Adjusting Entries 702h57

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3i3n4

Overview 26281t

& View Adjusting Entries as PDF for free.

More details 6y5l6z

- Words: 1,096

- Pages: 21

ADJUSTING JOURNAL ENTRIES

- It is very important that the ants properly measure the expenses and revenues of the business during the ing year. - The correct Net Income should be reflected in the Income Statement. - To accomplish this, the ant should be able to record all revenues earned and expenses incurred during the ing year.

PRINCIPLES APPLIED The concepts and principles that guide the measurement of the expenses and income are the following: (1) Accrual Basis of ing (2) ing Period (3) Revenue and Matching Principle (4) Time Period Concept

PRINCIPLES APPLIED

(1) ACCRUAL BASIS ING • •

an ant recognizes the impact of business event as it occurs. when a business enters into a transaction such as performing a service, making a sale or incurring an expense, the ant enters the transaction into the books, whether or not cash has been received or paid.

CASH BASIC ING • the ant does not record a transaction until cash is received or paid. • Cash receipts are treated as revenue and cash payments are treated as Expense

PRINCIPLES APPLIED (2) ING PERIOD • Since business entities need periodic reports on their progress, ants divide time into small segments and prepare financial statement for specific period . • One year is the most basic ing period and virtually most businesses prepare financial statement s.

PRINCIPLES APPLIED (3) MATCHING PRINCIPLE • An expense is a decrease in Owner’s Equity that occurs in the course of operating a business. • Matching principle requires that all expenses incurred during the ing year should be identified, measured and subtracted from the revenues earned during the same span of time.

NEED FOR ADJUSTING JOURNAL ENTRIES • To measure income, business must do some additional ing at the end of the ing period to bring the records up to date before preparing the financial statements. This process is called Adjusting the Books. • Adjusting the books consist of making special entries called Adjusting Journal Entries. • To help determine that all items are properly recognized, we should review all the balances in the general ledger s.

THE NEED FOR ADJUSTING JOURNAL ENTRY • Adjusting entries are journal entries made at the end of the year for the following reasons: (1) There may be unrecorded EARNED income (2) There may be unrecorded INCURRED expenses (3) There may have been already a consumed portion/or expired portion of prepaid expenses OR there may be unexpired portion portion or unused portion in the recorded expenses.

NEED FOR ADJUSTING JOURNAL ENTRY (4) There may have been already an earned portion in the recorded unearned income OR maybe an unearned portion of the recorded income (5) There is a need to provide depreciation for depreciable fixed assets. (6) There is a need to provide estimated doubtful s in relation to s receivable

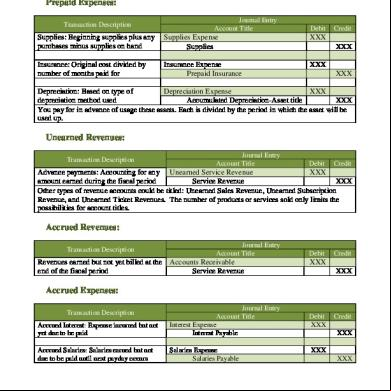

TYPES OF ADJUSTING ENTRIES (1) Accrued Expenses - these are expenses incurred but remains unpaid at the end of the ing period. In effect, this is a liability , a payable . (2) Accrued Income – these are income earned but remains uncollected at the end of the ing period. In effect, this is an asset , a receivable .

TYPES OF ADJUSTING ENTRIES (3) Prepaid Expenses - these prepayment of expenses or advance payment of expenses. (4) Unearned Income – these are revenues collected in advance.

ACCRUED EXPENSES a. Accrued Utilities Expense Case : Unpaid and unrecorded MERALCO bill as of Dec. 31, 2010 amounted to P2,500 remains

ACCRUED EXPENSE Adjusting Journal Entry: Dec 31 Utilities Expense 2,500 Utilities Payable 2,500 To record accrued utilities expense Important note: * Recognize the expense incurred, and come up with a liability because it remains unpaid as of end of ing period.

ACCRUED EXPENSES b. Accrued Salaries Expense Case : Unpaid salaries of the workers as of Dec. 31, 2010, end of the ing period amounted to P15,000.

ACCRUED EXPENSE Adjusting Journal Entry: Dec 31 Salaries Expense 15,000 Salaries Payable 15,000 To record accrued salaries expense Important note: * Recognize the expense incurred, and come up with a liability because it remains unpaid as of end of ing period.

ACCRUED EXPENSE c. Accrued Interest Expense Case: Interest expense on a 60 day , 18 % promissory note with principal amount of P 100,000 dated Dec 1, 2010, remain unpaid and unrecorded as of end of ing period Dec. 31, 2010

ACCRUED EXPENSE Adjusting Journal Entry: Dec 31 Interest Expense 1,500 Interest Payable 1,500 To record accrued interest on notes issued ( interest = P 100,000 x 18% x 30/360 = P1,500)

Important note: *Interest accrued is for 30 days ( Dec 1-31) we count following the rule – exclude the 1st day. Include the last day. *The 60 days term has affected 2 ing period – 2010 (Dec 1-31) and 2011 ( Jan 1-30). Following the expense recognition principal, we should record and recognize expense on the period they were incurred. The 2010 (Dec 1-31) interest therefore on this note has to be recognize as expense for 2010, adjusting journal entry therefore is required.

ACCRUED INCOME a. Accrued Rent Income Case : As of end of Dec 31, 2010, rentals for Oct, Nov, Dec from a tenant of an idle office space amounting to P15,000. has not yet been collected and recorded.

ACCRUED INCOME Adjusting Journal Entry: Dec 31 Rent Receivable 15,000 Rent Income 15,000 To record accrued rent income Important note: * we have to recognize this particular rent for three months as revenue for 2010, because they were revenues earned in 2010.

* Following the accrual principle of ing, we recognize revenue when it is earned whether we received cash or not.

ACCRUED INCOME b. Accrued Interest Income Case: As of Dec 31, 2010, interest income on a 90 day, 18% note dated Nov 15, 2010 for P 100,000 has not yet been received and recorded.

ACCRUED INCOME Journal Entry: Dec 31 Interest Receivable 2,300 Interest Income 2,300 To record accrued interest income ( interest = P100,000 x 18%% 46/360 = P2,300)

Important note: * Interest accrued is for 45 days ( Nov 15- Dec 31), we count following the rule – exclude the 1st day. Include the last day. * The 90 days term has affected 2 ing period – 2010 (Nov 15-Dec 31) and 2011 ( Jan 1- Feb. 13). Following the revenue realization principal, we should record and recognize income in the period they were earned. The 2010 (Nov 15- Dec 31) interest therefore on this note has to be recognize as revenue for 2010, adjusting journal entry is therefore required.

- It is very important that the ants properly measure the expenses and revenues of the business during the ing year. - The correct Net Income should be reflected in the Income Statement. - To accomplish this, the ant should be able to record all revenues earned and expenses incurred during the ing year.

PRINCIPLES APPLIED The concepts and principles that guide the measurement of the expenses and income are the following: (1) Accrual Basis of ing (2) ing Period (3) Revenue and Matching Principle (4) Time Period Concept

PRINCIPLES APPLIED

(1) ACCRUAL BASIS ING • •

an ant recognizes the impact of business event as it occurs. when a business enters into a transaction such as performing a service, making a sale or incurring an expense, the ant enters the transaction into the books, whether or not cash has been received or paid.

CASH BASIC ING • the ant does not record a transaction until cash is received or paid. • Cash receipts are treated as revenue and cash payments are treated as Expense

PRINCIPLES APPLIED (2) ING PERIOD • Since business entities need periodic reports on their progress, ants divide time into small segments and prepare financial statement for specific period . • One year is the most basic ing period and virtually most businesses prepare financial statement s.

PRINCIPLES APPLIED (3) MATCHING PRINCIPLE • An expense is a decrease in Owner’s Equity that occurs in the course of operating a business. • Matching principle requires that all expenses incurred during the ing year should be identified, measured and subtracted from the revenues earned during the same span of time.

NEED FOR ADJUSTING JOURNAL ENTRIES • To measure income, business must do some additional ing at the end of the ing period to bring the records up to date before preparing the financial statements. This process is called Adjusting the Books. • Adjusting the books consist of making special entries called Adjusting Journal Entries. • To help determine that all items are properly recognized, we should review all the balances in the general ledger s.

THE NEED FOR ADJUSTING JOURNAL ENTRY • Adjusting entries are journal entries made at the end of the year for the following reasons: (1) There may be unrecorded EARNED income (2) There may be unrecorded INCURRED expenses (3) There may have been already a consumed portion/or expired portion of prepaid expenses OR there may be unexpired portion portion or unused portion in the recorded expenses.

NEED FOR ADJUSTING JOURNAL ENTRY (4) There may have been already an earned portion in the recorded unearned income OR maybe an unearned portion of the recorded income (5) There is a need to provide depreciation for depreciable fixed assets. (6) There is a need to provide estimated doubtful s in relation to s receivable

TYPES OF ADJUSTING ENTRIES (1) Accrued Expenses - these are expenses incurred but remains unpaid at the end of the ing period. In effect, this is a liability , a payable . (2) Accrued Income – these are income earned but remains uncollected at the end of the ing period. In effect, this is an asset , a receivable .

TYPES OF ADJUSTING ENTRIES (3) Prepaid Expenses - these prepayment of expenses or advance payment of expenses. (4) Unearned Income – these are revenues collected in advance.

ACCRUED EXPENSES a. Accrued Utilities Expense Case : Unpaid and unrecorded MERALCO bill as of Dec. 31, 2010 amounted to P2,500 remains

ACCRUED EXPENSE Adjusting Journal Entry: Dec 31 Utilities Expense 2,500 Utilities Payable 2,500 To record accrued utilities expense Important note: * Recognize the expense incurred, and come up with a liability because it remains unpaid as of end of ing period.

ACCRUED EXPENSES b. Accrued Salaries Expense Case : Unpaid salaries of the workers as of Dec. 31, 2010, end of the ing period amounted to P15,000.

ACCRUED EXPENSE Adjusting Journal Entry: Dec 31 Salaries Expense 15,000 Salaries Payable 15,000 To record accrued salaries expense Important note: * Recognize the expense incurred, and come up with a liability because it remains unpaid as of end of ing period.

ACCRUED EXPENSE c. Accrued Interest Expense Case: Interest expense on a 60 day , 18 % promissory note with principal amount of P 100,000 dated Dec 1, 2010, remain unpaid and unrecorded as of end of ing period Dec. 31, 2010

ACCRUED EXPENSE Adjusting Journal Entry: Dec 31 Interest Expense 1,500 Interest Payable 1,500 To record accrued interest on notes issued ( interest = P 100,000 x 18% x 30/360 = P1,500)

Important note: *Interest accrued is for 30 days ( Dec 1-31) we count following the rule – exclude the 1st day. Include the last day. *The 60 days term has affected 2 ing period – 2010 (Dec 1-31) and 2011 ( Jan 1-30). Following the expense recognition principal, we should record and recognize expense on the period they were incurred. The 2010 (Dec 1-31) interest therefore on this note has to be recognize as expense for 2010, adjusting journal entry therefore is required.

ACCRUED INCOME a. Accrued Rent Income Case : As of end of Dec 31, 2010, rentals for Oct, Nov, Dec from a tenant of an idle office space amounting to P15,000. has not yet been collected and recorded.

ACCRUED INCOME Adjusting Journal Entry: Dec 31 Rent Receivable 15,000 Rent Income 15,000 To record accrued rent income Important note: * we have to recognize this particular rent for three months as revenue for 2010, because they were revenues earned in 2010.

* Following the accrual principle of ing, we recognize revenue when it is earned whether we received cash or not.

ACCRUED INCOME b. Accrued Interest Income Case: As of Dec 31, 2010, interest income on a 90 day, 18% note dated Nov 15, 2010 for P 100,000 has not yet been received and recorded.

ACCRUED INCOME Journal Entry: Dec 31 Interest Receivable 2,300 Interest Income 2,300 To record accrued interest income ( interest = P100,000 x 18%% 46/360 = P2,300)

Important note: * Interest accrued is for 45 days ( Nov 15- Dec 31), we count following the rule – exclude the 1st day. Include the last day. * The 90 days term has affected 2 ing period – 2010 (Nov 15-Dec 31) and 2011 ( Jan 1- Feb. 13). Following the revenue realization principal, we should record and recognize income in the period they were earned. The 2010 (Nov 15- Dec 31) interest therefore on this note has to be recognize as revenue for 2010, adjusting journal entry is therefore required.