as well as the ongoing financial assessment of the adidas Group’s supply base. Providing industry-leading availability: Building on the solid platform that has been established to ensure product availability, Global Operations will further shorten our order-to-delivery lead times. This will be accomplished by establishing and offering a set of tailored and sophisticated replenishment models to our customers via improvements in our planning systems and processes. The development of risk-oriented planning and production models for selected product ranges as well as the shift from buying to inventory planning at our distribution centres both form key requirements for the successful delivery of this initiative.

Enabling later ordering: Enabling later ordering is a cross-functional priority in Global Operations focused on allowing our customers to order our products closer to the time of sale, facilitating buying decisions that are based on better market knowledge. This will our Route 2015 goal of reducing the lead times across the Group’s product portfolio to 60 days or less. Specifically, the initiative will focus on immediately reducing production lead times on the majority of Reebok footwear from 90 days to 60 days. Since the majority of adidas footwear is already on 60 days, the change will allow us to align sales processes across the brands and improve efficiencies. Preparations are also underway to bring apparel lead times down to 60 days or less over time. The above improvements involve establishing a greater regional source base for apparel, which will enable us to manufacture closer to our key markets to deliver and replenish products faster. ing the Group’s growth projects: Global Operations will the growth projects outlined in the Group’s Route 2015 plan, such as the adidas NEO label, key market programmes, Retail and eCommerce as well as other key brand programmes such as customisation see Global Brands Strategy, p. 87 and Global Sales Strategy, p. 82.

For example, with the adidas NEO label, Global Operations will this business with fast fashion creation, sourcing and supply chain management capabilities. For Retail, Global Operations will continue to build the processes and systems backbone with the ultimate goal being a demand-driven supply chain that leverages existing short lead time production models to improve availability without excessive inventory see Retail Strategy, p. 84. Finally, Global Operations will focus on evolving existing customisation models in of business expansion, particularly within our eCommerce channel.

Global Operations strategic pillars

Replenishment

End-to-End Profitability

Adaptive Supply Network

End-to-End Planning

Modernising the Group’s infrastructure: Global Operations will continue to focus on building the required infrastructure, processes and systems to the Group’s growth plans. This will include further process simplification, consolidation of legacy systems and distribution structures, as well as the creation of state-of-the-art systems required to new business demands. An example of this is the opening of our new Spartanburg distribution campus designed to growth in the USA. Also under this priority, the function will continue delivering its existing long-term improvement programmes such as Fast and Lean Creation for apparel, the roll-out of the Global Procurement Solution platform and the expansion of virtualisation to new product categories and the design teams.

Accelerated Creation to Shelf

02

Provide high product availability and timely and fast deliveries to Wholesale and Retail customers while minimising finished goods inventory, to the Group’s controlled space initiatives. Identify key cost and profitability drivers and their interrelationships to optimise decision-making to mitigate financial risks and ensure the longterm profitability of the Group and its supply base. Enhance the flexibility and responsiveness of both the Global Operations Sourcing and Supply Chain Management organisations to satisfy fast-changing market needs. Optimise the Group’s demand and supply planning system landscape to improve efficiency, transparency and cross-functionality of processes across the Wholesale and Retail segments as well as Other Businesses. Build capabilities, processes and technologies that drive faster, smarter and more efficient product creation to enhance the Group’s topline and bottom-line growth.

Group Management Report – Our Group

Global Operations

107

Several major programmes reach important milestones in 2010 Throughout 2010, Global Operations made significant progress on key projects. In May, we saw the formal opening of the Group’s Spartanburg distribution facility in South Carolina, USA. With this state-of-the-art facility, we are now servicing our wholesale customers as well as our own-retail and e-commerce activities in the USA across the brands adidas, Reebok, TaylorMadeadidas Golf and Rockport – with 80% of our customers receiving their orders in three days or less. We also successfully completed several important system simplification projects. The Reebok and Ashworth brands were integrated into the long-term roll-out of the adidas Group’s Global Procurement Solution (GPS). adidas, Reebok and Ashworth purchase orders are now procured through one common platform covering the entire flow from market demand, factory planning through to supplier invoice procurement and subsidiary billing. In total, the GPS 2.0 release replaced five major IT applications. We also reduced the total number of supply planning systems across the adidas Group from three to one, establishing a common planning, reporting and communication platform. Another major achievement in 2010 was the official implementation of the Fast and Lean Creation process for footwear. Product creation teams are now developing around 75% of all footwear directly with factories, laying the foundation for the introduction of creation calendars of 12 months or less.

Majority of production through independent suppliers To minimise production costs, we outsource over 95% of production to independent third-party suppliers, primarily located in Asia. While we provide them with detailed specifications for production and delivery, these suppliers possess excellent expertise in cost-efficient, high-volume production of footwear, apparel and accessories. The latest list of our supplier factories can be found on our website www.adidas-Group. com/en/sustainability/suppliers_and_workers. The adidas Group also operates a limited amount of own production and assembly sites in (1), Sweden (1), Finland (1), the USA (4), Canada (4), China (1) and Japan (1). In order to ensure the high quality consumers expect from our products, we enforce strict control and inspection procedures at our suppliers and in our own factories. In addition, we promote adherence to social and environmental standards throughout our supply chain see Sustainability, p. 120.

108

Global Operations

Group Management Report – Our Group

Fast and Lean Creation for apparel also reached a major milestone with the launch of a new product lifecycle management system, FlexPLM, within just eight months of the project launch. Also in 2010, Global Operations teams contributed to both the Group’s Virtualisation programme by creating over 18,000 articles as 3D files, and to the “Fit & Size” programme which involved the adjustment of over 500 base patterns to current consumers’ body shapes for an improved overall fit of garments.

Overall number of manufacturing partners stable In 2010, Global Operations worked with 270 independent manufacturing partners. While the number of suppliers in apparel decreased as a result of further rationalisation of the supply base, it increased in footwear and hardware. The increase in footwear was the result of the significant growth in volumes and expansion into new sourcing countries (e.g. Cambodia). Of our independent manufacturing partners, 75% were located in Asia, 16% were located in the Americas and 9% in Europe see 03. 32% of all suppliers were located in China. Our Global Operations function manages product development, commercialisation and distribution, and also supervises sourcing for our Wholesale and Retail segments as well as for adidas Golf see 01. Due to the specific sourcing requirements in their respective fields of business, TaylorMade, Rockport, Reebok-CCM Hockey and the Sports Licensed Division are not serviced through Global Operations, but instead utilise their own purchasing organisation. In order to quickly seize short-term opportunities in their local market or react to trade regulations, Group subsidiaries may, with the approval of our Social and Environmental team, also source from selected local suppliers outside the realm of Global Operations. Local purchases, however, only for a minor portion of the Group’s total sourcing volume.

03

Suppliers by region 1)

75% Asia 16% Americas 9% Europe

1) Figures include adidas, Reebok and adidas Golf, but exclude local sourcing partners, sourcing agents, subcontractors, second-tier suppliers and licensee factories.

04

Footwear production by region 1)

97% Asia 2% Europe 1% Americas

1) Figures include adidas, Reebok and adidas Golf.

05

Footwear production 1) in million pairs

2007 2008 2009 2010 1) Figures include adidas, Reebok and adidas Golf.

201 221 171 219

China’s share of footwear production decreases 97% of our total 2010 footwear volume for adidas, Reebok and adidas Golf was produced in Asia (2009: 97%). Production in Europe and the Americas combined ed for 3% of the sourcing volume (2009: 3%) see 04. China represents our largest sourcing country with approximately 39% of the total volume, followed by Vietnam with 31% and Indonesia with 22%. As part of our strategy to increase the regional diversity of our supplier base to meet the ongoing needs of our business, the overall representation of China in our sourcing mix declined 2 percentage points. At the same time, the footwear volumes sourced from Cambodia almost tripled in 2010 from a low comparison base. In 2010, our footwear suppliers produced approximately 219 million pairs of shoes (2009: approx. 171 million pairs) see 05. The year-over-year increase was driven by the strong sales growth in 2010 and a low comparison base in 2009 due to inventory clean-up activities. Our largest footwear factory produced approximately 9% of the footwear sourcing volume (2009: 11%). Rockport purchased approximately 8 million pairs of footwear in 2010, which represents an increase of 27% versus the prior year. Products were primarily sourced from factories in China (67%), Vietnam (25%), Indonesia (5%) and India (3%). The largest factory ed for 37% of the total sourcing volume of the Rockport brand.

Volume of apparel production increases In 2010, we sourced 82% of the total apparel volume for adidas, Reebok and adidas Golf from Asia (2009: 83%). Europe remained the second-largest apparel sourcing region, representing 12% of the volume (2009: 11%). The Americas ed for 6% of the volume (2009: 6%) see 06. China was the largest source country, representing 36% of the produced volume, followed by Thailand with 13% and Indonesia with 13%. In total, our suppliers produced approximately 301 million units of apparel in 2010 (2009: approx. 239 million units) see 07. The largest apparel factory produced approximately 9% of this apparel volume in 2010 (2009: 11%). In addition, Reebok-CCM Hockey sourced around 2 million units of apparel in 2010 (2009: approx. 2 million units). The majority of this volume was also produced in Asia, while small portions were sourced from the Americas (particularly Canada) and Europe. The Sports Licensed Division sourced approximately 23 million units of apparel and 15 million units of headwear (2009: 20 million and 14 million, respectively). The majority of purchased apparel products was sourced as unfinished goods from Latin America (85%) and Asia (15%), and was subsequently finished in our own screen-printing facilities in the USA. The majority of headwear sourced was finished products manufactured predominately in Asia (97%) and the USA (3%).

67% of adidas and Reebok branded hardware produced in China In 2010, the bulk (i.e. 98%) of adidas and Reebok branded hardware products, such as balls and bags, was also produced in Asia (2009: 98%). China remained our largest source country, ing for 67% of the sourced volume, followed by Vietnam with 20% and Pakistan with 11%. The remaining 2% was sourced via European countries see 08. The total 2010 hardware sourcing volume was approximately 48 million units (2009: approximately 34 million units), with the largest factory ing for 21% of production see 09. TaylorMade and Reebok-CCM Hockey sourced 98% and 72% of their hardware volumes from Asia, respectively (2009: 92% and 78%). In addition, both brands sourced a portion of hardware products in the Americas. At TaylorMade, the majority of golf club components were manufactured by suppliers in China and assembled by TaylorMade in the USA, China and Japan.

06

Apparel production by region 1)

82% Asia 12% Europe 6% Americas

1) Figures include adidas, Reebok and adidas Golf.

07

Apparel production 1) in million units

2007 2008 2009 2010

252 284 239 301

1) Figures include adidas, Reebok and adidas Golf.

08

Hardware production by region 1)

98% Asia 2% Europe

1) Figures include adidas, Reebok and adidas Golf.

09

Hardware production 1) in million units

2007 2008 2009 2010

39 42 34 48

1) Figures include adidas, Reebok and adidas Golf.

Group Management Report – Our Group

Global Operations

109

Throughout the next five years, Global Operations will focus on five strategic priorities ed by 15 initiatives for the Group: – Ensuring cost competitiveness – Providing industry-leading availability – Enabling later ordering – ing the Group’s growth projects – Modernising the Group’s infrastructure.

106

Global Operations

Group Management Report – Our Group

By delivering on these initiatives, the function will not only enable the Group to achieve its Route 2015 goals, but will also ensure our supply chain remains a competitive advantage in making us the partner of choice for both consumers and customers. The first two priorities in Global Operations’ 2015 strategic plan ensure the function continues to deliver upon the Group’s basic requirements. The remaining three priorities are aimed at positioning Global Operations ahead of industry competition.

01

Global Operations in go-to-market process

global operations

Marketing

Design

Product Development

Sourcing

Supply Chain Management

Sales Subsidiaries

Briefing

Concept

Product creation

Manufacturing

Distribution

Sales

Business Solutions Processes and infrastructure of the future

Ensuring cost competitiveness: As part of this priority, Global Operations will focus on further optimising product creation through a more efficient material and colour selection process. This, coupled with increased automation in manufacturing, will enhance productivity, shorten lead times and improve overall quality. These improvements are expected to enhance profitability for the Group and ensure we provide our consumers with the best value proposition in the industry. The Profitability Management department within Global Operations assumes a central role in realising cost competitiveness by driving our strategic costing efforts and optimising our buying strategies. This includes monitoring macroeconomic trends, to identify the future impact on product costs as well as the ongoing financial assessment of the adidas Group’s supply base. Providing industry-leading availability: Building on the solid platform that has been established to ensure product availability, Global Operations will further shorten our order-to-delivery lead times. This will be accomplished by establishing and offering a set of tailored and sophisticated replenishment models to our customers via improvements in our planning systems and processes. The development of risk-oriented planning and production models for selected product ranges as well as the shift from buying to inventory planning at our distribution centres both form key requirements for the successful delivery of this initiative.

Enabling later ordering: Enabling later ordering is a cross-functional priority in Global Operations focused on allowing our customers to order our products closer to the time of sale, facilitating buying decisions that are based on better market knowledge. This will our Route 2015 goal of reducing the lead times across the Group’s product portfolio to 60 days or less. Specifically, the initiative will focus on immediately reducing production lead times on the majority of Reebok footwear from 90 days to 60 days. Since the majority of adidas footwear is already on 60 days, the change will allow us to align sales processes across the brands and improve efficiencies. Preparations are also underway to bring apparel lead times down to 60 days or less over time. The above improvements involve establishing a greater regional source base for apparel, which will enable us to manufacture closer to our key markets to deliver and replenish products faster. ing the Group’s growth projects: Global Operations will the growth projects outlined in the Group’s Route 2015 plan, such as the adidas NEO label, key market programmes, Retail and eCommerce as well as other key brand programmes such as customisation see Global Brands Strategy, p. 87 and Global Sales Strategy, p. 82.

For example, with the adidas NEO label, Global Operations will this business with fast fashion creation, sourcing and supply chain management capabilities. For Retail, Global Operations will continue to build the processes and systems backbone with the ultimate goal being a demand-driven supply chain that leverages existing short lead time production models to improve availability without excessive inventory see Retail Strategy, p. 84. Finally, Global Operations will focus on evolving existing customisation models in of business expansion, particularly within our eCommerce channel.

Global Operations strategic pillars

Replenishment

End-to-End Profitability

Adaptive Supply Network

End-to-End Planning

Modernising the Group’s infrastructure: Global Operations will continue to focus on building the required infrastructure, processes and systems to the Group’s growth plans. This will include further process simplification, consolidation of legacy systems and distribution structures, as well as the creation of state-of-the-art systems required to new business demands. An example of this is the opening of our new Spartanburg distribution campus designed to growth in the USA. Also under this priority, the function will continue delivering its existing long-term improvement programmes such as Fast and Lean Creation for apparel, the roll-out of the Global Procurement Solution platform and the expansion of virtualisation to new product categories and the design teams.

Accelerated Creation to Shelf

02

Provide high product availability and timely and fast deliveries to Wholesale and Retail customers while minimising finished goods inventory, to the Group’s controlled space initiatives. Identify key cost and profitability drivers and their interrelationships to optimise decision-making to mitigate financial risks and ensure the longterm profitability of the Group and its supply base. Enhance the flexibility and responsiveness of both the Global Operations Sourcing and Supply Chain Management organisations to satisfy fast-changing market needs. Optimise the Group’s demand and supply planning system landscape to improve efficiency, transparency and cross-functionality of processes across the Wholesale and Retail segments as well as Other Businesses. Build capabilities, processes and technologies that drive faster, smarter and more efficient product creation to enhance the Group’s topline and bottom-line growth.

Group Management Report – Our Group

Global Operations

107

Several major programmes reach important milestones in 2010 Throughout 2010, Global Operations made significant progress on key projects. In May, we saw the formal opening of the Group’s Spartanburg distribution facility in South Carolina, USA. With this state-of-the-art facility, we are now servicing our wholesale customers as well as our own-retail and e-commerce activities in the USA across the brands adidas, Reebok, TaylorMadeadidas Golf and Rockport – with 80% of our customers receiving their orders in three days or less. We also successfully completed several important system simplification projects. The Reebok and Ashworth brands were integrated into the long-term roll-out of the adidas Group’s Global Procurement Solution (GPS). adidas, Reebok and Ashworth purchase orders are now procured through one common platform covering the entire flow from market demand, factory planning through to supplier invoice procurement and subsidiary billing. In total, the GPS 2.0 release replaced five major IT applications. We also reduced the total number of supply planning systems across the adidas Group from three to one, establishing a common planning, reporting and communication platform. Another major achievement in 2010 was the official implementation of the Fast and Lean Creation process for footwear. Product creation teams are now developing around 75% of all footwear directly with factories, laying the foundation for the introduction of creation calendars of 12 months or less.

Majority of production through independent suppliers To minimise production costs, we outsource over 95% of production to independent third-party suppliers, primarily located in Asia. While we provide them with detailed specifications for production and delivery, these suppliers possess excellent expertise in cost-efficient, high-volume production of footwear, apparel and accessories. The latest list of our supplier factories can be found on our website www.adidas-Group. com/en/sustainability/suppliers_and_workers. The adidas Group also operates a limited amount of own production and assembly sites in (1), Sweden (1), Finland (1), the USA (4), Canada (4), China (1) and Japan (1). In order to ensure the high quality consumers expect from our products, we enforce strict control and inspection procedures at our suppliers and in our own factories. In addition, we promote adherence to social and environmental standards throughout our supply chain see Sustainability, p. 120.

108

Global Operations

Group Management Report – Our Group

Fast and Lean Creation for apparel also reached a major milestone with the launch of a new product lifecycle management system, FlexPLM, within just eight months of the project launch. Also in 2010, Global Operations teams contributed to both the Group’s Virtualisation programme by creating over 18,000 articles as 3D files, and to the “Fit & Size” programme which involved the adjustment of over 500 base patterns to current consumers’ body shapes for an improved overall fit of garments.

Overall number of manufacturing partners stable In 2010, Global Operations worked with 270 independent manufacturing partners. While the number of suppliers in apparel decreased as a result of further rationalisation of the supply base, it increased in footwear and hardware. The increase in footwear was the result of the significant growth in volumes and expansion into new sourcing countries (e.g. Cambodia). Of our independent manufacturing partners, 75% were located in Asia, 16% were located in the Americas and 9% in Europe see 03. 32% of all suppliers were located in China. Our Global Operations function manages product development, commercialisation and distribution, and also supervises sourcing for our Wholesale and Retail segments as well as for adidas Golf see 01. Due to the specific sourcing requirements in their respective fields of business, TaylorMade, Rockport, Reebok-CCM Hockey and the Sports Licensed Division are not serviced through Global Operations, but instead utilise their own purchasing organisation. In order to quickly seize short-term opportunities in their local market or react to trade regulations, Group subsidiaries may, with the approval of our Social and Environmental team, also source from selected local suppliers outside the realm of Global Operations. Local purchases, however, only for a minor portion of the Group’s total sourcing volume.

03

Suppliers by region 1)

75% Asia 16% Americas 9% Europe

1) Figures include adidas, Reebok and adidas Golf, but exclude local sourcing partners, sourcing agents, subcontractors, second-tier suppliers and licensee factories.

04

Footwear production by region 1)

97% Asia 2% Europe 1% Americas

1) Figures include adidas, Reebok and adidas Golf.

05

Footwear production 1) in million pairs

2007 2008 2009 2010 1) Figures include adidas, Reebok and adidas Golf.

201 221 171 219

China’s share of footwear production decreases 97% of our total 2010 footwear volume for adidas, Reebok and adidas Golf was produced in Asia (2009: 97%). Production in Europe and the Americas combined ed for 3% of the sourcing volume (2009: 3%) see 04. China represents our largest sourcing country with approximately 39% of the total volume, followed by Vietnam with 31% and Indonesia with 22%. As part of our strategy to increase the regional diversity of our supplier base to meet the ongoing needs of our business, the overall representation of China in our sourcing mix declined 2 percentage points. At the same time, the footwear volumes sourced from Cambodia almost tripled in 2010 from a low comparison base. In 2010, our footwear suppliers produced approximately 219 million pairs of shoes (2009: approx. 171 million pairs) see 05. The year-over-year increase was driven by the strong sales growth in 2010 and a low comparison base in 2009 due to inventory clean-up activities. Our largest footwear factory produced approximately 9% of the footwear sourcing volume (2009: 11%). Rockport purchased approximately 8 million pairs of footwear in 2010, which represents an increase of 27% versus the prior year. Products were primarily sourced from factories in China (67%), Vietnam (25%), Indonesia (5%) and India (3%). The largest factory ed for 37% of the total sourcing volume of the Rockport brand.

Volume of apparel production increases In 2010, we sourced 82% of the total apparel volume for adidas, Reebok and adidas Golf from Asia (2009: 83%). Europe remained the second-largest apparel sourcing region, representing 12% of the volume (2009: 11%). The Americas ed for 6% of the volume (2009: 6%) see 06. China was the largest source country, representing 36% of the produced volume, followed by Thailand with 13% and Indonesia with 13%. In total, our suppliers produced approximately 301 million units of apparel in 2010 (2009: approx. 239 million units) see 07. The largest apparel factory produced approximately 9% of this apparel volume in 2010 (2009: 11%). In addition, Reebok-CCM Hockey sourced around 2 million units of apparel in 2010 (2009: approx. 2 million units). The majority of this volume was also produced in Asia, while small portions were sourced from the Americas (particularly Canada) and Europe. The Sports Licensed Division sourced approximately 23 million units of apparel and 15 million units of headwear (2009: 20 million and 14 million, respectively). The majority of purchased apparel products was sourced as unfinished goods from Latin America (85%) and Asia (15%), and was subsequently finished in our own screen-printing facilities in the USA. The majority of headwear sourced was finished products manufactured predominately in Asia (97%) and the USA (3%).

67% of adidas and Reebok branded hardware produced in China In 2010, the bulk (i.e. 98%) of adidas and Reebok branded hardware products, such as balls and bags, was also produced in Asia (2009: 98%). China remained our largest source country, ing for 67% of the sourced volume, followed by Vietnam with 20% and Pakistan with 11%. The remaining 2% was sourced via European countries see 08. The total 2010 hardware sourcing volume was approximately 48 million units (2009: approximately 34 million units), with the largest factory ing for 21% of production see 09. TaylorMade and Reebok-CCM Hockey sourced 98% and 72% of their hardware volumes from Asia, respectively (2009: 92% and 78%). In addition, both brands sourced a portion of hardware products in the Americas. At TaylorMade, the majority of golf club components were manufactured by suppliers in China and assembled by TaylorMade in the USA, China and Japan.

06

Apparel production by region 1)

82% Asia 12% Europe 6% Americas

1) Figures include adidas, Reebok and adidas Golf.

07

Apparel production 1) in million units

2007 2008 2009 2010

252 284 239 301

1) Figures include adidas, Reebok and adidas Golf.

08

Hardware production by region 1)

98% Asia 2% Europe

1) Figures include adidas, Reebok and adidas Golf.

09

Hardware production 1) in million units

2007 2008 2009 2010

39 42 34 48

1) Figures include adidas, Reebok and adidas Golf.

Group Management Report – Our Group

Global Operations

109