Rr 4-86 686259

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 3i3n4

Overview 26281t

& View Rr 4-86 as PDF for free.

More details 6y5l6z

- Words: 961

- Pages: 2

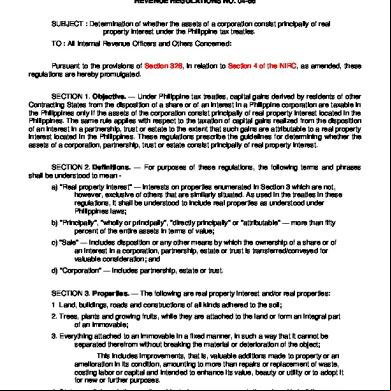

April 2, 1986 REVENUE REGULATIONS NO. 04-86 SUBJECT : Determination of whether the assets of a corporation consist principally of real property interest under the Philippine tax treaties. TO : All Internal Revenue Officers and Others Concerned: Pursuant to the provisions of Section 326, in relation to Section 4 of the NIRC, as amended, these regulations are hereby promulgated. SECTION 1. Objective. — Under Philippine tax treaties, capital gains derived by residents of other Contracting States from the disposition of a share or of an interest in a Philippine corporation are taxable in the Philippines only if the assets of the corporation consist principally of real property interest located in the Philippines. The same rule applies with respect to the taxation of capital gains realized from the disposition of an interest in a partnership, trust or estate to the extent that such gains are attributable to a real property interest located in the Philippines. These regulations prescribe the guidelines for determining whether the assets of a corporation, partnership, trust or estate consist principally of real property interest. SECTION 2. Definitions. — For purposes of these regulations, the following and phrases shall be understood to mean a) "Real property interest" — interests on properties enumerated in Section 3 which are not, however, exclusive of others that are similarly situated. As used in the treaties in these regulations, it shall be understood to include real properties as understood under Philippines laws; cd i b) "Principally", "wholly or principally", "directly principally" or "attributable" — more than fifty percent of the entire assets in of value; c) "Sale" — includes disposition or any other means by which the ownership of a share or of an interest in a corporation, partnership, estate or trust is transferred/conveyed for valuable consideration; and d) "Corporation" — includes partnership, estate or trust. SECTION 3. Properties. — The following are real property interest and/or real properties: 1 Land, buildings, roads and constructions of all kinds adhered to the soil; 2. Trees, plants and growing fruits, while they are attached to the land or form an integral part of an immovable; 3. Everything attached to an immovable in a fixed manner, in such a way that it cannot be separated therefrom without breaking the material or deterioration of the object; This includes improvements, that is, valuable additions made to property or an amelioration in its condition, amounting to more than repairs or replacement of waste, costing labor or capital and intended to enhance its value, beauty or utility or to adopt it for new or further purposes. cd 4. Statues, reliefs, painting or other objects for use as ornamentation, placed in buildings or on lands by the owner of the immovable in such a manner that it reveals the intention to attach them permanently to the tenements;

5. Machinery receptacles, instruments or implements intended by the owner of the tenement for an industry or works which may be carried on in a building or on a piece of land, and which tend directly to meet the needs of the said industry or works; The machinery mentioned above shall embrace machines, mechanical contrivances, instruments, appliances and apparatus attached to the real estate. It includes the physical facilities available for production, as well as the installations and appurtenant service facilities, together with all the other equipment designed for or essential to its manufacturing, industrial or agricultural purposes. 6. Animal houses, pigeon-houses, beehives, fish ponds or breeding places of similar nature, in case their owner has placed them or preserves them with the intention to have them permanently attached to the land, and forming a permanent part of it; the animals in these places are included; 7. Fertilizer actually used on a piece of land; 8. Mines, quarries and slag dumps, while the matter thereof forms part of the bed, and waters either running or stagnant; aisa dc 9. Docks and structures which, though floating, are intended by their nature and object to remain at a fixed place on a river, lake or coast; 10. Contracts for public works, and servitudes and other real rights over immovable property including real estate mortgages, possessory retentions, antichresis, usufructs and lessee of property; 11. Accessory to the above mentioned properties, such as livestock and equipment used in agriculture and forestry, rights to which provisions of general law respecting landed property apply, usufruct of immovable property and rights to variable or fixed payments as consideration for the working of, or the right to work, mineral deposits, sources and other natural resources. SECTION 4. Basis. — The value of all the assets of the subject corporation both real and personal as appearing in its financial statement on the date of sale of the share or interest in such corporation, as verified by the BIR, shall be used as the basis for determining the composition of its assets. casia In case the financial statement as of the date of the sale is not available, the most recent financial statement may be used, after the necessary adjustments are made to reflect transactions made during the period from the date of such financial statement to the date of the sale. SECTION 5. Exception. — When the book value of an asset is not reflected in the financial statement or when it is clearly manifest that the same is under or over stated, then the prevailing market value of such asset will be used as the basis. SECTION 6. Effectivity. — These regulations shall take effect immediately. (SGD.) JAIME V. ONGPIN Minister of Finance

Recommended by:

(SGD.) BIENVENIDO A. TAN, JR. Commissioner of Internal Revenue ||| (Determination of whether the assets of a corporation consist principally of real property interest under the Philippine tax treaties., REVENUE REGULATIONS NO. 04-86, [April 2, 1986])

5. Machinery receptacles, instruments or implements intended by the owner of the tenement for an industry or works which may be carried on in a building or on a piece of land, and which tend directly to meet the needs of the said industry or works; The machinery mentioned above shall embrace machines, mechanical contrivances, instruments, appliances and apparatus attached to the real estate. It includes the physical facilities available for production, as well as the installations and appurtenant service facilities, together with all the other equipment designed for or essential to its manufacturing, industrial or agricultural purposes. 6. Animal houses, pigeon-houses, beehives, fish ponds or breeding places of similar nature, in case their owner has placed them or preserves them with the intention to have them permanently attached to the land, and forming a permanent part of it; the animals in these places are included; 7. Fertilizer actually used on a piece of land; 8. Mines, quarries and slag dumps, while the matter thereof forms part of the bed, and waters either running or stagnant; aisa dc 9. Docks and structures which, though floating, are intended by their nature and object to remain at a fixed place on a river, lake or coast; 10. Contracts for public works, and servitudes and other real rights over immovable property including real estate mortgages, possessory retentions, antichresis, usufructs and lessee of property; 11. Accessory to the above mentioned properties, such as livestock and equipment used in agriculture and forestry, rights to which provisions of general law respecting landed property apply, usufruct of immovable property and rights to variable or fixed payments as consideration for the working of, or the right to work, mineral deposits, sources and other natural resources. SECTION 4. Basis. — The value of all the assets of the subject corporation both real and personal as appearing in its financial statement on the date of sale of the share or interest in such corporation, as verified by the BIR, shall be used as the basis for determining the composition of its assets. casia In case the financial statement as of the date of the sale is not available, the most recent financial statement may be used, after the necessary adjustments are made to reflect transactions made during the period from the date of such financial statement to the date of the sale. SECTION 5. Exception. — When the book value of an asset is not reflected in the financial statement or when it is clearly manifest that the same is under or over stated, then the prevailing market value of such asset will be used as the basis. SECTION 6. Effectivity. — These regulations shall take effect immediately. (SGD.) JAIME V. ONGPIN Minister of Finance

Recommended by:

(SGD.) BIENVENIDO A. TAN, JR. Commissioner of Internal Revenue ||| (Determination of whether the assets of a corporation consist principally of real property interest under the Philippine tax treaties., REVENUE REGULATIONS NO. 04-86, [April 2, 1986])