Adjusting Journal Entries 1u3k5g

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3i3n4

Overview 26281t

& View Adjusting Journal Entries as PDF for free.

More details 6y5l6z

- Words: 223

- Pages: 1

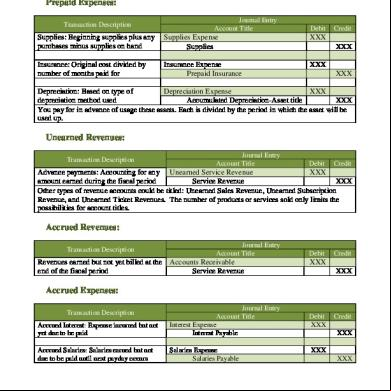

Adjusting Journal Entries Prepaid Expenses: Transaction Description

Journal Entry Title

Debit

Supplies: Beginning supplies plus any purchases minus supplies on hand

Supplies Expense Supplies

XXX

Insurance: Original cost divided by number of months paid for

Insurance Expense Prepaid Insurance

XXX

Credit

XXX

XXX

Depreciation Expense XXX Depreciation: Based on type of depreciation method used Accumulated Depreciation-Asset title XXX You pay for in advance of usage these assets. Each is divided by the period in which the asset will be used up.

Unearned Revenues: Transaction Description

Journal Entry Title

Debit

Credit

XXX Advance payments: ing for any Unearned Service Revenue amount earned during the fiscal period Service Revenue XXX Other types of revenue s could be titled: Unearned Sales Revenue, Unearned Subscription Revenue, and Unearned Ticket Revenues. The number of products or services sold only limits the possibilities for titles.

Accrued Revenues: Transaction Description

Journal Entry Title

Revenues earned but not yet billed at the s Receivable end of the fiscal period Service Revenue

Debit

Credit

XXX XXX

Accrued Expenses:

Accrued Interest: Expense incurred but not yet due to be paid

Journal Entry Title Interest Expense Interest Payable

Accrued Salaries: Salaries earned but not due to be paid until next payday occurs

Salaries Expense Salaries Payable

Transaction Description

MJC Revised 10-2011

Debit XXX

Credit XXX

XXX XXX

Page 1

Journal Entry Title

Debit

Supplies: Beginning supplies plus any purchases minus supplies on hand

Supplies Expense Supplies

XXX

Insurance: Original cost divided by number of months paid for

Insurance Expense Prepaid Insurance

XXX

Credit

XXX

XXX

Depreciation Expense XXX Depreciation: Based on type of depreciation method used Accumulated Depreciation-Asset title XXX You pay for in advance of usage these assets. Each is divided by the period in which the asset will be used up.

Unearned Revenues: Transaction Description

Journal Entry Title

Debit

Credit

XXX Advance payments: ing for any Unearned Service Revenue amount earned during the fiscal period Service Revenue XXX Other types of revenue s could be titled: Unearned Sales Revenue, Unearned Subscription Revenue, and Unearned Ticket Revenues. The number of products or services sold only limits the possibilities for titles.

Accrued Revenues: Transaction Description

Journal Entry Title

Revenues earned but not yet billed at the s Receivable end of the fiscal period Service Revenue

Debit

Credit

XXX XXX

Accrued Expenses:

Accrued Interest: Expense incurred but not yet due to be paid

Journal Entry Title Interest Expense Interest Payable

Accrued Salaries: Salaries earned but not due to be paid until next payday occurs

Salaries Expense Salaries Payable

Transaction Description

MJC Revised 10-2011

Debit XXX

Credit XXX

XXX XXX

Page 1